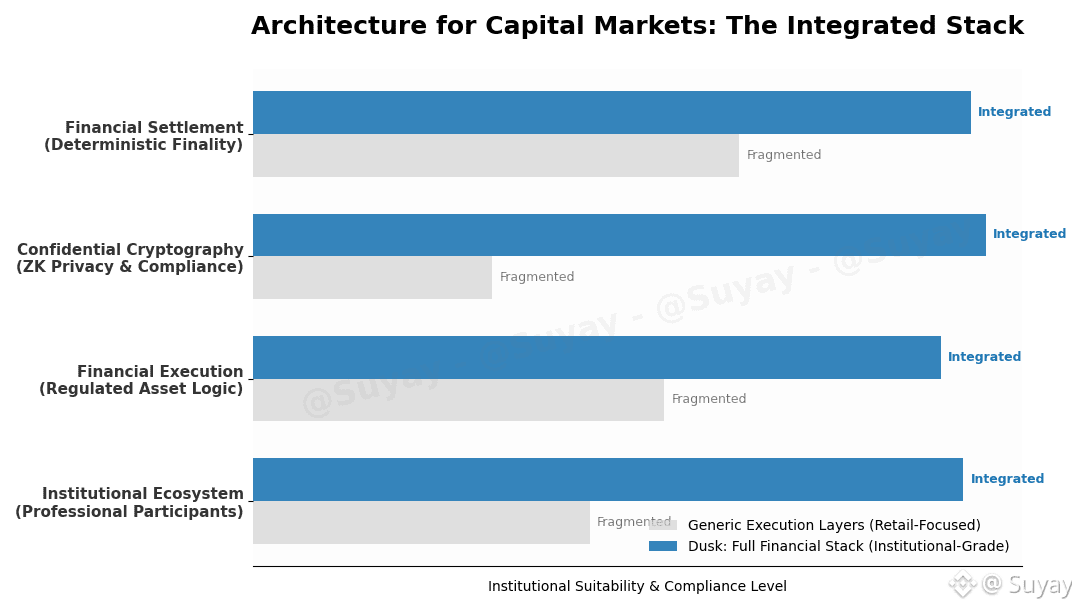

Most blockchains present themselves as execution layers. They focus on transactions, smart contracts, and applications. But financial markets are not just software environments. They are multi-layered systems that combine settlement, compliance, asset logic, confidentiality, and institutional operations. What Dusk Foundation is building is not an app platform. It is a full financial stack.

At the foundation of this stack is Dusk Network’s settlement architecture. Unlike general-purpose chains that optimize primarily for open execution, Dusk is built around the idea of financial finality. Transactions are designed to settle in a way that reflects how capital markets function: deterministic, auditable, and aligned with regulated processes. This settlement-first approach is what allows higher layers to operate with institutional guarantees.

Above settlement, Dusk integrates a cryptographic layer purpose-built for finance. Confidentiality is not treated as an optional add-on. Zero-knowledge systems and privacy-preserving primitives enable transactions where sensitive financial data can remain protected while still supporting verification and regulatory oversight. This allows institutions to operate on-chain without exposing positions, strategies, or counterparties.

On top of this foundation sits Dusk’s financial execution environment. Instead of generic asset logic, the network supports asset behavior that reflects real financial lifecycles. Issuance, distribution, trading, and management are structured around enforceable rules rather than simple token transfers. This creates an environment where regulated instruments can exist natively, not as abstractions maintained off-chain.

The stack continues into the ecosystem layer. Dusk is not growing an app marketplace aimed at retail users. Its ecosystem is oriented around professional participants: issuers, operators, infrastructure providers, and financial service builders. These actors require tooling for compliant issuance, confidential markets, institutional custody flows, and regulated settlement. The network’s development priorities reflect this. Ecosystem growth is measured in financial capability, not in application count.

What makes this stack coherent is architectural intent. Each layer reinforces the others. Confidential cryptography supports compliant assets. Financial settlement supports institutional execution. The ecosystem is shaped around infrastructure, not speculation. Rather than forcing institutions to assemble financial systems from unrelated tools, Dusk is composing them into a single coordinated protocol environment.

This approach also changes how risk is handled. Financial systems are judged not by innovation speed, but by operational resilience. Dusk’s stack is designed to reduce fragmentation: fewer intermediaries, fewer off-chain enforcement points, fewer reconciliation layers. The more financial logic is embedded into the protocol, the less room there is for structural failure.

Dusk is therefore not building one product. It is building the rails, the logic, and the environment for on-chain capital markets.

Why this matters: financial markets will not be rebuilt on isolated tools. They will emerge from integrated stacks designed around financial reality.

As on-chain finance matures, will institutions assemble fragmented systems — or converge on protocols that already embed the full financial stack?