Plasma’s story in 2026 is shifting from “project potential” to real network progress — with milestones that reflect real user activity, protocol evolution, and ecosystem expansion. The team’s focus remains on lowering friction for stablecoin movement, enhancing scalability, and unlocking new ways to secure value and capture liquidity.

One of the most anticipated updates this season is the rollout of delegated staking for $XPL holders. Instead of only validators earning rewards, regular holders soon will be able to delegate their tokens to trusted validators and share in network reward distribution. This unlocks long-term participation and deepens the security layer as more value locks into the system.

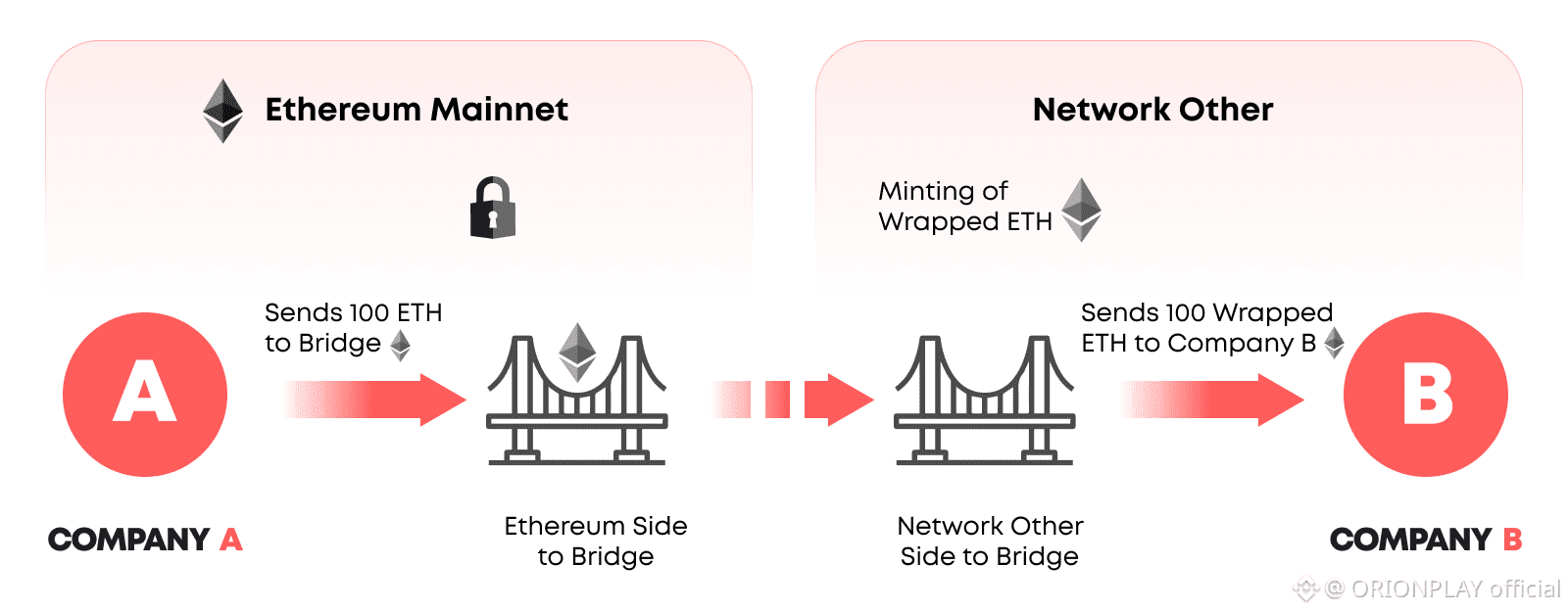

Alongside staking, Plasma’s native Bitcoin bridge initiative is gaining traction in developer circles. This bridge will let users bring BTC liquidity into Plasma’s ecosystem — adding depth to liquidity pools, DeFi projects, and stablecoin rails that rely on abundant capital. Such integration expands Plasma’s interoperability and makes it an appealing choice for users who want fast, low-fee value movement without sacrificing security.

On the adoption front, Plasma is seeing growth in wallet integrations and developer tooling. More wallets now allow seamless transfers of stablecoins with minimal fees, and several dApps are experimenting with Plasma’s throughput advantages. The narrative is clear: real usage beats hype when infrastructure begins handling everyday transfers and interactions.

Market behavior around $XPL has shown mixed moves, yet the broader community engagement has improved. People are talking more about staking, decentralized validator participation, and real transaction flow — shifting discussion away from price swings to network utility.

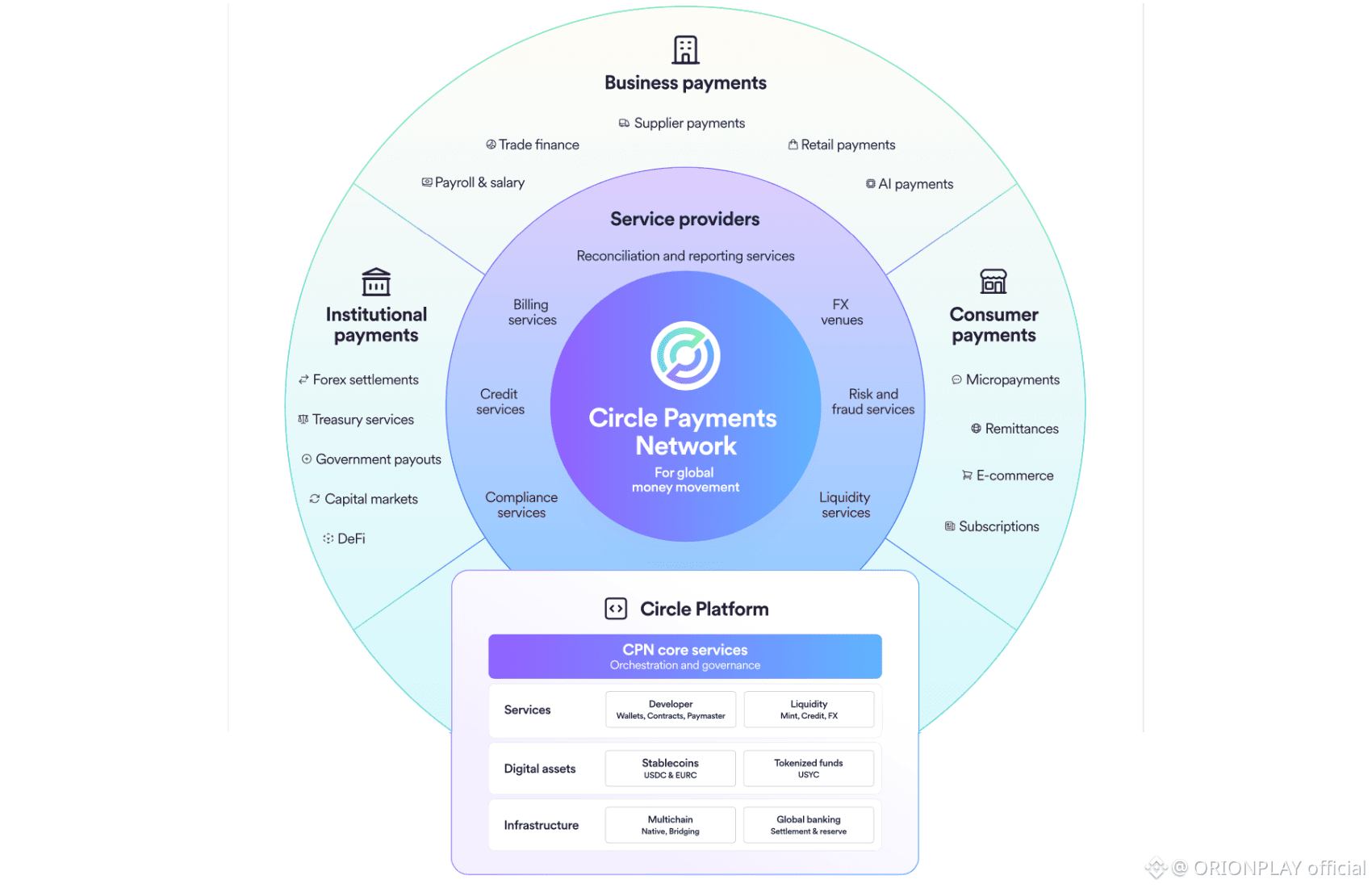

Another noteworthy trend is the attention from cross-chain liquidity aggregators exploring ways to route stablecoins through Plasma efficiently. Projects seeing this kind of traction tend to attract capital that’s looking for low friction and high throughput rails — especially as global stablecoin adoption grows.

In summary, Plasma’s evolution in 2026 feels less like a prelaunch buildup and more like meaningful ecosystem activation. Between delegated staking, native BTC liquidity paths, growing wallet support, and real transaction growth, the network is maturing in ways that matter to builders and users alike.