Plasma is designed to keep the stablecoin transfer process simple and easy to understand without burdening users with complex technical details. Here’s how stablecoin transfers work on the network.

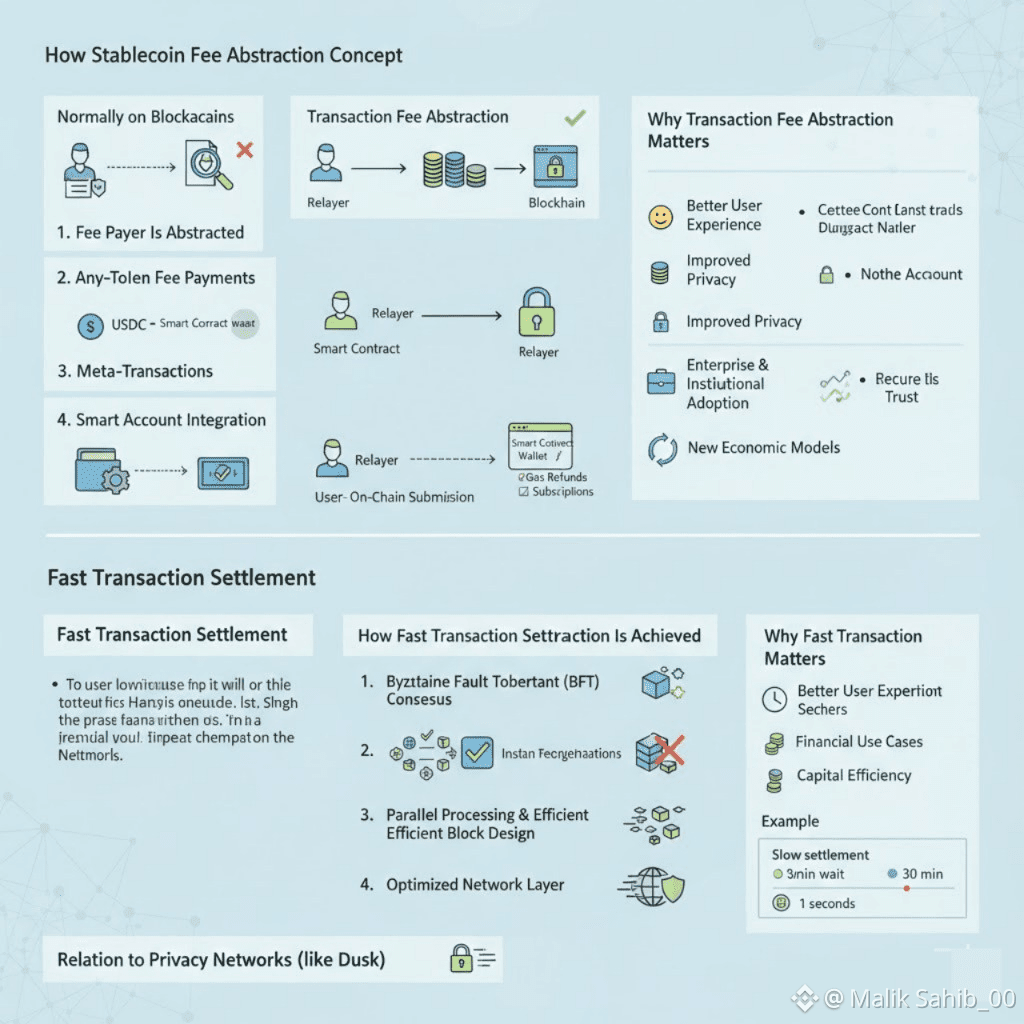

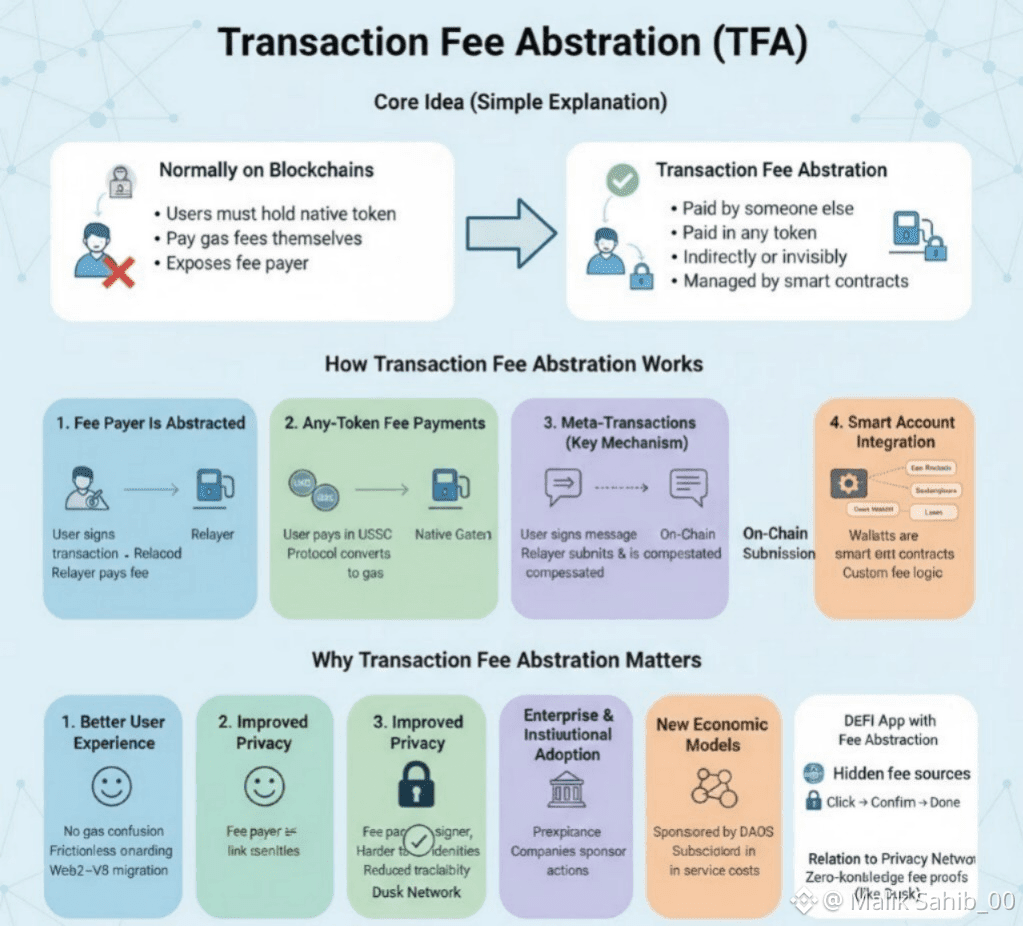

1. Transaction Fee Abstraction Concept

Normally on blockchains, users must hold the native token (ETH, SOL, DUSK, etc.). They must pay gas fees themselves. Every transaction directly exposes who paid the fee. But Transaction Fee Abstraction changes this by allowing fees to be paid by someone else, paid in any token and paid indirectly or invisibly. It is managed by smart contracts or protocols.So the user focuses on the action, not the fee mechanics. In simple stablecoin transfers, users don’t always need to own XPL tokens. Transaction fees are structured to be more streamlined for end-users, including the possibility of paying directly with stablecoins. This approach reduces friction and makes the transfer process more convenient.

How Transaction Fee Abstraction Works?

1. Fee Payer Is Abstracted:

Instead of the user paying gas:

• A relayer, sponsor, or dApp pays the transaction fee

• The user signs the transaction, but doesn’t pay gas directly

For instance,

You sign a transaction → A relayer submits it → The relayer pays the fee

2. Any-Token Fee Payments:

With TFA:

• Fees don’t have to be paid in the native token

• Smart contracts can accept stablecoins, deduct fees from balances, or convert tokens automatically.

For instance,

User pays in USDC → Protocol converts it to native gas token behind the scenes

3. Meta-Transactions (Key Mechanism)

TFA is often implemented using meta-transactions, user signs a message (not a blockchain transaction), a relayer submits it on-chain, the relayer is compensated later.

This preserves, user intent, security, gasless UX

4. Smart Account Integration:

With account abstraction (e.g., ERC-4337 style systems), wallets behave like smart contracts, fee logic can be customized, conditions can be added (limits, sponsors, batching). This enables, sponsored transactions, gas fee refunds, subscription-based models.

Why Transaction Fee Abstraction Matters?

1. For better user experience:

No need to buy native tokens first

No gas confusion

Onboarding becomes frictionless

This is crucial for Web2 → Web3 migration and Non-technical users.

2. Improved Privacy:

Fee payer ≠ transaction signer

Harder to link identities

Reduced on-chain traceability

This aligns well with privacy-focused networks like Zero-knowledge–based chains.

3. Enterprise & Institutional Adoption:

Businesses prefer:

Predictable costs

Centralized fee management

Compliance-friendly billing

TFA allows companies to sponsor user actions, users to transact without holding crypto.

4. New Economic Models

Transaction fees can be:

Sponsored by DAOs

Paid through subscriptions

Included in service costs

Dynamically adjusted

Let see the Use Case:

✓ DeFi App with Fee Abstraction

• User swaps tokens

• User signs a message

• Relayer submits transaction

• Protocol pays gas

• User is charged a small fee in swapped token

• User experience: “Click → Confirm → Done”

No gas wallets. No native tokens.

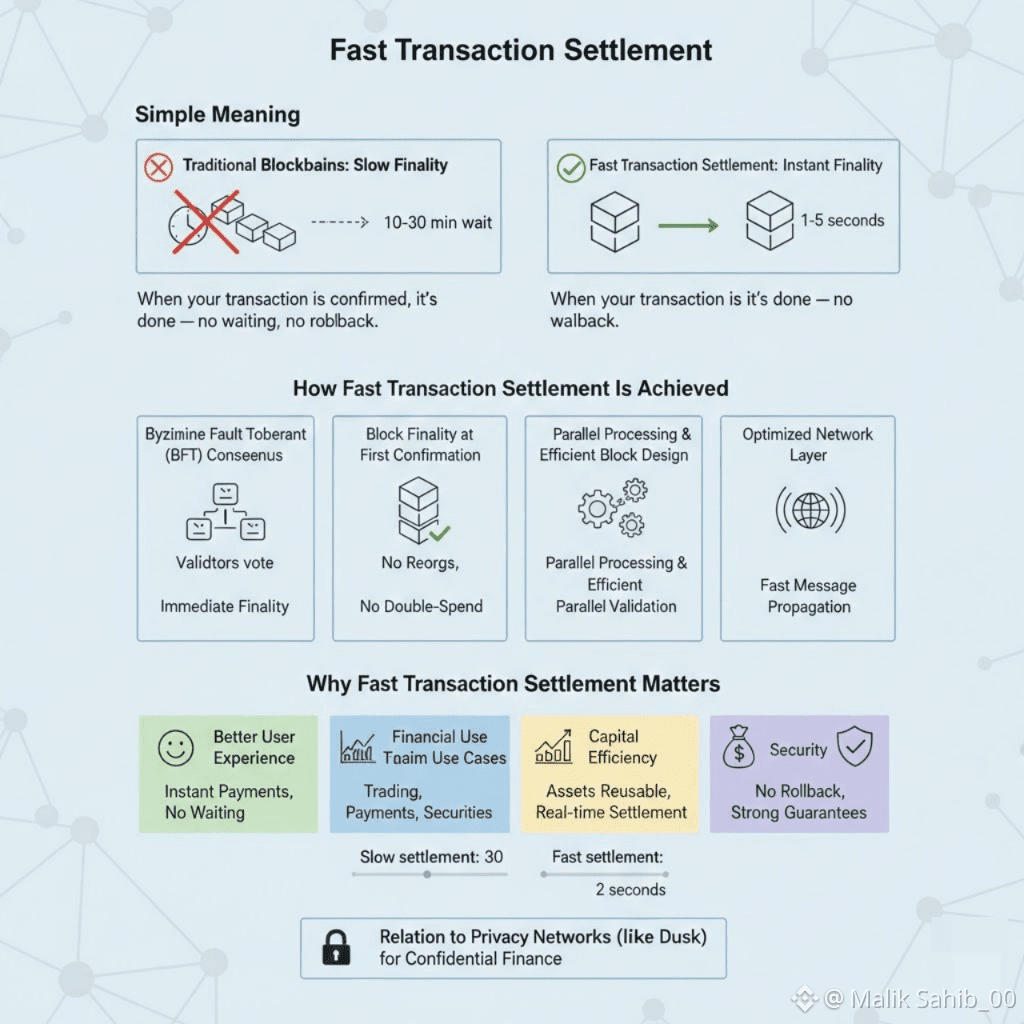

2. Fast Transaction Settlement:

The Plasma network is optimized to achieve transaction finality in a short time. This design ensures that stablecoin transfers can be processed quickly and reliably, making it suitable for cross-border payments and fund transfers. So that once a transaction is accepted, it is irreversible and safe to rely on within a very short time (seconds or less). Fast transaction settlement means when your transaction is confirmed, it’s done — no waiting, no rollback.

How Fast Transaction Settlement Is Achieved?

1. Byzantine Fault Tolerant (BFT) Consensus

Instead of probabilistic consensus (like PoW):

• Validators vote on blocks

• Once consensus is reached, finality is immediate

For instance, Segregated Byzantine Agreement (SBA)

Result: Settlement in 1–5 seconds

2. Block Finality at First Confirmation:

Some networks finalize at the first block, without needing multiple confirmations.

This eliminates chain reorganizations, double-spend risk.

3. Parallel Processing & Efficient Block Design:

Fast settlement also depends on small block sizes, efficient transaction execution, parallel validation.

This reduces congestion and latency.

4. Optimized Network Layer:

High-speed settlement requires fast message propagation, low validator communication overhead and geographic decentralization without delays.

Why Fast Transaction Settlement Matters?

1. For Better User Experience:

• Payments feel instant

• No waiting for confirmations

• Web2-like responsiveness

2. Financial Use Cases:

Critical for Trading & DeFi, Payments & remittances and Tokenized securities

Where: Delays = financial risk

3. Capital Efficiency:

Assets can be reused immediately. There is no need to lock funds. Enables real-time settlement

4. Security & Trust:

Fast final settlement means no rollback, no uncertainty, strong economic guarantees.

For instance, slow settlement

Transaction confirmed → wait 10–30 minutes → considered final

Fast settlement

Transaction confirmed → final in 2 seconds → funds reusableFor example:

Privacy-preserving networks finalize transactions quickly without exposing user data

This enables confidential finance at scale.