Most blockchain narratives place every network inside the same frame: DeFi, applications, users, liquidity. But not all blockchains are built to serve the same economic function. Some are designed to enable open experimentation. Others are designed to operate markets. Dusk Foundation belongs firmly to the second category.

From its origin, Dusk was not conceived as a platform for consumer finance or decentralized applications. It was conceived as financial infrastructure. Its mission has consistently focused on building a network capable of supporting regulated markets, institutional actors, and real financial instruments. This positions Dusk conceptually much closer to traditional market infrastructure like NASDAQ than to the DeFi ecosystem.

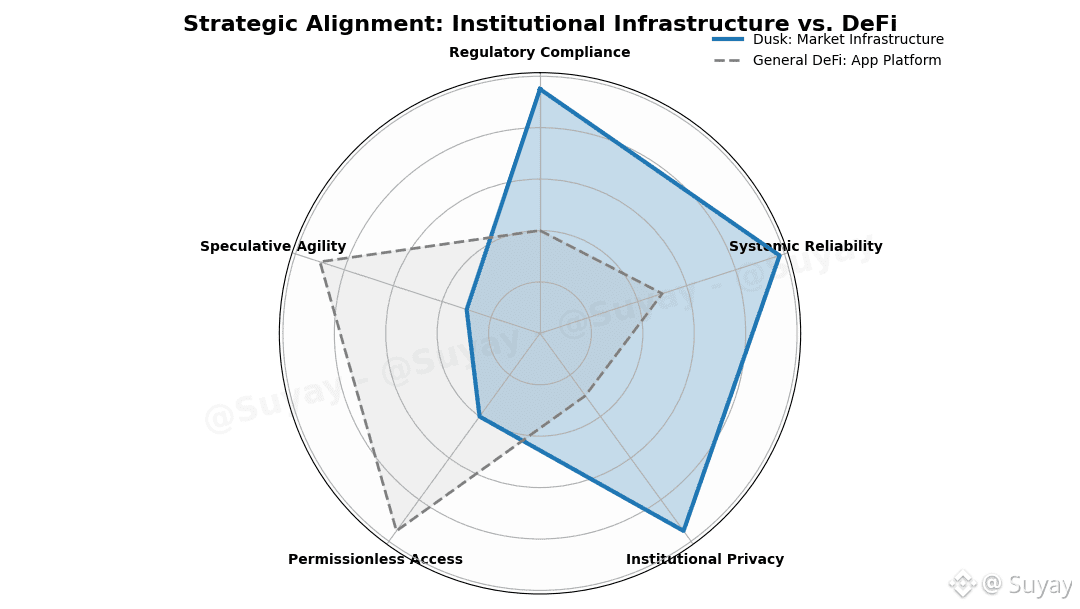

DeFi platforms optimize for openness, composability, and permissionless access. They thrive on rapid iteration, retail participation, and speculative capital. Market infrastructure optimizes for stability, compliance, and systemic reliability. It exists to coordinate issuers, operators, and institutions under enforceable rules. These are fundamentally different missions.

Dusk is built around the logic of market infrastructure. Its design prioritizes deterministic settlement, confidentiality, and regulatory alignment. These are not secondary features. They are core conditions for operating financial markets. Exchanges like NASDAQ are not valued for their user interfaces. They are valued for trust, continuity, and their ability to function under strict regulatory oversight. Dusk is engineering those same properties into a blockchain environment.

This alignment is visible in Dusk’s core values. The network is oriented around long-term utility, financial responsibility, and institutional viability rather than short-term experimentation. It treats privacy not as an ideological stance, but as a market requirement. It treats compliance not as a barrier, but as the framework that enables markets to exist at scale.

The story of Dusk is therefore not one of disrupting finance from the outside. It is one of reconstructing financial market infrastructure from the inside. Instead of building tools for individuals to speculate, Dusk is building systems for markets to operate. This includes environments where issuers can structure regulated assets, where operators can run compliant markets, and where institutions can settle value without exposing sensitive information.

This also explains why Dusk’s ecosystem looks different. Its success is not measured by total value locked or daily active wallets. It is measured by the maturity of its financial stack, the viability of its institutional tooling, and the depth of its integration into regulated contexts. These are the same metrics that define real financial infrastructure.

NASDAQ is not a financial product. It is a financial environment. Dusk is pursuing the same role on-chain.

Why this matters: blockchain adoption in capital markets will not come from DeFi models. It will come from infrastructure that behaves like markets, not like applications.

As blockchain matures, will the industry continue to frame everything as DeFi — or will a new category emerge around on-chain market infrastructure?