Bitcoin (BTC) Market Insights

Report Date: January 21, 2026 | Time: 20:00 UTC

Executive Summary (TL;DR)

The Bitcoin market is currently navigating a period of heightened volatility, marked by a 7.9% price correction over the last 24 hours. While institutional and corporate integration continues to reach new milestones, the short-term outlook is tempered by weakening demand, significant liquidations, and broader macroeconomic uncertainty.

Technical & On-Chain Performance

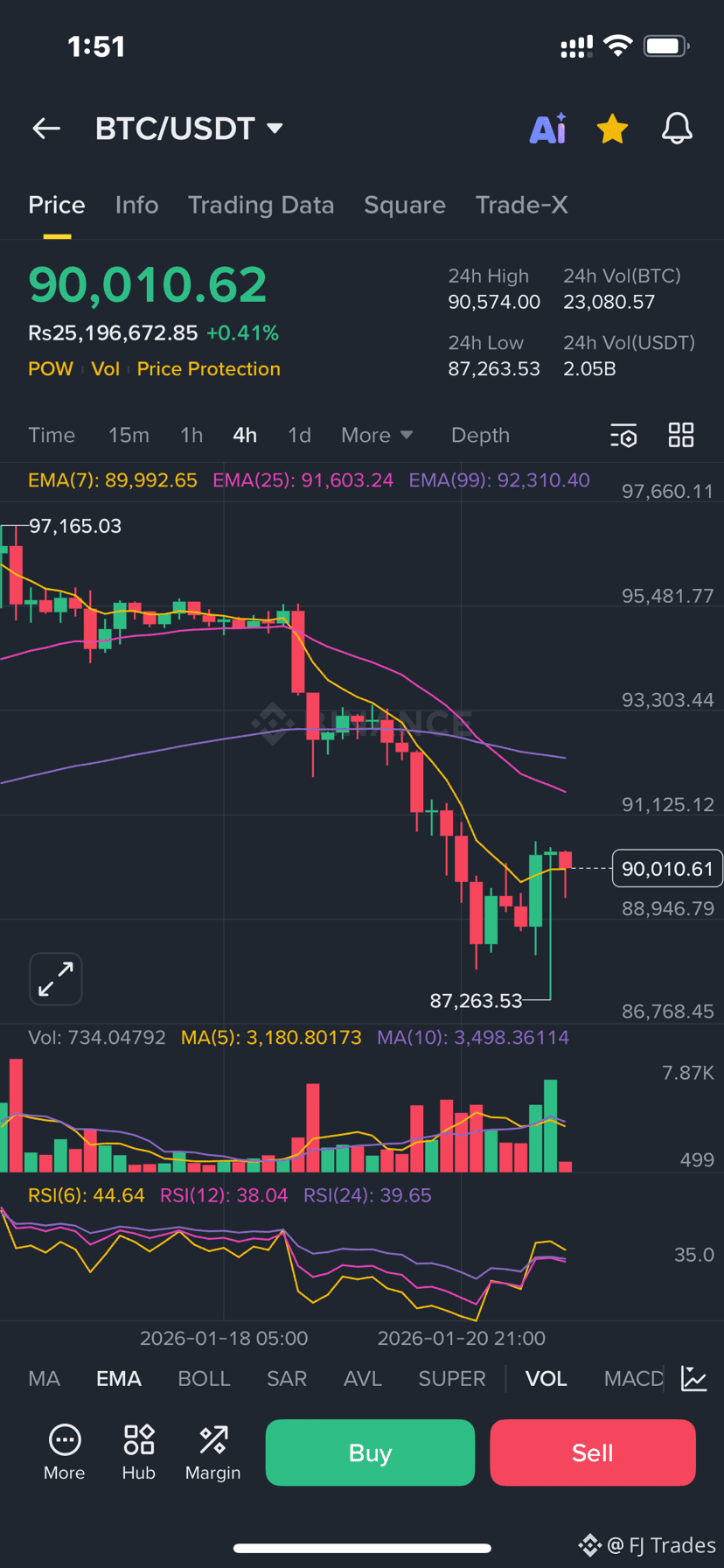

Price Action & Volume: The recent 7.9% decline is compounded by a notable drop in trading volume, suggesting a lack of aggressive "dip-buying" and a general cooling of demand.

Momentum Indicators: Technical setups are signaling a shift. The RSI (6) stands at 64.69, and the MACD histogram (124.13) indicates that the previous bullish momentum is exhausting, potentially giving way to a sustained bearish trend.

Inflow Dynamics: On-chain data reveals a trend of "negative net inflows." Large-scale holders (whales) are moving assets toward exchanges, typically a precursor to selling, which is currently intensifying downward pressure.

Fundamental Catalysts (The Positives)

Despite the price drop, long-term adoption metrics remain strong:

Institutional Innovation: BlackRock and Delaware Life have launched the first Bitcoin-linked annuity in the US. This represents a critical bridge between traditional retirement planning and digital assets.

Labor Market Utility: Steak 'n Shake's initiative to offer Bitcoin bonuses to hourly workers highlights a shift in corporate compensation strategies and increases real-world circular usage of the token.

Expert Sentiment: ARK Invest’s Cathie Wood remains optimistic, suggesting that the current "down cycle" is nearing its floor and forecasting a robust recovery.

Critical Risk Factors

Investors should remain cautious regarding the following:

Geopolitical Instability: New US tariff threats against Europe have triggered a global "risk-off" environment. In these scenarios, speculative assets like Bitcoin often face initial sell-offs as capital moves to safer havens.

Leverage Cascades: The market recently witnessed $199 million in liquidations due to a "long squeeze." This underscores the danger of high leverage, where small price drops trigger mandatory sell orders, leading to a "waterfall" effect.

Whale Distribution: On-chain monitoring shows that long-term holders are actively taking profits, contributing to the current overhead supply.

Community & Sentiment Analysis

The prevailing mood in the crypto community is one of caution and political scrutiny. Conversations are heavily focused on how the "tariff wars" and US fiscal policy will dictate the next leg of the market. There is a palpable concern that crypto is becoming increasingly sensitive to traditional geopolitical news cycles.