Your brain gets a little messed up the first time you encounter sub-second finality. When you look down at your phone after sending a transfer, the payment is already "done" in a way that truly feels complete by the time your thumb leaves the screen. Not "waiting for 12 confirmations," "probably fine," or "pending." I just finished. That level of speed alters traders' perceptions of settlement risk. For investors, it modifies the kind of products that are practically feasible to develop on-chain without customers silently quitting up midway.

PlasmaBFT is the driving force behind the fundamental promise that Plasma is attempting to fulfill.

Rather than being a generic chain that just so happens to facilitate payments, Plasma presents itself as a Layer-1 specifically designed for stablecoin settlement. Its design principles are straightforward: stablecoin-native user experience, quick confirmation, and predictable finality. According to Plasma's official chain overview, the network's performance is directly linked to PlasmaBFT, which is based on Fast HotStuff and designed to handle thousands of transactions per second while maintaining quick and effective settlement for stablecoins.

This is where a lot of articles get into hype, so let's get something out of the way. Until you describe "sub-second finality" in everyday terms, it seems like marketing.

The point at which a transaction becomes irreversible without the network essentially consenting to change history is known as finality. Certain chains provide quick blocks but little assurance. Others provide you with a high degree of assurance but a slow pace of implementation. Because PlasmaBFT is designed to promote both speedy block production and quick validator agreement, the network not only processes your payment rapidly but also completes it swiftly.

According to Plasma's own documentation, PlasmaBFT is a BFT consensus backbone that combines performance engineering and Byzantine Fault Tolerance theory to achieve "high throughput under load," "resilience to faults," and strong finality qualities.

Here's the mental model for non-technical people: picture a table with decision-makers (validators). They adhere to a strict round-based routine rather than all shouting at once. A block is proposed by one validator, verified by the others, and then put to a vote. The decision is locked in when a supermajority of votes are gathered. The protocol is simplified in HotStuff style consensus such that messages are "pipelined," which means the network doesn't waste time waiting for previous rounds to settle completely before continuing. That type of technology is expanded upon by PlasmaBFT, which is designed for high payment throughput.

Why is that important to market players?

Because "number go up" isn't the majority of actual financial activity. It includes exchange movements, remittances, merchant payments, settlement, reconciliation, and treasury operations. Time and certainty are two factors that those workflows are most sensitive to. A seamless checkout is impossible if finality takes thirty seconds. Arbitrage windows and hedging methods get disorganized if finality takes two minutes. Risk teams begin to say "no" even when fees are appealing if finality is probabilistic.

This friction is directly addressed by a fast-finality consensus such as PlasmaBFT.

And the retention issue is rooted in friction.

At the headline level, retention is maintained. It's lost in little things like an exchange deposit that remains "pending" long enough to cause you to question the system, a transfer that takes too long, or a wallet that needs gas but you don't have. Stablecoin-centric features, like as zero-fee USD₮ transfers and support for bespoke gas tokens, are highlighted in Plasma's documentation. These features are specifically made to fit how stablecoins are actually used. To put it in human terms, Plasma is attempting to eliminate the unseen causes of user attrition.

Here is a real-world example that I have witnessed: someone attempts to send USDT to a friend across international borders in order to make a time-sensitive purchase. The user is more concerned with whether the money arrives before the item is sold than they are with decentralization disputes. They won't stick around if they have to wait, reload the app, fret about "confirmations," or pay perplexing costs. They turn into a one-time guest. That is the issue with retention, and it goes beyond onboarding.

By making stablecoin transactions feel more like contemporary fintech than a scientific endeavor, sub-second finality tackles that issue at its core.

What is the current state of the market?

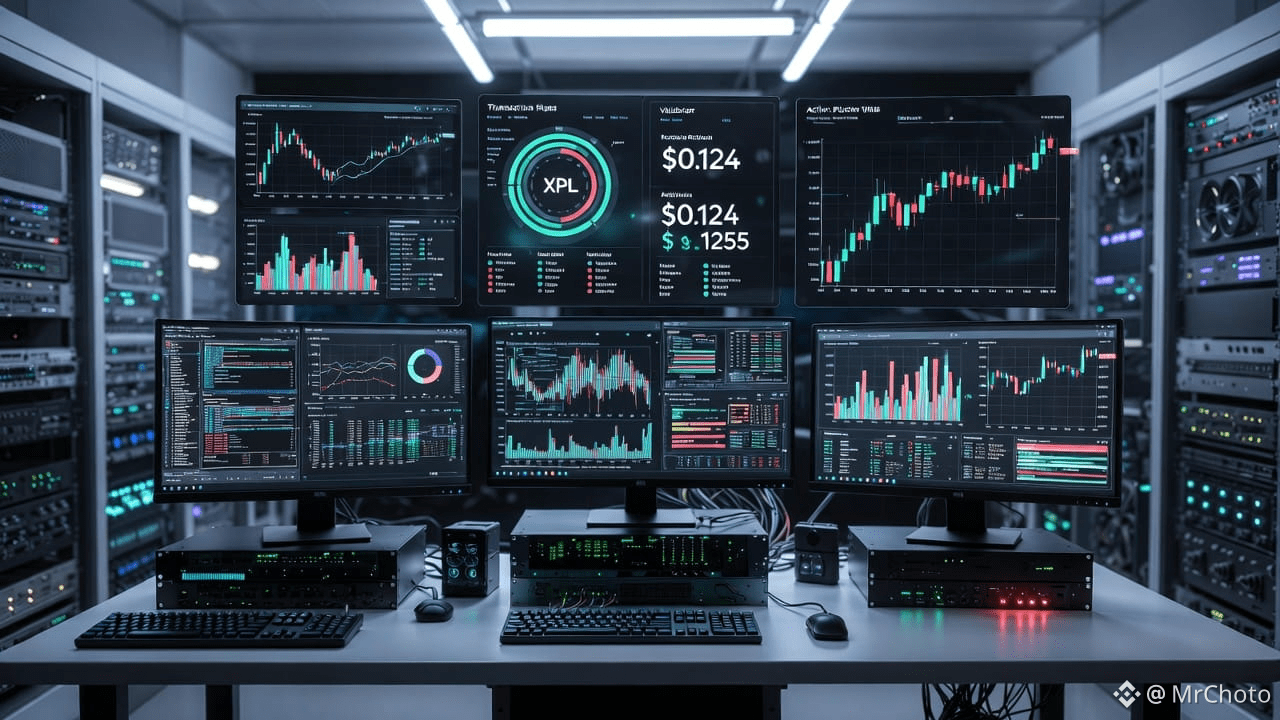

Depending on the location and feed timestamp, Plasma (XPL) is currently trading between $0.124 and $0.125, with a market capitalization of approximately $223 million to $232 million and a 24-hour volume of approximately $87 million to $91 million. On CoinMarketCap, the total supply is displayed as 10B XPL, with circulating supply stated at about 1.8B $XPL .

These figures are important since they provide insight into positioning. The comparatively high volume-to-market-cap ratio indicates active trading interest as opposed to passive holding. That's not necessarily bullish or bearish, but it does indicate that Plasma is not a neglected asset because price discovery is taking place in real time, which is precisely the moment where execution quality and finality start to matter more than catchphrases.

What makes this angle special, then?

The majority of chains use speed as a standard. As a product requirement for stablecoin settlement, Plasma discusses speed. There is a difference in that framing. It implies that the payment chain that makes stablecoin movement appear dull and dependable will triumph, not the one with the most elaborate story. The method that attempts to achieve that reliability at scale is called PlasmaBFT.

However, investors should be aware that consensus design by itself does not ensure success. When developers grow, liquidity comes in, and users continue to return, networks succeed. That brings us full around to retention.

Only when sub-second finality manifests itself in the user's actual experience—such as instantaneous deposits, withdrawals, and merchant confirmations—is it useful. Plasma becomes more than just "fast" if it can reliably supply that. It turns into a settlement layer that you can genuinely rely on without giving it any thought, which is the best thing about payments.

When trading $XPL , keep an eye on adoption signs like as transaction growth, stablecoin transfer volumes, exchange integrations, wallet UX enhancements, and whether the network maintains its performance under load. Ask a more difficult question if you're an investor: can Plasma become the chain that people use when they simply want to transfer money quickly rather than "use crypto"?

Since that is the actual battle. Not to get notice. for habit.

And marketplaces are won by habits.

Track the chain rather than simply the chart if you want to stay ahead of where this moves next. Keep track of Plasma's development updates, keep an eye on stablecoin settlement activity, and evaluate actual performance against rivals. The networks that retain users beyond the initial transaction are ultimately the ones that endure. In order to produce long-term value, PlasmaBFT is designed to win both the second and third transactions. #Plasma $XPL @Plasma