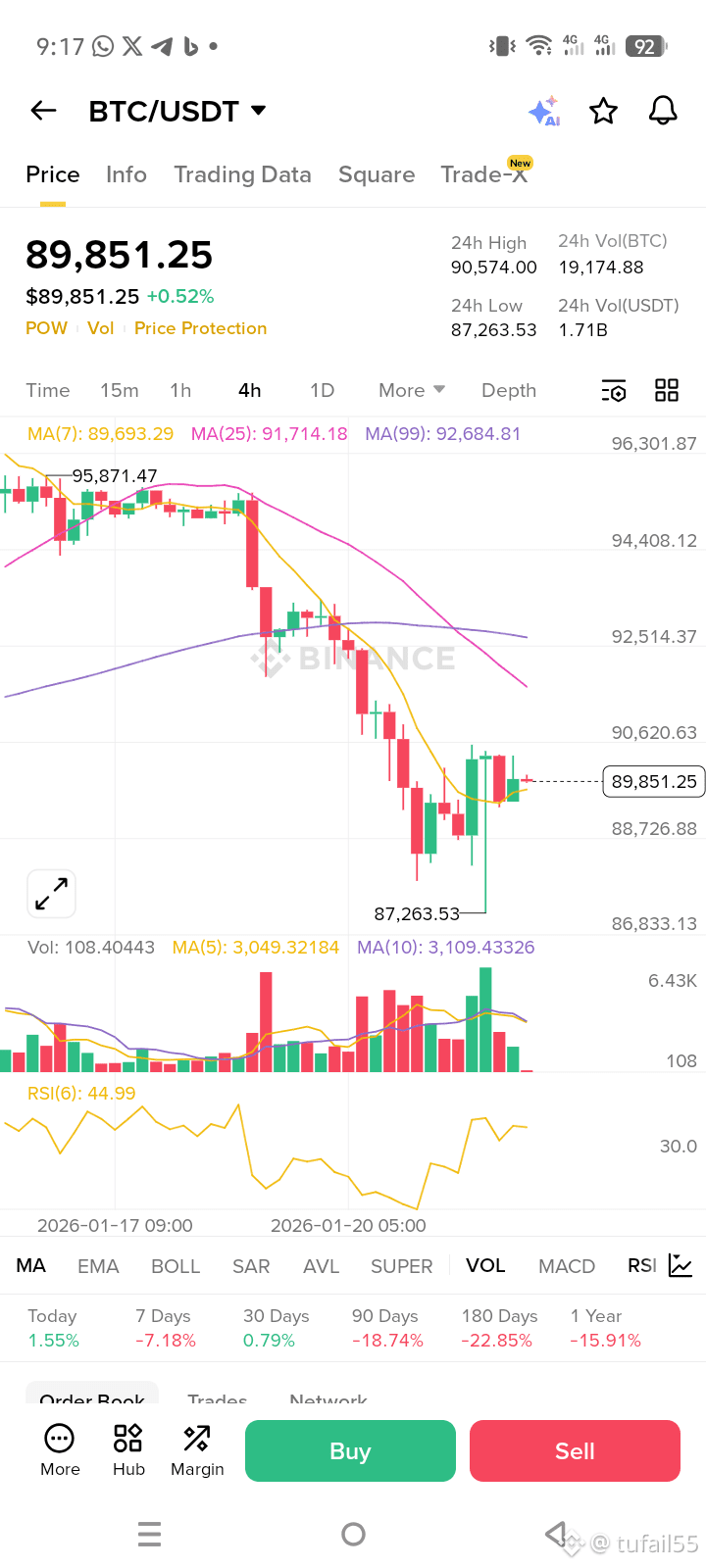

$BTC ≈ 92,680

MA(7) ≈ 89,690 is acting as minor dynamic resistance

Price Action

Strong sell-off from ~95,800

Local bottom formed at 87,263

Current price (~89,850) is a dead-cat bounce / corrective move

Momentum

RSI(6) ≈ 45 → recovering from oversold, but still below bullish zone

Volume spike on the bounce → short-term relief rally, not trend reversal

Key Levels

Support: 88,700 → 87,260

Resistance: 90,600 → 91,700

2. Intraday Trading Bias

Primary bias:

➡️ Short the rally (trend continuation setup)

Alternative bias:

➡️ Scalp long only if support holds (counter-trend, lower confidence)

3. Trade Setup 1 – HIGH-PROBABILITY SHORT (Preferred)

🔴 Short Entry (Scaling allowed)

Entry Zone:

90,400 – 90,800

Near prior support → resistance flip

Close to MA(7) & intraday supply

🛑 Stop-Loss

91,850

Above MA(25)

Invalidation of short-term bearish structure

🎯 Take-Profit Targets

TP1: 89,200 (safe partial)

TP2: 88,200

TP3: 87,300 (range low / liquidity sweep)

Risk–Reward:

≈ 1 : 2.5 – 1 : 3

4. Trade Setup 2 – COUNTER-TREND LONG (Lower Confidence)

⚠️ Use smaller size

🟢 Long Entry

88,600 – 88,800

Only valid if price holds above 87,260 and shows rejection wicks

🛑 Stop-Loss

87,150

Clean break below support invalidates longs

🎯 Take-Profit Targets

TP1: 89,700

TP2: 90,600

TP3: 91,600 (only if strong momentum)

Risk–Reward:

≈ 1 : 2

5. Trade Management Rules (Important)

If 4H closes above 91,800, invalidate all shorts

Trail stop to breakeven once TP1 is hit

Avoid entering mid-range (89,200–90,000) → poor R:R

Best entries occur near London / NY volatility

6. Quick Summary

Best Intraday Play:

✅ Sell rallies below 91,700

Bullish only if:

❌ Price reclaims and holds above 92,000 on 4H close

If you want, I can:

Refine this for 15m or 1H execution

Convert this into a Binance Futures setup (leverage & position sizing)

Mark exact liquidity zones and order blocks

Just tell me 👍

#BTC #btc70k #bitcoin #BTC走势分析