Most blockchain discussions about finance stop at tokenization. They focus on representing assets digitally, enabling transfers, and improving market accessibility. But real financial markets are not defined by tokens. They are defined by structured lifecycles: issuance, compliance validation, distribution, trading, corporate actions, and settlement. This is the gap Dusk Foundation is addressing.

Dusk Network is not designed to host isolated financial applications. It is designed to support the full market process — from the first legal structuring of an asset to its final settlement between counterparties.

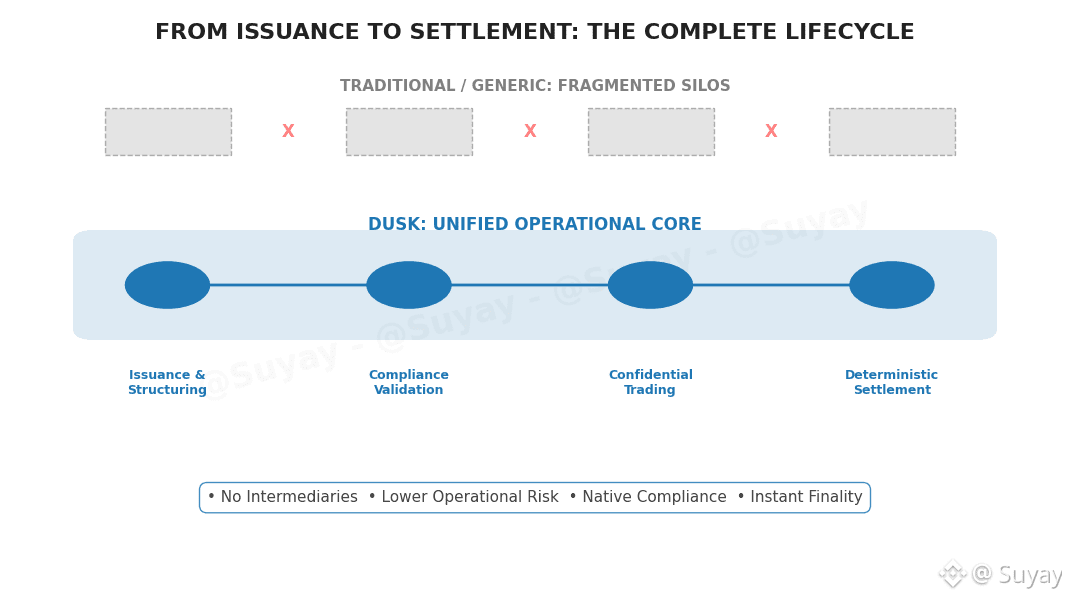

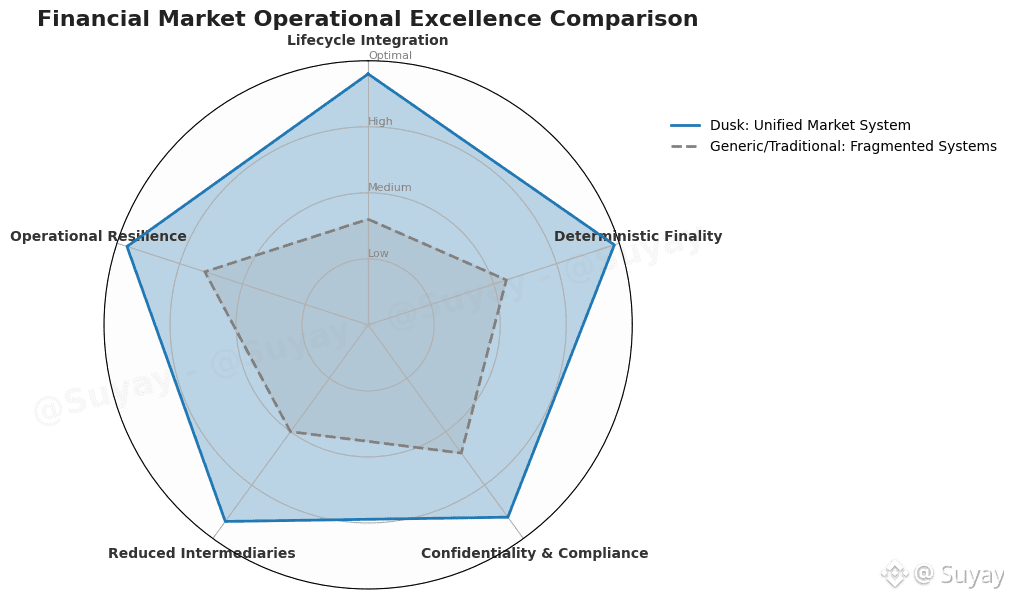

In traditional systems, these stages are fragmented across institutions, platforms, and intermediaries. Issuance is separated from trading. Trading is separated from settlement. Settlement is reconciled against external custodians. Each boundary introduces delay, cost, and operational risk. Tokenization on general blockchains often replicates this fragmentation by placing only the trading surface on-chain while keeping the financial core off-chain.

Dusk takes a different path. Its architecture enables native issuance, meaning assets are created directly within a protocol environment designed for regulated instruments. Asset logic can embed eligibility conditions, compliance constraints, and lifecycle behaviors from inception, rather than relying on off-chain enforcement.

From issuance, assets move into on-chain markets that support confidential trading. Institutions can interact without exposing sensitive positions or flows, while still preserving verifiability and regulatory alignment. This is critical. Financial markets do not function when participants are forced into radical transparency, nor when compliance is sacrificed for privacy. Dusk’s cryptographic design allows both to coexist.

Settlement is where Dusk’s full market vision becomes clearest. Instead of probabilistic confirmation or delayed reconciliation, the network is engineered for deterministic finality. When a transaction settles on Dusk, it is final. This property is essential for capital markets, where unsettled risk translates directly into systemic risk.

By unifying issuance, market interaction, and settlement within one coordinated protocol, Dusk reduces dependence on intermediaries. There is no need to reconstruct asset states across multiple ledgers. The on-chain state becomes the financial record, not a representation of it.

This full-stack vision also reshapes the ecosystem. Builders are not limited to creating applications on top of financial infrastructure. They are participating in financial infrastructure. Issuers can design instruments that live entirely on-chain. Operators can structure markets where compliance and confidentiality are protocol properties. Institutions can integrate on-chain processes without breaking regulatory continuity.

What emerges is not a set of disconnected tools, but a financial environment. Dusk is not trying to digitize existing markets. It is re-engineering their operational foundations.

Why this matters: financial transformation will not come from faster tokens. It will come from unified market systems.

Will on-chain finance remain a layer around traditional markets — or evolve into environments that replace their operational core?