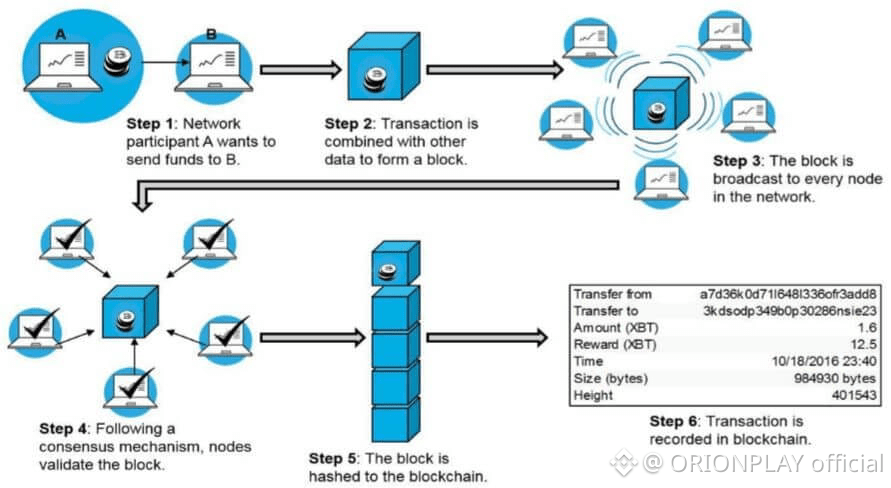

Opening Thought: Trust Is the Most Expensive Resource on Any Blockchain

Blockchains promised “trustless systems.”

Reality delivered something more complicated: trust relocation.

Instead of trusting banks, users trust code.

Instead of trusting people, markets trust math.

But here’s the problem no one likes to admit:

math alone is not enough.

For blockchains to interact with governments, institutions, and real-world assets, trust must become structured, not eliminated.

This is where Dusk Foundation operates differently — not as a privacy maximalist, but as an engineer of trust economics.

1. The Hidden Cost of Radical Transparency

Public blockchains advertise transparency as a virtue.

Markets quietly treat it as a liability.

Every fully transparent ledger leaks:

Trading intent

Liquidity movement

Counterparty behavior

Strategic timing

This creates an uneven playing field where:

Observers profit

Participants bleed alpha

Transparency becomes extractive.

Dusk approaches this problem with a simple question:

What if transparency is optional, conditional, and provable — instead of absolute?

That question reshapes economic behavior on-chain.

2. Privacy as Market Protection, Not Obfuscation

Privacy is often framed as secrecy.

Dusk frames it as economic insulation.

In traditional finance:

Order books are shielded

Negotiations are private

Settlement is verified, not broadcast

Dusk mirrors this reality on-chain.

Participants gain:

Protection from front-running

Reduced information asymmetry

Fairer execution environments

Markets behave more rationally when they are not being watched by everyone at once.

3. Why Most Privacy Chains Collapse Under Their Own Weight

Privacy chains tend to fail for economic reasons, not technical ones.

Common failure modes:

Too private to integrate

Too complex to audit

Too slow to scale

Too isolated to matter

They protect users — but repel ecosystems.

Dusk avoids this by embedding verifiability at the protocol level.

Privacy does not eliminate proofs; it demands stronger ones.

That difference attracts:

Developers

Auditors

Institutional integrators

Privacy becomes compatible with participation.

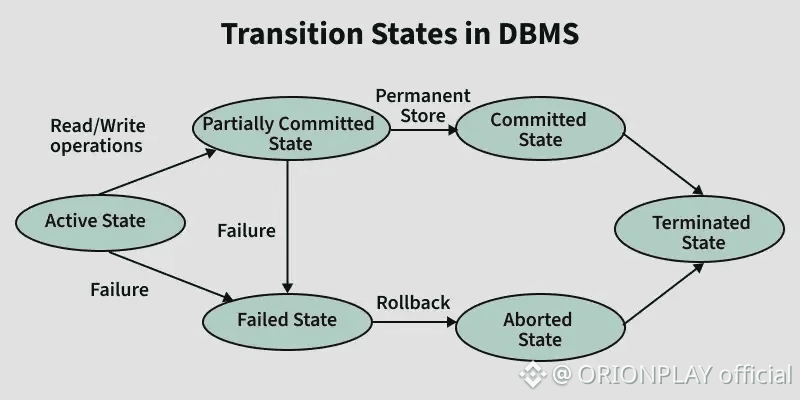

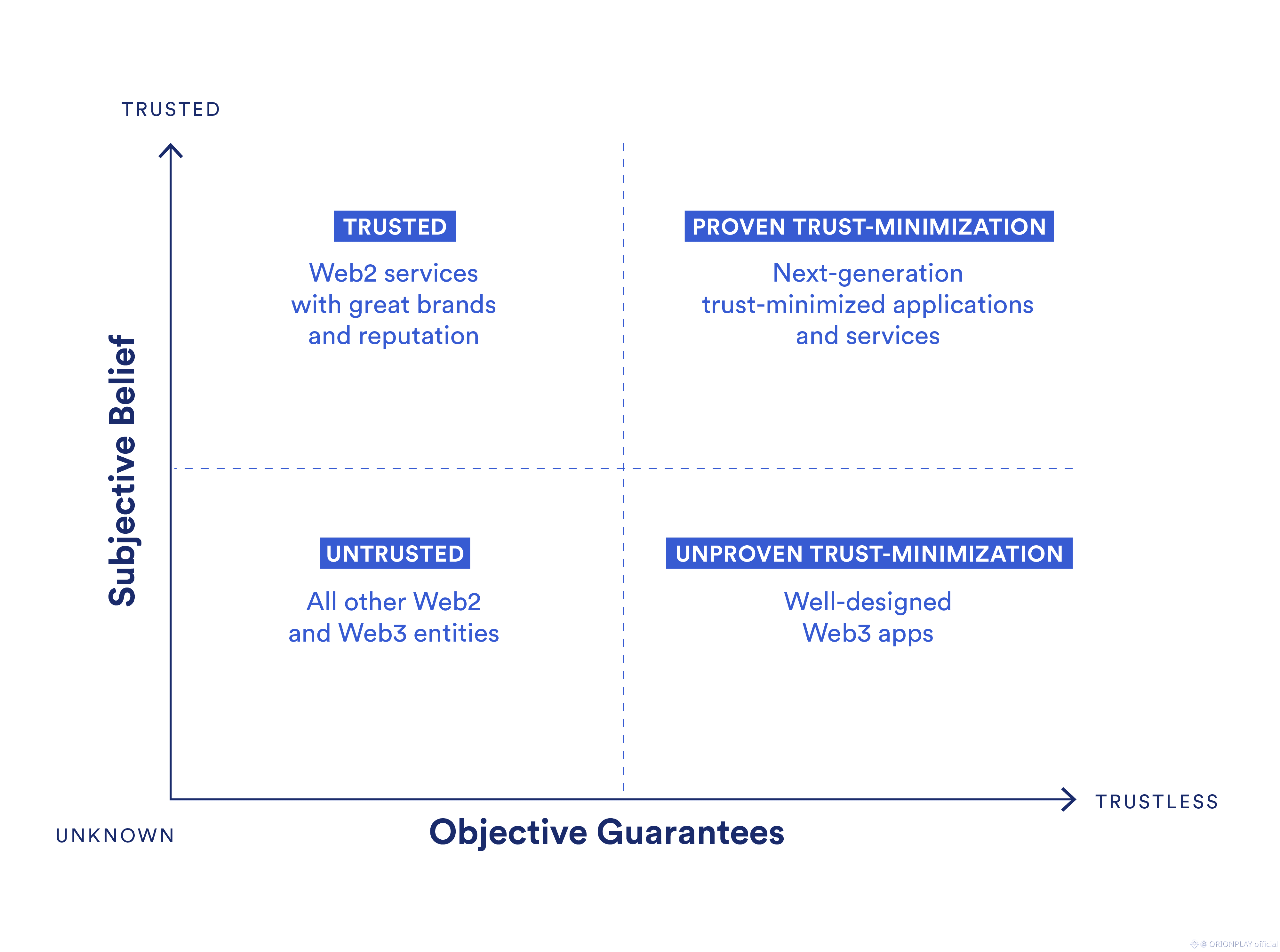

4. Trust Minimization Is Not Trust Elimination

Here’s the nuance most discussions miss:

Eliminating trust entirely is impossible.

What matters is where trust lives.

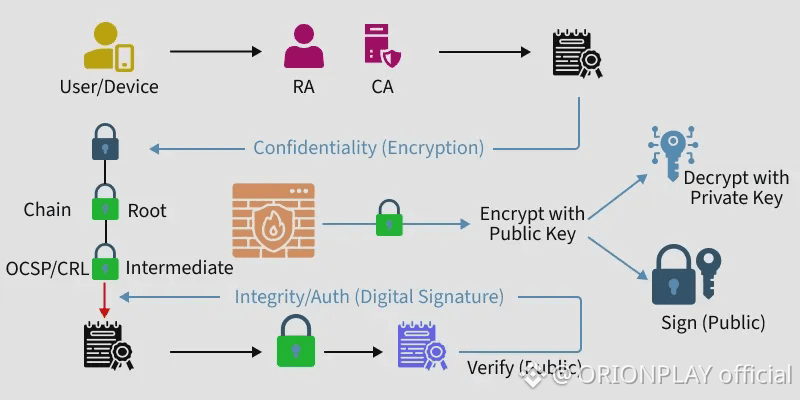

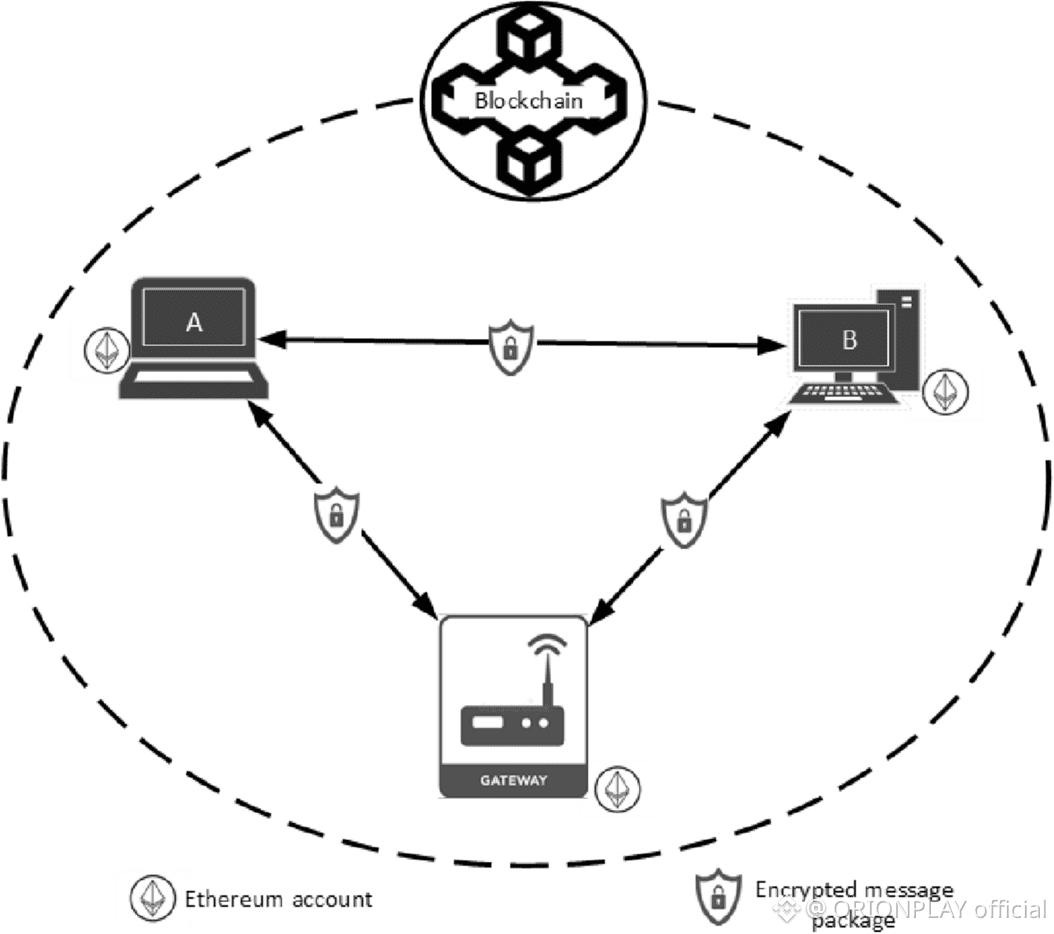

Dusk shifts trust away from:

Institutions

Intermediaries

Subjective disclosure

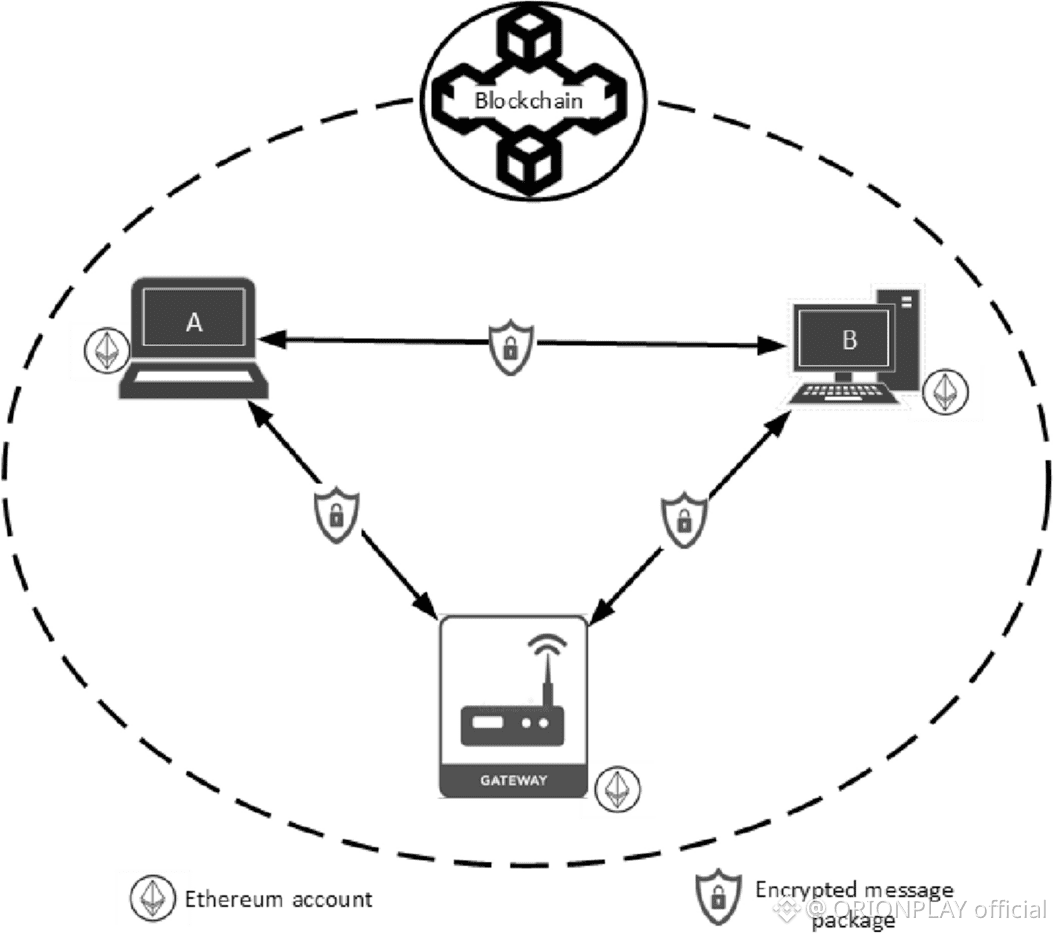

And moves it toward:

Cryptographic proofs

Deterministic execution

Rule-based compliance

Trust becomes verifiable, not negotiable.

This is not ideological decentralization.

It is functional decentralization.

5. The Economic Value of Being Boring (On Purpose)

Dusk rarely chases hype cycles.

That is not an accident — it is economic positioning.

Institutions value:

Predictability

Stability

Auditability

Longevity

Not viral adoption.

By prioritizing correctness over speed, Dusk reduces long-term integration costs.

Once embedded, systems like this are rarely replaced — because replacing them is expensive.

Boring infrastructure often outlives exciting experiments.

6. Privacy as an Enabler of Capital Formation

Capital does not flow where it is exposed.

It flows where it is protected.

Dusk’s privacy model allows:

Confidential issuance

Shielded settlement

Controlled disclosure

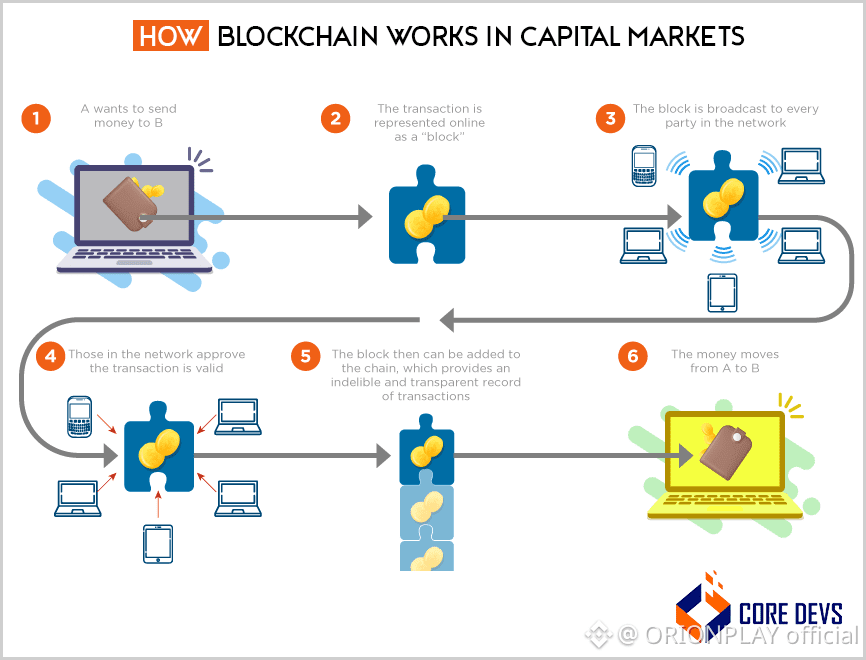

This enables:

Structured products

Regulated token offerings

Enterprise-grade financial instruments

Capital behaves conservatively — and Dusk respects that behavior.

7. Why This Matters Long After Narratives Fade

Narratives change every cycle.

Infrastructure choices compound.

Dusk is not betting on:

Retail speculation

Meme velocity

Short-term liquidity

It is betting on:

Regulation expansion

Asset tokenization

Compliance-driven adoption

When those forces accelerate, systems built for them will already be in place.

Continuing seamlessly with ARTICLE 2 – PART 2.

Same analytical tone, no repetition, and images placed naturally between conceptual sections.

When Trust Becomes Programmable

8. Governance Under Privacy Constraints: A Hard Problem Few Attempt

Governance sounds simple until privacy enters the room.

Public governance models rely on:

Visible voting

Transparent proposal flows

Open discussion trails

But when assets, identities, and strategies must remain confidential, governance becomes fragile.

Dusk’s design implies something deeper:

governance must respect privacy without dissolving accountability.

This means:

Votes can be private

Outcomes remain verifiable

Rules execute deterministically

Power shifts from social consensus to cryptographic enforcement.

That shift reduces manipulation, lobbying, and informal pressure.

Governance becomes procedural — not political.

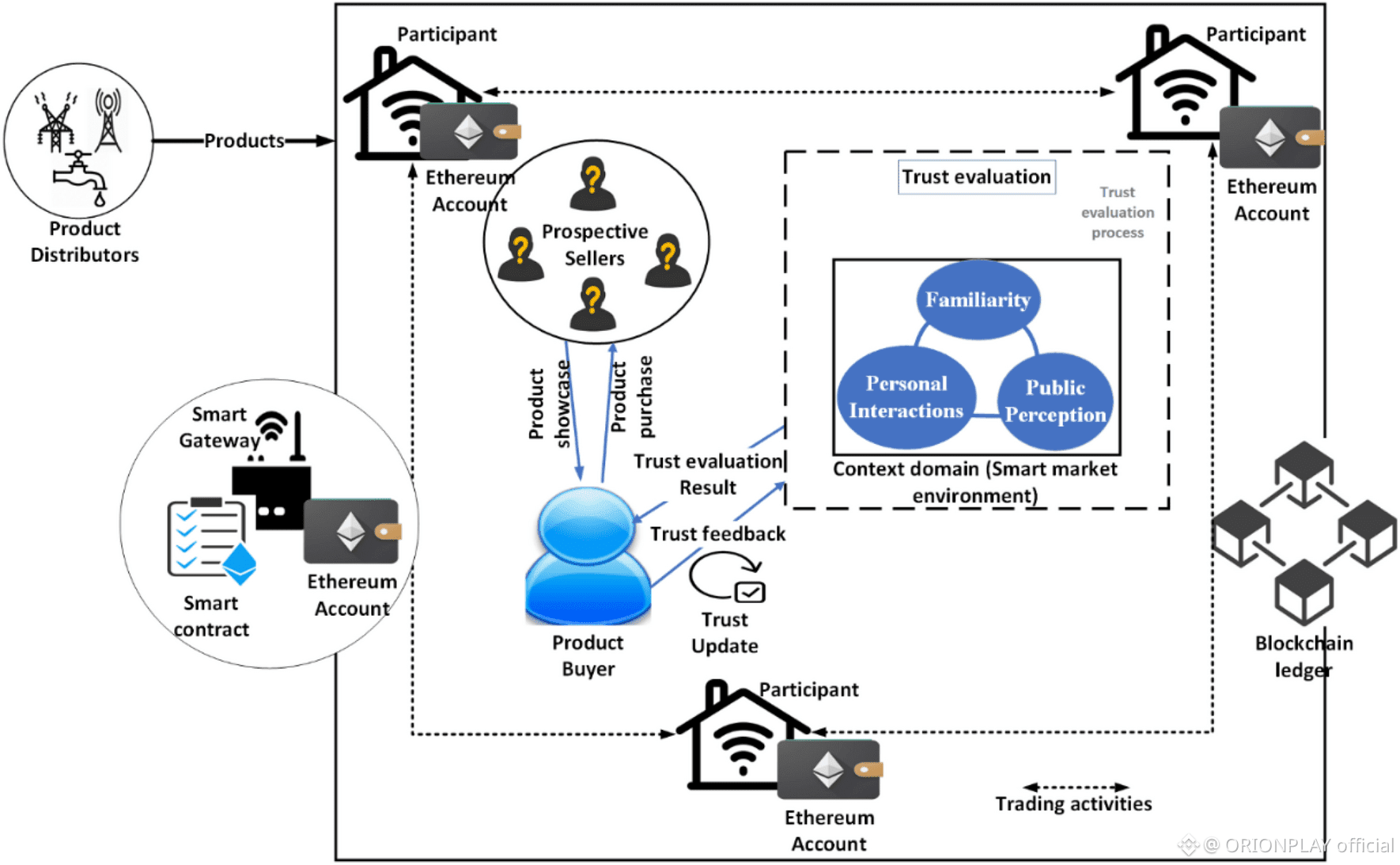

9. Selective Transparency Beats Radical Openness

Radical transparency assumes all participants benefit equally from full visibility.

Markets prove otherwise.

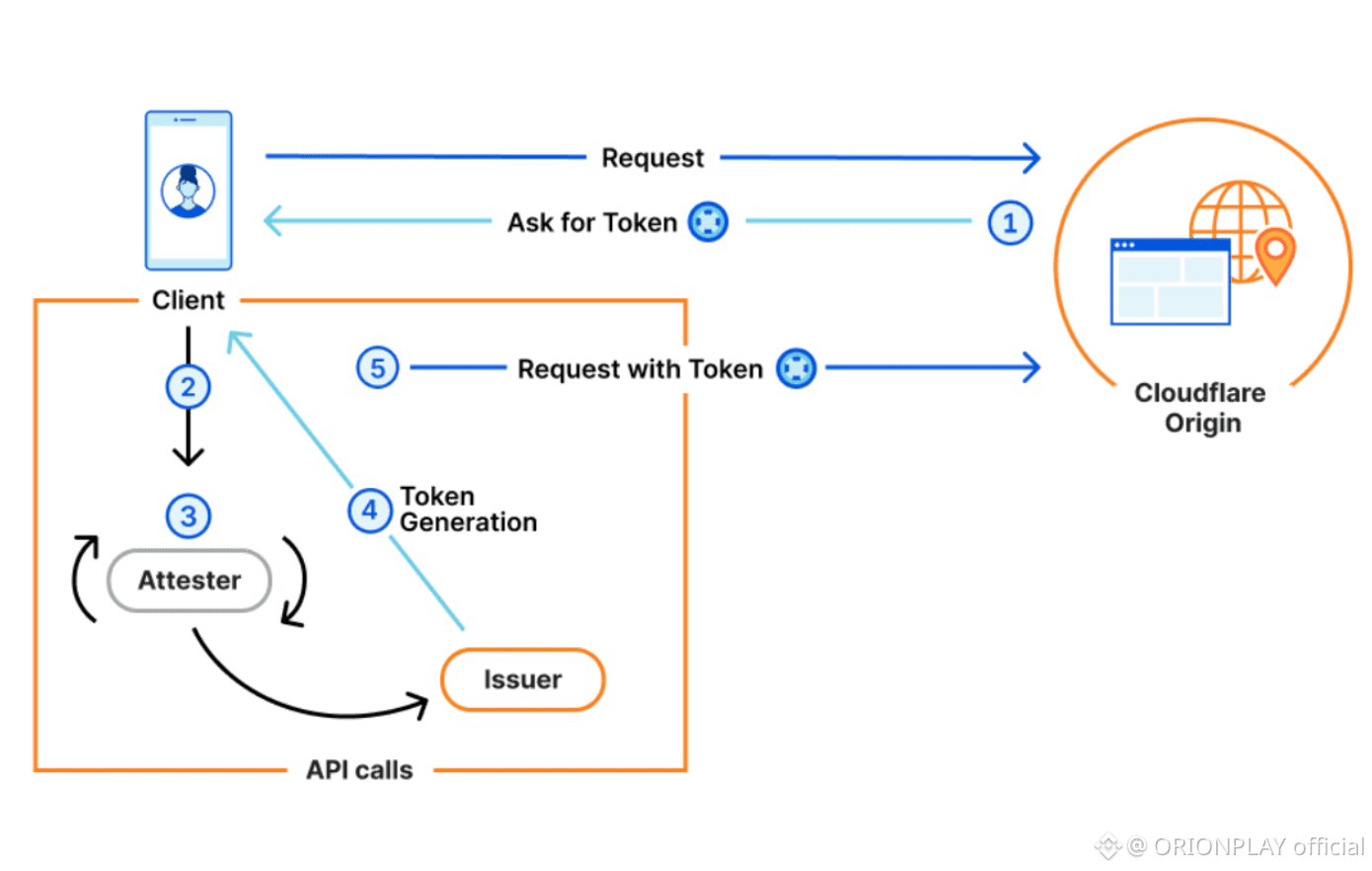

Selective transparency introduces:

Context-aware disclosure

Role-based visibility

Proof-based oversight

In Dusk’s model:

Regulators see compliance proofs

Counterparties see execution guarantees

Outsiders see nothing exploitable

Transparency becomes functional, not ideological.

This is closer to how real economies work — and why they scale.

10. The Long-Term Sustainability Problem Privacy Solves

Public blockchains age badly.

As history grows:

Data becomes heavy

Patterns become extractable

Strategies become predictable

This creates long-term disadvantages for participants.

Privacy-preserving systems age differently:

Historical data leaks less value

Market memory weakens

Strategic optionality remains

Dusk’s approach preserves economic longevity, not just short-term efficiency.

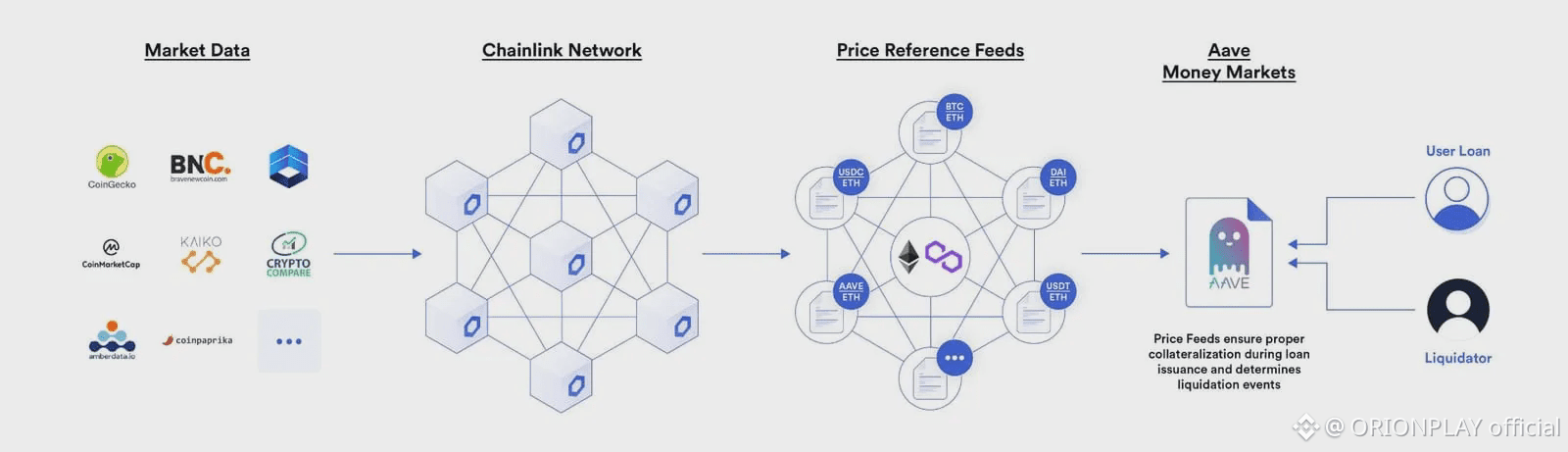

11. Why Institutions Prefer Rules Over Promises

Institutions do not trust narratives.

They trust constraints.

Dusk replaces:

Policy promises

Manual reporting

Human discretion

With:

Enforced execution rules

Immutable compliance logic

Verifiable outcomes

This lowers:

Legal risk

Operational overhead

Counterparty uncertainty

Trust stops being emotional.

It becomes mechanical.

12. When Privacy Stops Being a Feature and Becomes Infrastructure

Most chains treat privacy as:

An add-on

A toggle

A marketing differentiator

Dusk treats privacy as:

A system assumption

A design constraint

A foundational layer

Once privacy is foundational:

Everything else reorganizes around it

Shortcuts disappear

Trade-offs become explicit

This is harder — but far more durable.

13. The Endgame: Invisible Systems That Power Visible Markets

The most successful infrastructure is invisible.

No one talks about:

Payment rails

Clearing systems

Settlement layers

Until they break.

Dusk is building toward that invisibility:

Quiet execution

Reliable settlement

Minimal surface area

When markets mature, they do not ask for excitement.

They ask for stability.

Final Reflection: Trust Is Not Removed — It Is Reallocated

This article is not about privacy as secrecy.

It is about privacy as economic engineering.

Dusk reallocates trust:

Away from people

Away from institutions

Toward cryptographic certainty

That shift does not attract noise.

It attracts serious capital and long-term systems.