💥 🚨 TOMORROW COULD SIGNAL A SIGNIFICANT SHIFT IN 2026.

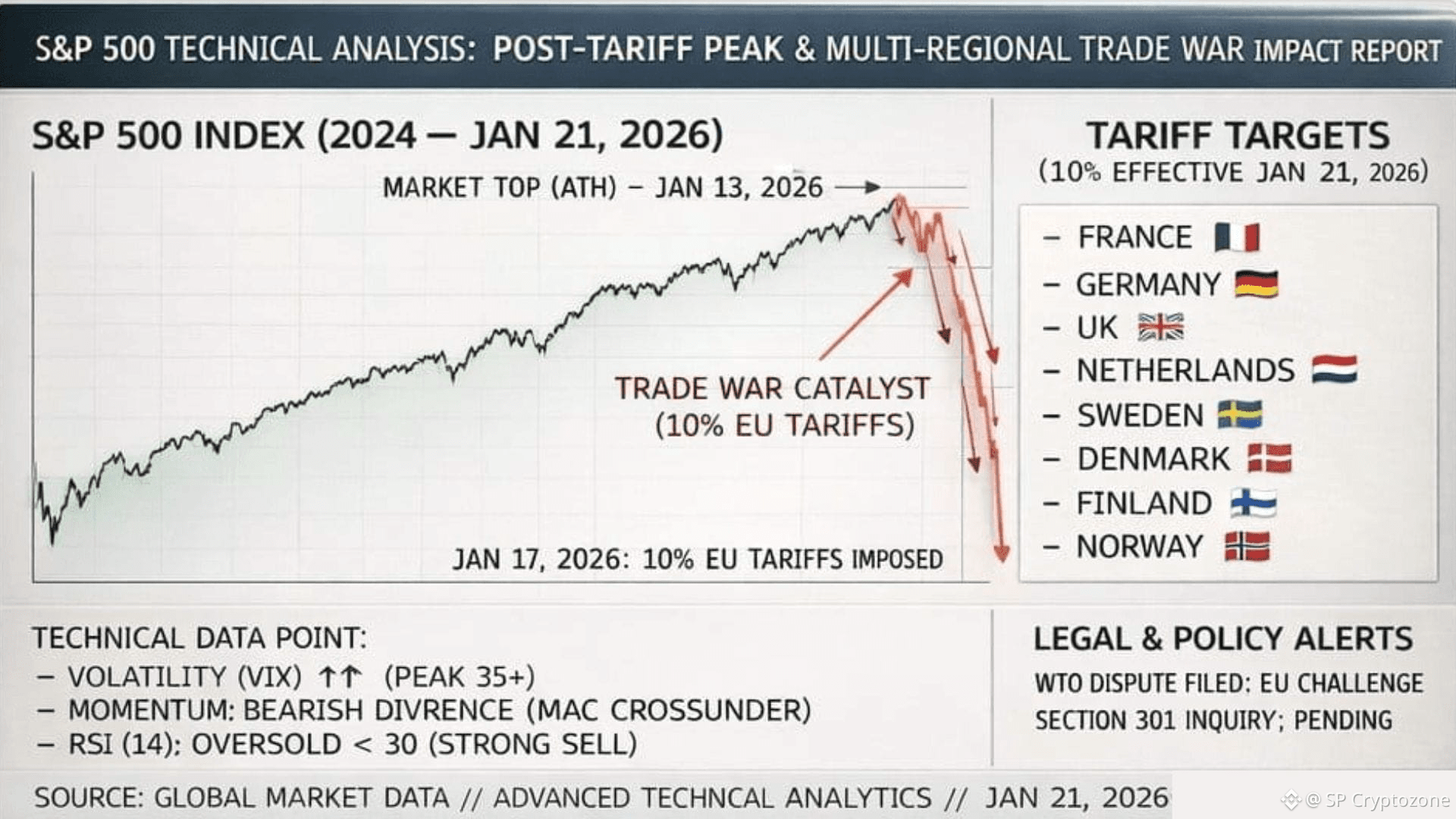

Get ready — risk factors in stocks, cryptocurrencies, and worldwide markets are escalating rapidly. Trump's remarks at Davos have reignited concerns over tariffs, and the U. S. Supreme Court is still deliberating the legality of those tariff powers.

No outcome appears straightforward.

If tariffs are enacted → risk of a dramatic sell-off

If tariffs are blocked → ambiguity in law, increased volatility, and potential declines regardless

There is no distinct "bullish" resolution in sight.

🔍 Why the Situation Appears Risky

1️⃣ Valuations Are Highly Inflated

Markets are expected to perform flawlessly:

The Buffett Indicator, which assesses the ratio of total stock market value to GDP, is nearing 220%, reaching an unprecedented peak and significantly exceeding the high valuations observed during the dot-com bubble.

Shiller P/E is around 40, a figure only touched once in more than a century—just before the 2000 market crash.

At such heights, even a minor disruption can provoke significant fluctuations.

2️⃣ Trump’s Remarks at Davos

Global markets are analyzing every trade statement.

Any signs of heightened tensions — or even strong opposition — may lead to immediate risk-off sentiments.

3️⃣ Tariff Pressure from Greenland

Proposed tariffs of 10% on crucial European allies — such as Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland — are slated to begin on February 1 if there is no deal concerning Greenland.

Given the current inflated valuations, multinational corporations have little room for mistakes.

4️⃣ The Uncertainty of the Supreme Court

The court’s decision could swing in either direction — and both outcomes are complicated:

Tariffs upheld → increased costs, decreasing profit margins, market downturn

Tariffs rejected → refunds, legal repercussions, fiscal challenges, and reminders of Smoot-Hawley apprehensions

Choose your risk.

⚠️ Two Unfavorable Options

💀 A trade war is pressuring corporate earnings.

💀 Or a legal and fiscal shock is undermining confidence.

Retail hopes for gains.

Professionals are bracing for panic-driven reactions.

Considerable changes do not occur at market peaks — they emerge when fear takes the reins.

🧠 In Summary

Markets are teetering on the brink.

What unfolds next could shape overall sentiment for the remainder of the year.

$SXT $RIVER $HANA

#WhoIsNextFedChair #TrumpTariffsOnEurope #GoldSilverAtRecordHighs #MarketRebound #WriteToEarnUpgrade