Every time I think Dusk cannot surprise me anymore, something unexpected shows up and flips my entire understanding of what they are building. Today it happened again. A random leak, a small clip, a tiny preview of something called Dusk Trade, and suddenly all the experiments we have been watching on DuskEVM feel like they were quietly pointing to something much bigger. It is that moment where you see a puzzle fall into place without anyone explaining the rules of the game. That is what this Dusk Intern alpha felt like.

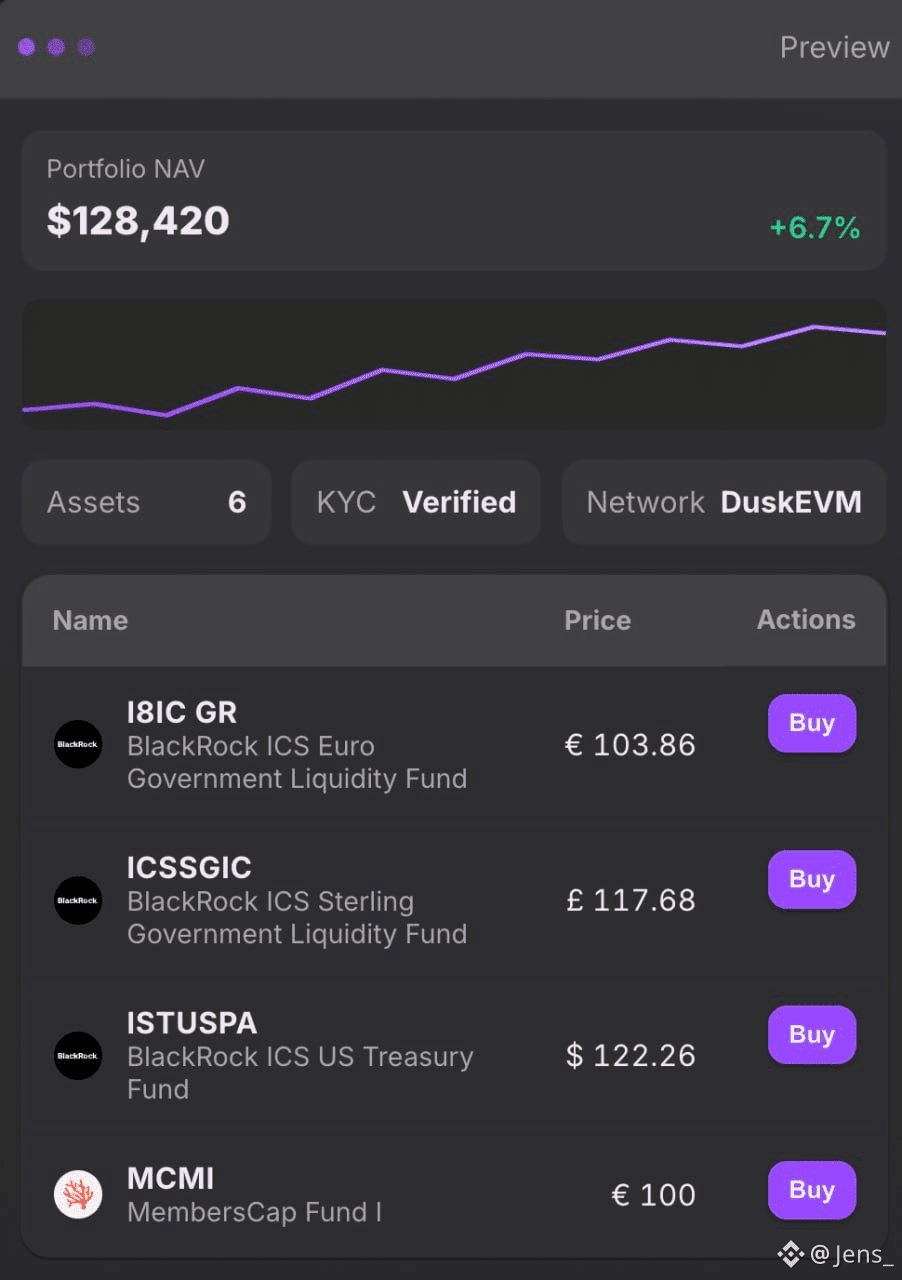

It all started with the experiments around money market funds that were deployed across DuskEVM last week. Developers were spinning up contracts that looked like the building blocks for something serious. Cash management flows. Real yield structures. Stable exposure. Fully private execution. It felt like someone was assembling the financial infrastructure that most teams only talk about in pitch decks but never actually deliver. The whole thing was programmable like Lego and it already felt different from the typical DeFi structures we see on other chains.

There was this quiet confidence in the design. Stability, real yield, privacy that is native at the protocol level, and a developer experience that actually feels mature. It looked like a playground for institutions and advanced users who want yield without noise, without data leaks and without constant operational risk. At first glance it looked like Dusk was testing tools for a private treasury system inside the EVM. We all thought we had a read on it. But then came the preview.

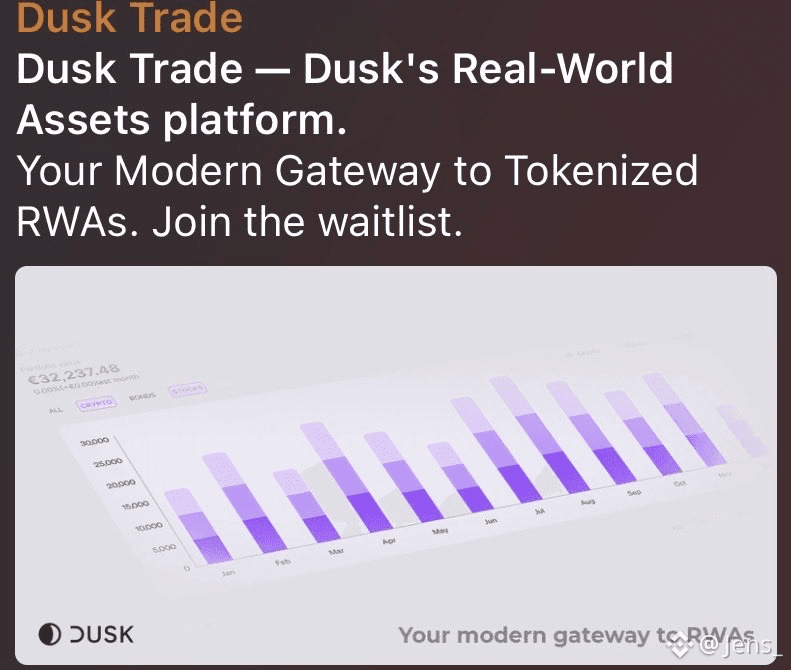

Someone dropped a tiny sneak peek of something called Dusk Trade. No announcement. No hype. No polished launch. Just a very raw view into something that looked like a gateway for real world assets on top of Dusk infrastructure. And that is when everything clicked. The MMF experiments were not just experiments. They were early pieces of a much larger system. A system that connects private yield engines with tokenized assets. A system that turns DuskEVM into the execution layer and Dusk Trade into the entrance point for capital.

The moment you connect the two, you see the full picture. If DuskEVM becomes the programmable layer where private yield strategies and money market funds operate, and Dusk Trade becomes the interface that lets users access tokenized treasury assets in a way that protects them, then Dusk is not just building another DeFi protocol. They are building a full stack treasury system that works for individuals, DAOs, funds and even institutions that want to move into tokenized finance without exposing their entire financial footprint to the world.

The missing piece has always been the balance between transparency and confidentiality. Everyone wants real yield. Everyone wants access to short term treasury products. Everybody wants programmable liquidity. But nobody wants their balance sheet or their yield positions dumped on chain in plain text. That is exactly where Dusk has an edge. The privacy is not optional and it is not an add on. It is part of the chain itself. It is selective and controlled. It gives regulators what is needed while giving users protection where it matters. If you take that privacy model and apply it to tokenized RWAs, you get something incredibly powerful.

The idea that Dusk could quietly assemble a private treasury stack makes perfect sense once you see the pieces. On one side you have MMF style instruments that can produce real yield with controlled risk. On the other side you have tokenized assets that can be distributed through a clean on chain gateway. Put those together and you get a system that can serve both retail and institutional flows. It becomes a financial operating system that is not trying to replace the existing world. It is trying to upgrade it with programmable privacy and better capital efficiency.

And that is why this leak matters more than it seems. It shows that Dusk is not only shipping technology but also connecting it into a coherent product suite. It shows that the build out is more intentional than it appears on the surface. It shows that the Dusk Intern might be joking but the scattered hints were pointing toward a real strategy. Most teams in crypto talk endlessly about RWAs and yield and privacy, but almost none of them can execute all three at the same time. Dusk is one of the few that can. They designed their chain around compliance ready privacy before RWAs were even trending. Now these pieces are finally aligning.

When people think about RWA platforms, they think about tokenization and issuance. But the real challenge is execution. Settlement. Privacy. Yield routing. It is not just about wrapping an instrument and pushing it on chain. It is about creating a place where capital can move safely and privately. A place where flows can settle without noise. A place where institutions can participate without compromising their data. That is exactly what Dusk seems to be quietly preparing.

Dusk Trade looks like the gateway. DuskEVM looks like the engine room. All the experiments we saw last week were probably just the warm up phase. The upcoming integrations will bring more clarity, but the direction is already visible. Dusk is building something that feels like a private money market layer combined with a regulated friendly RWA hub. They are doing it in a way that does not copy Ethereum or Solana. They are doing it in a way that respects how real financial markets work.

The crypto space tends to ignore quiet builders until they suddenly flip a switch and the whole market wakes up. Dusk has always been one of those projects. It stays focused, it ships without noise, it builds infrastructure for serious users, and it never relies on hype cycles to gain attention. The leak today is another reminder that this team is playing a long strategic game. They do not release previews unless something real is coming.

The funny thing is that what looks like an accidental leak might be one of the strongest signals we have seen in months. It shows direction, it confirms assumptions, and it hints at an RWA plus zk stack that could become one of the most complete in the entire industry. If the pieces continue to align the way they appear to be aligning, then MMFs were just one small part of the story. The real flow, the real adoption and the real capital activity will happen at the junction between DuskEVM and Dusk Trade.

For everyone watching Dusk closely, this is one of those moments where you smile a little because the signs have been there all along. Experimentation, privacy, compliance alignment, programmable yield, tokenization rails, and now a gateway that ties the concepts together. I am convinced we are about to see more experiments and maybe even more leaks. The building phase is reaching the point where things start to surface. And when that happens, the narrative will shift fast.

The conclusion is simple. Dusk Trade is not just a tool. It is a missing piece in a larger financial architecture. It is the place where private cash management and tokenized real world assets finally meet. It is the point where yield becomes accessible without sacrificing privacy. It is the interface that could bring regulated capital into programmable on chain systems. It is what makes the Dusk Intern alpha feel less like a joke and more like an early signal.

Dusk is quietly building one of the most underrated RWA and zk stacks in the entire space. The pieces are aligning and the system is starting to reveal itself. More experiments are coming. More previews will drop. And soon the market will understand that the warm up phase is over. The real flow is about to begin.