Most blockchain projects describe their audience in broad, abstract terms: developers, users, the community. Plasma is more specific. Because it is built as a payment-oriented financial network, it attracts a different set of participants—people and organizations whose relationship with blockchain is practical rather than experimental.

Plasma is not designed for those searching for the next app. It is designed for those building, operating, and integrating financial systems.

Understanding who Plasma is really for clarifies how its ecosystem is meant to evolve.

Builders of financial experiences

Plasma is built for developers who want to create financial products, not just deploy smart contracts. Its environment is structured around stable value movement, native financial primitives, and payment-oriented tooling.

For builders, this means less time reconstructing payment logic and more time designing real economic interactions: consumer payments, merchant systems, on-chain balances, settlement layers, and programmable money flows.

Plasma is positioned for teams who think in terms of systems rather than isolated applications—those who care about how money behaves across an entire product stack.

Merchants and payment-driven businesses

Merchants are rarely at the center of blockchain narratives. Plasma places them closer to the core.

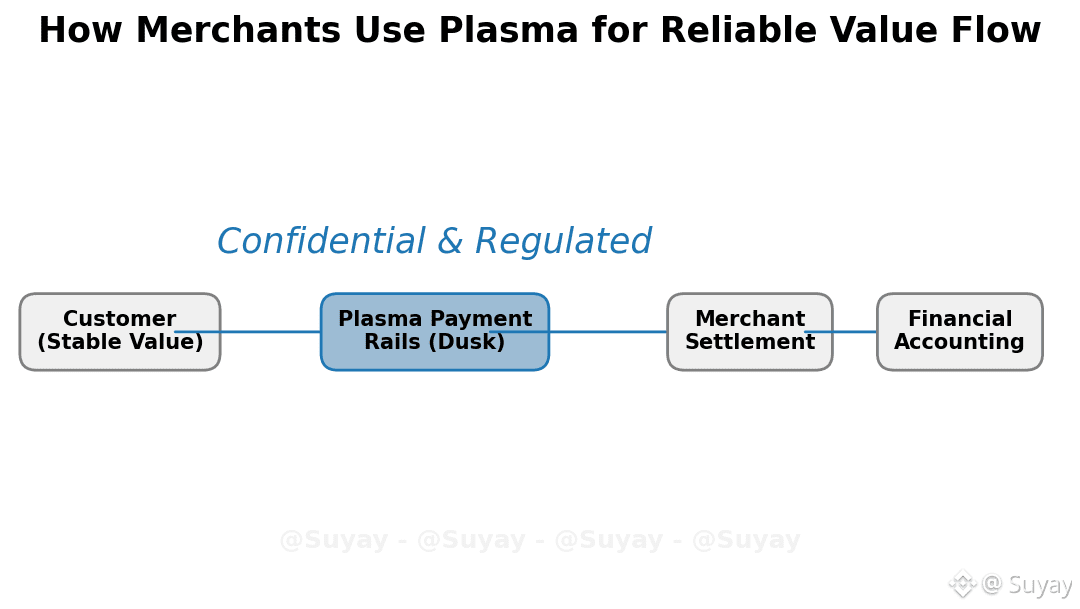

Because Plasma is designed around stablecoins, predictable execution, and payment flows, it aligns naturally with the needs of commerce: pricing stability, high transaction volume, recurring payments, and operational clarity.

For merchants and payment-driven businesses, Plasma offers a blockchain environment shaped around their reality. Not speculation, but transactions. Not tokens, but accounting. Not novelty, but usability.

This positioning makes Plasma relevant not only to crypto-native users, but to businesses whose primary concern is moving value reliably.

Fintechs and financial platforms

Fintechs operate between software and finance. They require programmable systems, but also compliance awareness, predictable behavior, and scalable financial infrastructure.

Plasma’s design speaks directly to this intersection. Its focus on stable value flows, native financial components, and infrastructure-level payment logic makes it a candidate layer for fintech platforms building wallets, remittance services, payment processors, and financial tooling.

Rather than embedding finance into apps, Plasma embeds financial logic into the network itself. This gives fintech teams a base layer that behaves closer to a financial system than a general computation engine.

Operators and infrastructure participants

Plasma is also built for those who run networks, not just use them.

Node operators, infrastructure providers, and technical participants play a different role in payment systems than in experimental blockchains. They are responsible not only for uptime, but for financial continuity.

Plasma’s network structure, operational tooling, and system design reflect this. Operators are positioned as maintainers of financial rails, not simply block producers.

This framing matters. It shifts participation from passive validation to active infrastructure stewardship.

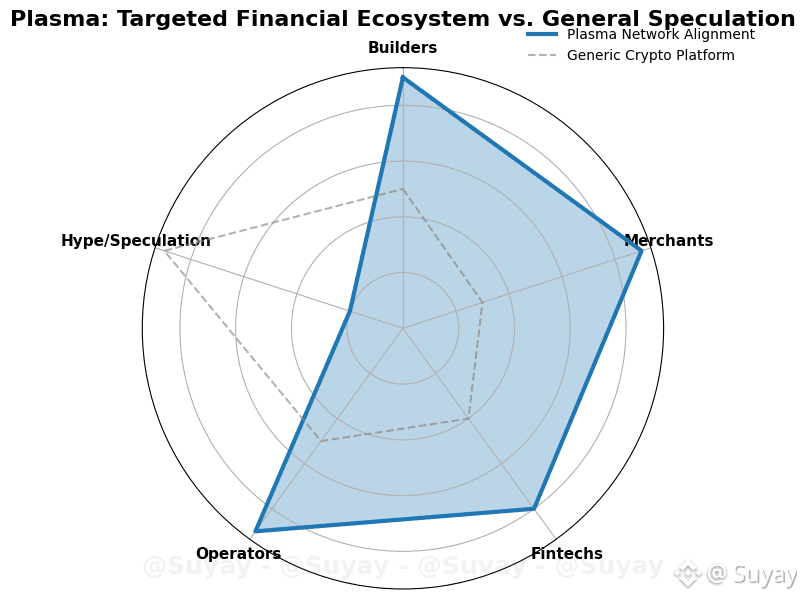

An ecosystem shaped by roles, not hype

When a blockchain defines its audience clearly, it shapes the ecosystem that grows around it.

Plasma is not primarily targeting traders, collectors, or app explorers. It is orienting itself toward builders of financial products, businesses that move money, fintech platforms, and operators who maintain systems.

These groups create different network effects. They bring long-term integrations, recurring transaction flows, and operational discipline.

They also bring constraints. Financial users demand reliability. Businesses demand predictability. Operators demand clarity. Plasma’s design choices reflect those expectations.

Conclusion

Who Plasma is for tells you what Plasma is becoming.

It is a network for those who build financial experiences, run payment systems, integrate money into products, and operate infrastructure that must function every day.

By focusing on builders, merchants, fintechs, and operators, Plasma defines itself less as a crypto platform and more as a financial network.

And financial networks are not grown through hype. They are built through roles, systems, and sustained economic use.