This is absolutely exploding right now. While traditional payment companies are still charging ridiculous fees and making you wait days for international transfers, Plasma just made the entire game obsolete. Free instant USDT transfers to anyone, anywhere in the world. Not "low fee." Not "next business day." Actually free. Actually instant. Actually global.

Let's get real about what just changed.

The Transfer Problem Nobody Should Accept Anymore

Here's what's insane about the current system: sending money internationally costs anywhere from $15 to $50 depending on your bank, takes 3-5 business days, and involves exchange rates that are basically hidden fees. Western Union and MoneyGram charge even more. Even the "disruptive" fintech apps still charge 1-3% on most transfers.

And we just accept this. We accept that moving digital information across borders should cost money and take time, even though literally everything else on the internet is instant and free. Your email doesn't cost $25 to send internationally. Your video calls don't take three days to connect.

Plasma says enough. USDT transfers are free and instant because that's how digital money should work.

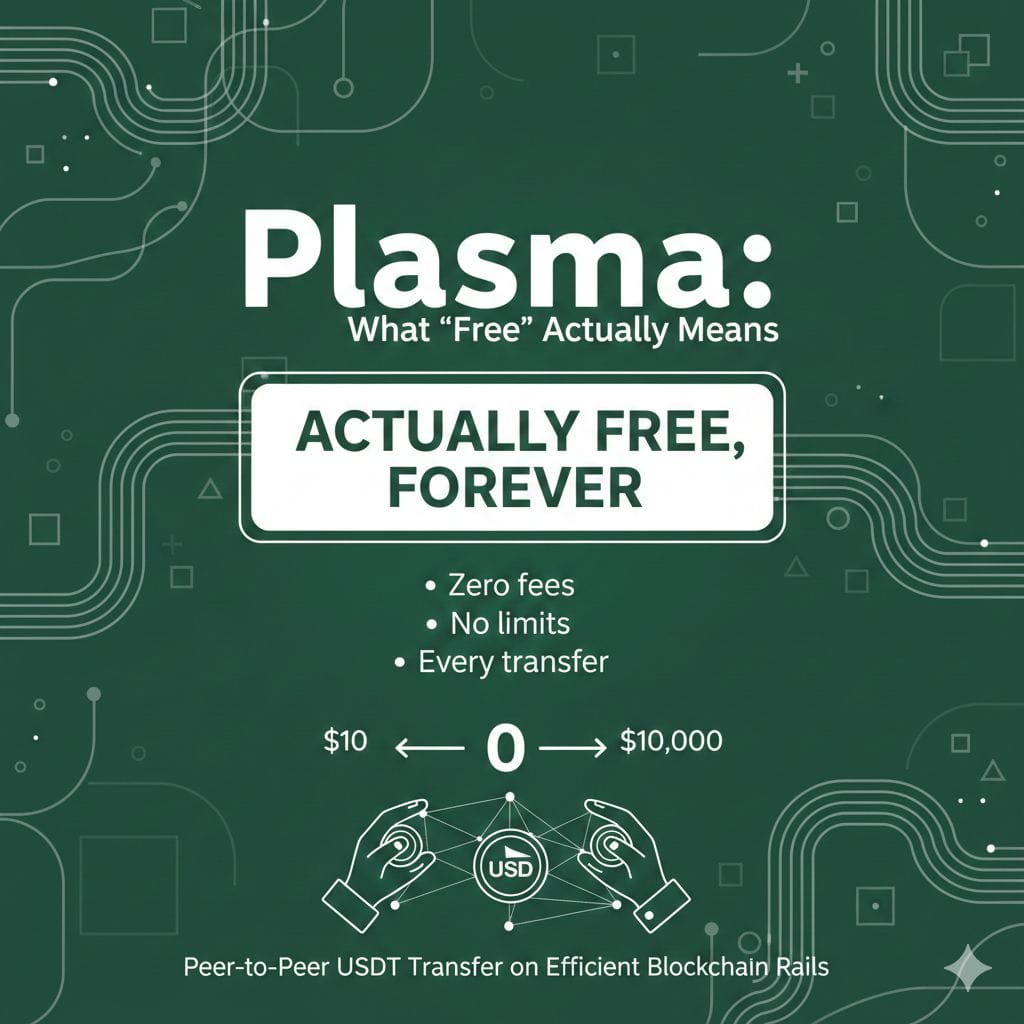

What "Free" Actually Means

Zero fees. Not "free up to a limit." Not "free for the first month." Actually free, forever, on every transfer. Whether you're sending $10 or $10,000, the cost is the same—nothing.

This works because Plasma's Layer 2 infrastructure processes transactions at near-zero cost. There's no correspondent banking network taking cuts. No currency conversion spreads. No intermediaries extracting value at every hop. Just peer-to-peer transfer of USDT on efficient blockchain rails.

The economics finally match what technology makes possible.

What "Instant" Really Means

Let's talk about speed. When Plasma says instant, they mean seconds. Not minutes. Definitely not days. You send USDT, and the recipient has it in their wallet before they can put their phone down.

This isn't just convenience—it fundamentally changes what's possible. Emergency money transfers actually work in emergencies. Business payments don't leave vendors waiting. Freelancers get paid when work is delivered, not when some bank feels like processing the wire.

Instant settlement means money that actually moves at the speed of the internet.

The Global Reality

Everyone keeps asking if this works everywhere. Yes. That's the whole point. USDT doesn't care about borders. Someone in the Philippines, Nigeria, Brazil, or Poland can receive transfers just as easily as someone in New York.

There's no "we don't serve that country" nonsense. No political restrictions on who can send money where. No artificial barriers created by correspondent banking relationships. If you have internet access, you can send and receive USDT through Plasma.

This is financial infrastructure that's actually global, not just global for people in rich countries.

The Remittance Revolution

Here's where this gets really important. Remittances—money sent home by workers abroad—represent over $600 billion annually. Families in developing countries rely on this money for basic needs. And traditional services extract roughly 6-7% on average through fees and exchange rates.

Do the math. That's $35-40 billion taken from some of the world's poorest people just for the privilege of sending money to their families. It's extractive and exploitative, and everyone knows it.

Plasma eliminates this entirely. A construction worker in Dubai can send their entire paycheck home to family in Manila for zero fees. A nurse in London can support relatives in Lagos without losing hundreds to Western Union. This isn't incremental improvement—it's transformative.

How the Economics Work

Let's get into why this is sustainable. Traditional money transfer services have massive overhead—physical locations, compliance staff, correspondent banking fees, currency exchange operations. All of those costs get passed to users.

Plasma operates on blockchain infrastructure where the marginal cost of an additional transaction is essentially zero. Compliance happens through smart contracts and on-chain verification. There's no branch network to maintain. The cost structure is just fundamentally different.

This allows Plasma to offer free transfers not as a promotional gimmick, but as the actual sustainable model.

Trust and Security

Free and instant means nothing if your money disappears. Plasma transfers happen on transparent blockchain rails where every transaction is cryptographically secured and publicly verifiable.

Your USDT moves through audited smart contracts on Plasma's Layer 2, with the security guarantees of Ethereum mainnet backing everything. This is arguably more secure than traditional wire transfers where you're trusting multiple banks not to make errors or freeze your funds arbitrarily.

The transparency also means you can verify exactly what happened with every transfer. No black box. No wondering where your money is during "processing."

The Business Use Case

Everyone focuses on personal transfers, but businesses should be paying attention too. International supplier payments, contractor payouts, cross-border invoicing—these all become dramatically simpler and cheaper with free instant USDT transfers.

A small business importing goods from Asia can pay suppliers instantly without wire fees eating into margins. A company with remote workers worldwide can process payroll without individual transfer fees adding up to thousands monthly. The cost savings scale with transaction volume.

What This Means for Financial Inclusion

Let's get honest about who traditional financial services exclude. The unbanked and underbanked globally number in the billions. High fees and slow transfers aren't just inconvenient for them—they're often prohibitively expensive.

When transfers are free and instant, participation becomes possible for people living on tight margins. The person earning $5 a day can afford to send money home. The small merchant can afford to pay suppliers internationally. Financial access stops being a luxury.

This is what inclusion actually looks like when you remove extractive intermediaries.

The Competitive Landscape

Traditional money transfer companies are watching their business model evaporate in real-time. You can charge $30 for a wire transfer or you can compete with free and instant. There's no middle ground here.

Fintech companies trying to "disrupt" remittances with 2% fees instead of 7% fees are solving the wrong problem. Plasma isn't trying to be slightly better than Western Union—it's making the entire category obsolete.

Network Effects Accelerate Everything

Here's what happens next. Every person who starts using Plasma for USDT transfers becomes a node in a global payment network. Their contacts see free instant transfers and sign up. Those contacts invite their contacts. The network effect compounds.

Traditional services relied on physical presence and brand recognition. Plasma relies on math and utility. When word spreads that you can send money anywhere instantly for free, adoption accelerates exponentially.

The Regulatory Reality

Everyone keeps asking about regulation. Here's the thing: USDT transfers on Plasma still involve identity verification and compliance with relevant regulations. This isn't some unregulated wild west.

But the regulatory compliance happens through modern technology rather than legacy processes. KYC through digital verification. AML through on-chain monitoring. This meets regulatory requirements without the costs that made traditional transfers expensive.

What This Unlocks

Think about what becomes possible when transfer costs disappear. Microtransactions for content creators globally. Split payments across borders. Real-time settlement of international invoices. Financial relationships that were previously too expensive to maintain.

The friction that prevented certain economic activity just evaporates. That unlocks productivity and commerce in ways we probably can't fully predict yet.

@Plasma offering free instant USDT transfers worldwide isn't charity or venture-backed customer acquisition at a loss. It's what becomes possible when you build payment infrastructure on modern technology rather than century-old correspondent banking networks.

Free because the actual cost is near-zero. Instant because settlement happens on-chain in seconds. Worldwide because stablecoins don't recognize borders.

This is what money movement should have been all along. And now that it exists, anything less seems like a rip-off—because it is.