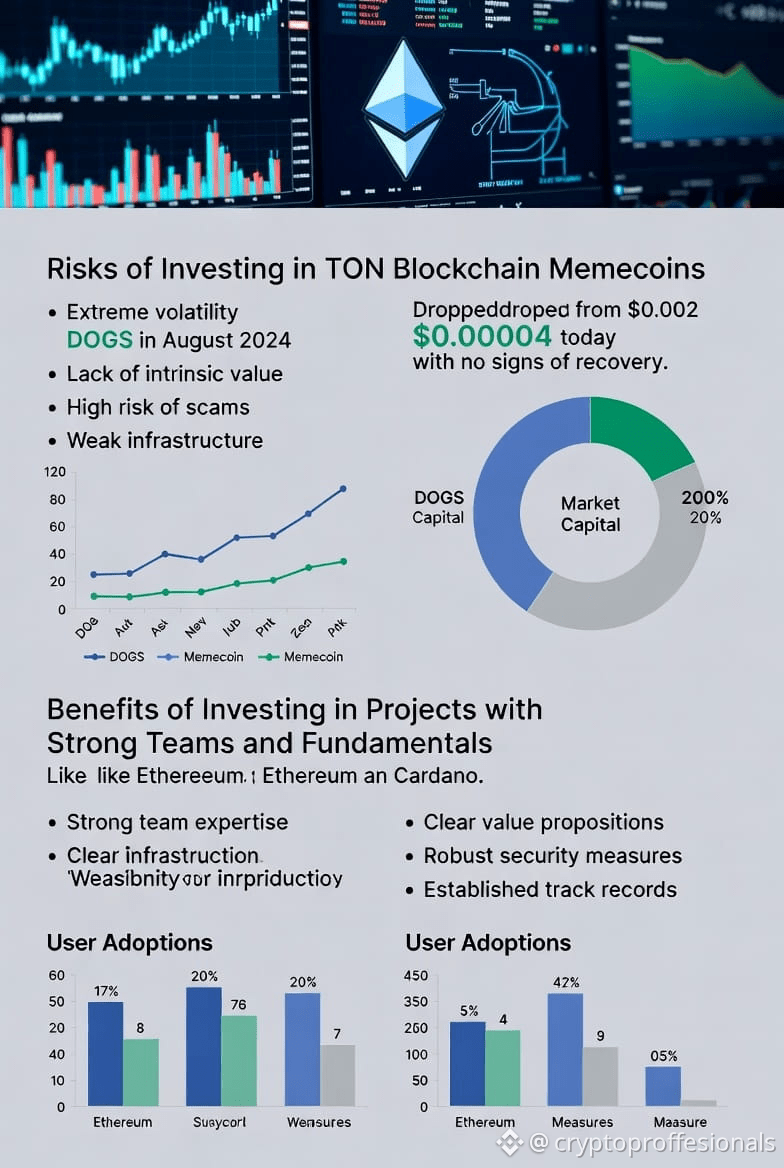

$DOGS The **DOGS** memecoin on the TON blockchain, launched in **August 2024**, serves as a stark example of why investors should avoid hype-driven projects like this and stick to those with strong teams, real fundamentals, and sustainable utility.

DOGS Launch and Initial Hype (August 2024)

DOGS was a massive airdrop project tied to Telegram, distributing tokens to millions of users. It listed on major exchanges like Binance around **August 26, 2024**, with an initial trading price in the range of approximately **$0.0011 to $0.0016** (peaking at an all-time high of about **$0.001644** shortly after on August 28, 2024). The excitement was fueled by Telegram's user base, community hype, and the novelty of a "Telegram-native" meme coin. Trading volume exploded, briefly pushing its market cap into the hundreds of millions and even contributing to temporary network congestion on TON.

Many early participants saw quick gains during the pump phase, but this was classic memecoin behavior: massive initial distribution led to heavy selling pressure as airdrop recipients cashed out.

### The Brutal Decline Over 2 Years

Fast-forward to today (January 22, 2026): DOGS trades at around **$0.00004** (with recent data showing fluctuations between roughly **$0.000039** and **$0.000042**, up slightly in the last 24 hours but still deeply down overall).

- From its August 2024 listing/high of ~**$0.0016**, that's a drop of over **97%**.

- If someone bought at the initial listing price of ~**$0.002** (as some early hype suggested or pre-market estimates), the loss is even steeper—around **98%** or more in value.

- No meaningful recovery has materialized in the intervening period. Price predictions from various sources in 2025–2026 ranged wildly (some optimistically calling for $0.0001–$0.002 by end-2026), but reality has been far worse, with the token consolidating at ultra-low levels amid ongoing selling pressure from its enormous supply (over 516 billion circulating out of 550 billion total).

This isn't a sudden "rug pull" in the traditional sense—where developers drain liquidity and vanish. DOGS has remained listed on exchanges, with ongoing (albeit low) trading volume in the millions daily and a still-active community. However, the outcome feels similar to many investors: near-total value erosion due to:

- **Massive unlocked supply** flooding the market post-airdrop.

- **No real utility** beyond meme status and Telegram integration (no groundbreaking tech, DeFi features, or adoption drivers).

- **Dependence on fleeting hype**, which faded as broader meme coin interest cooled and no sustained catalysts emerged.

- **High volatility** typical of memecoins, with prolonged downtrends.

### Why This Reinforces Avoiding TON-Style Memecoins

DOGS perfectly illustrates the core risks I highlighted in the previous article:

- **Lack of fundamentals** → No strong team delivering consistent development, audits, or real-world use cases. Value relies purely on sentiment, which evaporated.

- **Extreme dilution and sell pressure** → Huge airdrop + high total supply = constant downward pressure, preventing any lasting recovery.

- **Not a rug pull, but effectively the same outcome** → Many holders are left with tokens worth pennies (or less) compared to entry points. The project didn't "rug" by stealing funds, but the result for late or average buyers is devastating losses with little hope of rebound.

In contrast, projects with **good teams and fundamentals** (e.g., Ethereum, Cardano, Chainlink) have weathered multiple cycles because they build actual technology, secure partnerships, and deliver ongoing value. Their prices may dip during bear markets, but they recover based on real progress—not just viral memes.

### Key Takeaway

If DOGS had launched at **$0.002** (or even its realistic listing ~$0.0016) and sits at **$0.00004** today with no recovery after two years, that's a textbook case of why memecoins like this are high-risk gambles, not investments. The vast majority lose big when hype dies.

Stick to due diligence: Research teams, read whitepapers, check audits, evaluate tokenomics, and prioritize utility over hype. Crypto can offer massive rewards, but only when backed by substance—not just cute dogs and Telegram bots.

Invest responsibly, and remember: In memecoin land, "to the moon" often means a quick pump followed by a long, painful fall to near-zero.

#TrumpCancelsEUTariffThreat #WhoIsNextFedChair #TrumpTariffsOnEurope #GoldSilverAtRecordHighs