Amazing Profits Are Useless If You Don’t Know When to Close

One of the biggest lessons in trading is not about entries, indicators, or strategies. It’s about decision-making under pressure. When profit is sitting in front of you, emotions become louder than logic. Greed whispers, “Hold a little longer.” Fear warns, “What if it reverses?” Discipline asks a simple but powerful question: What was the plan?

Look at any strong winning trade and you’ll notice something important — the trade itself is only half the job. The other half is how you manage it.

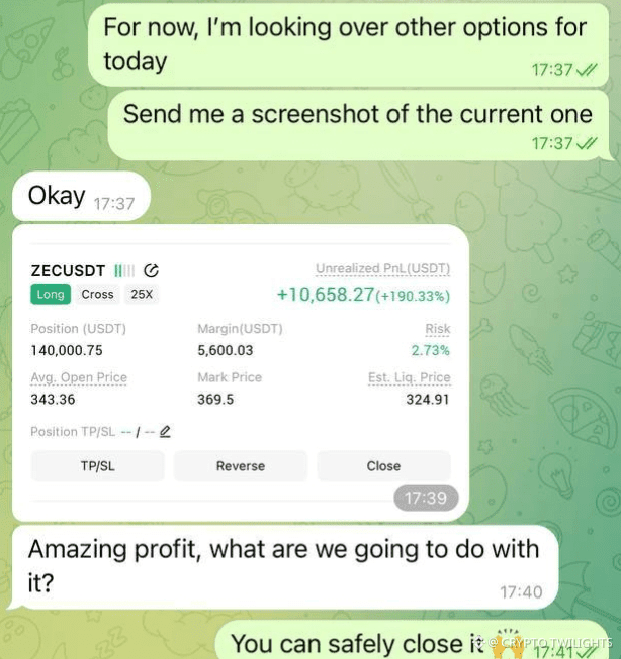

Many traders believe the goal is to maximize profit at all costs. In reality, the goal is to protect what the market has already given you. Unrealized profit is not real. It’s just a number on the screen until you close the position.

When a trade moves heavily in your favor, you are no longer trading the market — you are trading your psychology.

At that moment, three common mistakes happen:

1. Greed takes control

The mind starts imagining even bigger numbers. Instead of respecting the setup, the trader hopes for continuation without confirmation. This is where winning trades turn into regret.

2. No exit plan

Many traders plan entries carefully but have no clear exit rules. Without rules, decisions are emotional. Emotional decisions are inconsistent.

3. Ignoring risk after profit

Some traders think, “I’m already in profit, so risk doesn’t matter now.” This is dangerous thinking. The market doesn’t care about your profit — it can take it back in seconds.

Professional thinking is different.

A disciplined trader understands that closing a profitable trade is not weakness — it is strength. It means you respected your plan. It means you didn’t let emotions hijack your execution. It means you survived to trade another day.

Here are a few powerful principles every trader should internalize:

1. Profits should reduce stress, not increase it

If you’re staring at the screen nervously while in big profit, something is wrong. Either position size is too large or you’re emotionally attached. Good trades feel calm.

2. There is no shame in closing early

The market will always give another opportunity. Missing extra upside is far better than watching profit disappear.

3. Discipline compounds faster than profits

One good trade doesn’t make you successful. Repeating disciplined behavior over hundreds of trades does.

4. Your account grows by protection, not prediction

You don’t need to catch the top or bottom. You only need to consistently take money out of the market.

5. A closed profit builds confidence

Every time you follow your rules and close responsibly, you train your mind to trust your process.

Many traders blow accounts not because they don’t know how to enter, but because they don’t know how to exit. They turn trading into gambling by hoping instead of executing.

Ask yourself this after every strong move in your favor:

Is my target reached?

Is momentum slowing?

Am I still following my original plan, or just dreaming?

If the answer is unclear, the safest action is often the simplest one — close the trade.

Remember:

The market rewards patience, but it punishes greed.

Discipline doesn’t feel exciting, but it feels sustainable.

And sustainability is what separates traders from gamblers.

Protect your capital. Respect your profits. Execute without emotion.

Because in trading, survival comes first — profits follow naturally.

Your. Cryptoywilights