Finance is not just changing it is actually being rebuilt from the ground up. The Finance system is being redesigned. While a lot of people in the world are looking for the next big thing we are thinking about something more important. We want to know how to build a Finance system that really works for everyone, in the world. This includes companies, institutions, regulators and importantly the individuals that these groups are supposed to serve. The Finance system is being rebuilt to work for everyone.

This isn't about speculation. It's about substance.

This is about building a foundation for the era of value. We are talking about the era of value and we need to build a foundation for the next era of value. The next era of value is going to be big. We have to be ready, for the next era of value.

The problem that we are all dealing with is something that affects every one of us. We all feel it deeply. This problem is an issue. The problem is always, on our minds.

This means a companys investment strategy is out in the open before they even do it. It also means your personal savings are not private all. This is what is happening on many of the digital ledgers we have today. It is great for some things. It is a big problem, for the way the world really handles money and value. The digital ledgers are public which is not how the world actually manages value and money.

Our current financial system looks out for our privacy from the start. The bank does not share our bank statement with everyone. When we buy or sell stocks it is not announced to the public. This privacy is not about keeping things hidden it is about being safe having a plan and being in control of our own financial decisions. Our financial system protects our privacy and that is what makes it secure it is about our freedom and the financial strategy we use with our money, like our stock trade and bank statement.

We need to have trust, oversight and clear rules at the time. The regulators have to make sure that the financial systems are stable and they have to stop people from doing things. Investors need to know what is going on in the systems they use. They need transparency into the systems they rely on.

The thing about money and banking these days is really strange. We need to figure out how to keep information private, for each person while also making sure everyone can trust and feel safe when they deal with money and banks. This is a problem because we want to protect individual privacy but at the same time we have to make sure that collective trust and safety are taken care of, which is a really tough balance to strike with our financial system and collective trust and safety.

Our Answer: A Bridge, Not a Wall

The Dusk Network is built on an idea: privacy and regulation are not against each other. The Dusk Network thinks that privacy and regulation are two parts that work together. The Dusk Network believes that you need both privacy and regulation for a system to work well. The Dusk Network says that privacy and regulation are, like two sides of the coin and the Dusk Network thinks that both are necessary.

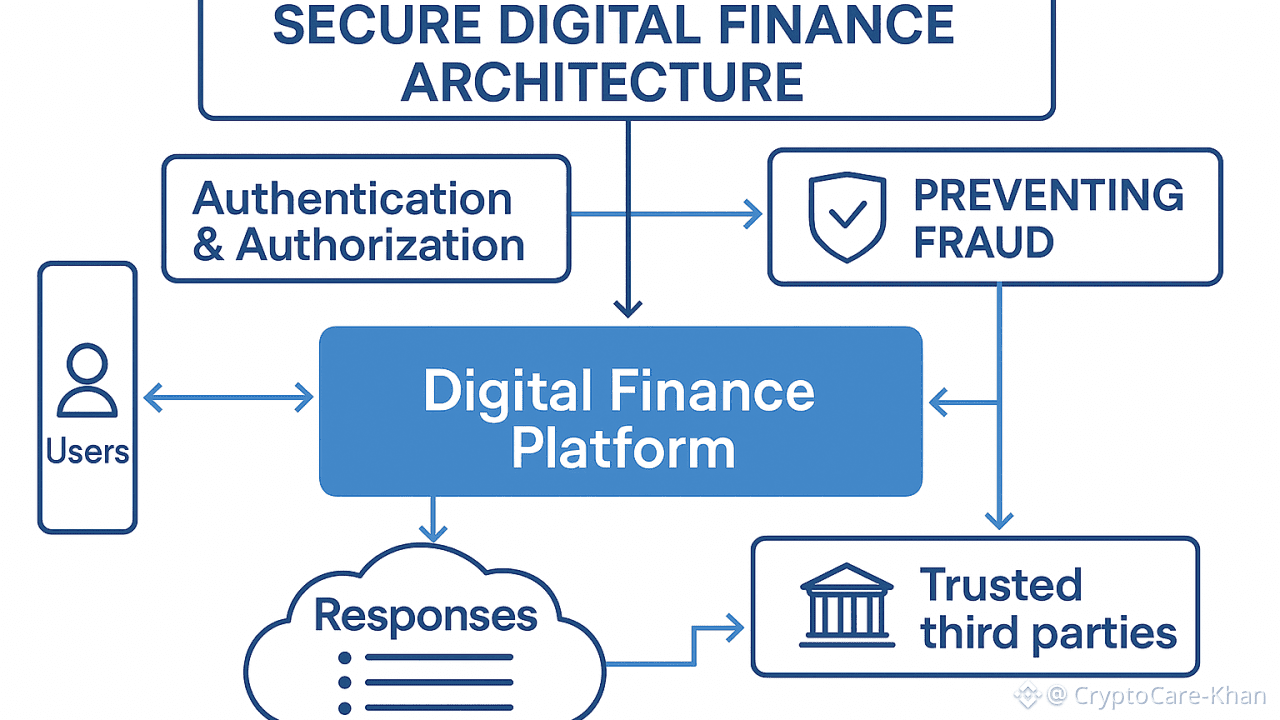

We use something called zero-knowledge proofs to make a kind of financial space. This is a way of keeping things secret. Think of it like a room, on a computer where people can meet and talk about money.

· This is, for you and your assets: Your transactions and your assets are kept private. You can buy, sell and look after your money without everyone knowing what you have.

· For people who make the rules and the institutions: The rules are part of the system from the beginning. Following the rules is not something you do later. It is something the system does naturally. The people in charge can check that everything that happens is legal without having to know all the things, about each person.

We are not hiding finance we are protecting finance. We are not fighting regulation we are actually building the tools to make regulation work well in a digital age. Finance is something that needs to be protected. We are doing that. Regulation is also necessary. We are building tools to make regulation work seamlessly with finance in this digital age.

Building for Real-World Use

Our technology is not made for things that're popular for a short time. It is made for the parts of the global economy:

· A company issuing digital shares to raise capital, securely and compliantly.

· A city is funding a bridge by using tokenized bonds that are traded on a market that is easy to see but still private, for the people involved in the citys new bridge project the citys tokenized bonds are being traded on this market for the new bridge.

· An investment fund settling a massive trade instantly, without leaking its strategy to the world.

· Someone who owns a part of an energy project has their rights and ownership protected by special codes that keep everything safe.

This is the territory we are building for: the transformation of stocks, bonds, funds and real world assets, into an efficient digital form a more accessible digital form and a more secure digital form. We are talking about stocks, bonds, funds and real world assets here. The goal is to make these stocks, bonds, funds and real world assets better and easier to use in a way.

The Community Building the Future

This movement is led by people who build things people who believe in something and people who have ideas that they think will work. Our community is not just buying a token they are actually taking part in the beginning of a way of doing finance. The people in our community are the ones making apps that keep your information private they are the ones giving advice on how to do things, in a responsible way and they are the ones who are using these new things early on because they know that real change happens when something is actually useful not just because it is popular.

These people are here, for the term. Building a system that millions of people can trust takes a lot of time. It also takes care. They have to focus on it all the time. The system has to be something that millions of people can trust.

The Quiet Shift

The digital asset space can be really loud. We think that making quiet progress is very important. We like to make deals, with companies that're ahead of the time. We like to write code that actually works. We like to talk to the people who make rules so that we can help make a future for the digital asset space. You do not build things with a lot of talk you build them by actually doing the work. The digital asset space needs people who can get things done not people who can talk about it.

When the world asks which systems can handle the weight of capital, which systems can protect sensitive data and which systems can operate within the bounds of law and trust we intend to be ready. This is not because we predicted what the future would be, like. Because we built our systems for the needs that people have always had.

The Future is Human

The future of finance is going to be digital. It still has to be about people. Finance has to make sure it keeps privacy safe it has to be able to work with trust from society and it has to help real people and institutions like banks to build things trade with each other and grow. The future of finance is digital. Finance must always remember that it is, about people.

The Dusk Network is building that foundation. We are the bridge between exciting cryptography and the familiar need for security. The Dusk Network is working on this. We are the connection between digital ideas and the old need for rules and trust, in the Dusk Network.

The shift is already happening. And we’re here to build it, thoughtfully, for everyone.