The evolution of Web3 has reached a critical crossroads. While public blockchains offer unprecedented transparency, that very same transparency has become a barrier to institutional adoption. Global financial giants cannot operate in an environment where every trade, balance, and strategic move is visible to competitors. This is where @dusk_foundation is changing the game.

Bridging the Gap Between Privacy and Compliance

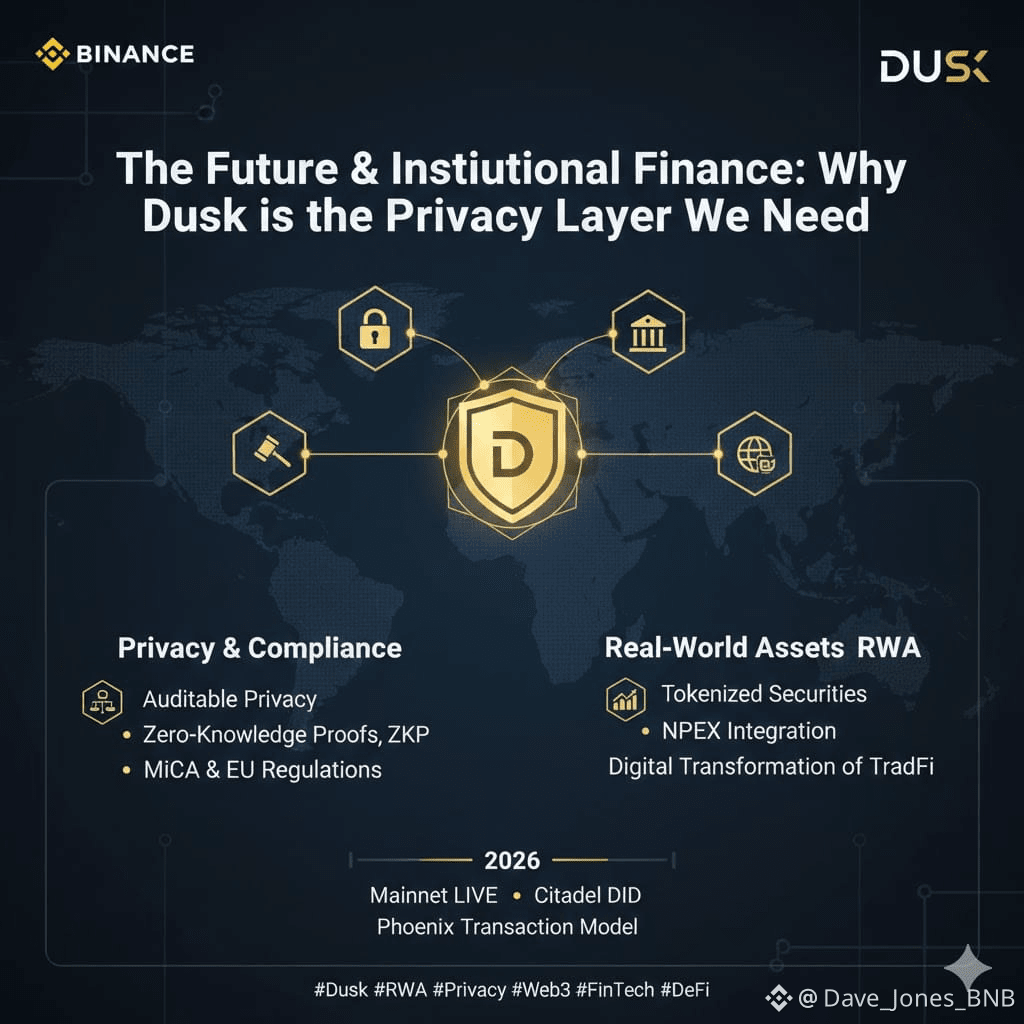

For years, the industry struggled with a paradox: how do you provide privacy without facilitating illicit activity? $DUSK solves this through a groundbreaking "auditable privacy" framework. By utilizing Zero-Knowledge Proofs (ZKPs), Dusk allows users to prove they are compliant with regulations like MiCA and AML/KYC requirements without ever revealing the underlying sensitive data.

Real-World Assets (RWA) and Tokenized Securities

The mission of Dusk extends far beyond simple transactions. The network is purpose-built for the Real-World Asset (RWA) revolution. Through its integration with platforms like NPEX, Dusk is enabling the issuance of tokenized securities that are legally binding and fully compliant. This isn't just "crypto-native" DeFi; this is the digital transformation of traditional stock exchanges and private equity.

Why 2026 is the Year of Dusk

With the mainnet now live, the ecosystem is rapidly expanding. The Citadel protocol is providing a decentralized identity (DID) solution that puts users back in control of their data, while the network’s native Phoenix transaction model ensures that high-throughput institutional trading can happen securely and privately.

As we look toward the future of global finance in 2026, the demand for regulated, private, and scalable infrastructure will only grow. $DUSK isn't just another Layer 1; it is the essential infrastructure for the next generation of finance.

DYOR

https://tinyurl.com/dusk-creatorpad