$BTC Something big is quietly happening in the global financial system — and most people are still ignoring it.

🌍 Global Money Is Shifting

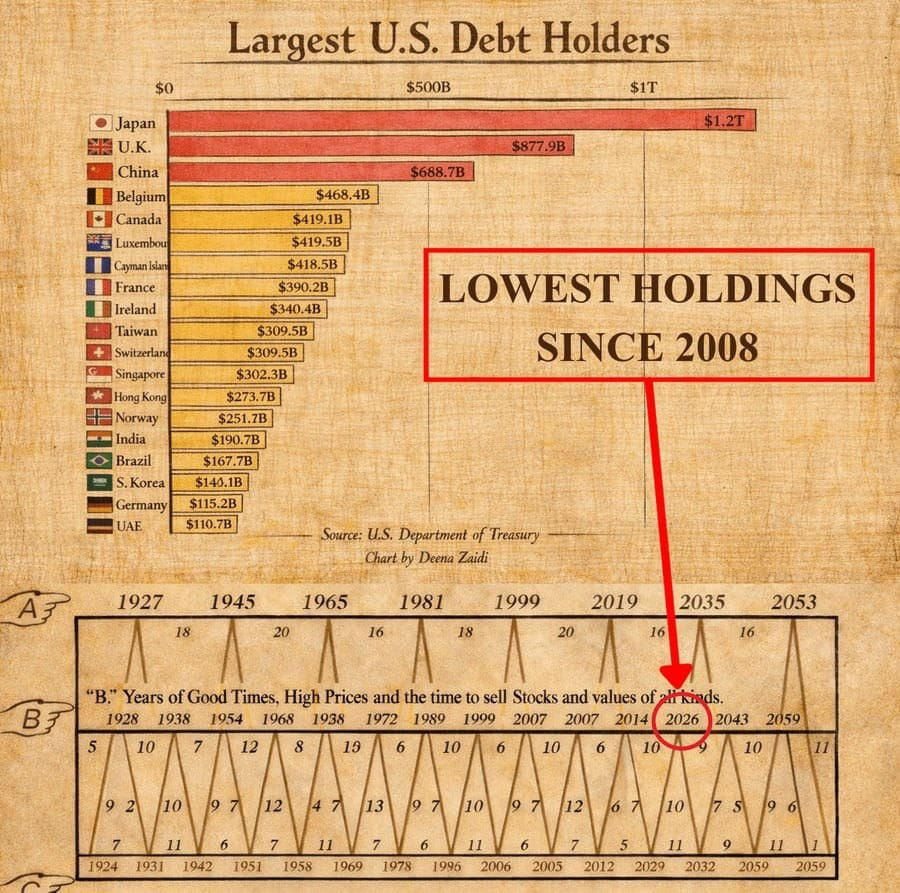

Major countries are slowly reducing their U.S. debt holdings — the lowest levels seen since 2008.

Japan, China, and the UK still hold large amounts,

but the direction is clear:

👉 Trust in traditional debt is weakening.

When governments start de-risking, money usually looks for hard assets —

gold, commodities… and now Bitcoin.

📉 The Benner Cycle Warning

According to the historical Benner Cycle:

Line B represents “Years of high prices and good times”

Historically, this zone has marked major market tops

And one year stands out clearly on the chart…

⚠️ 2026

A year historically linked with peaks — not beginnings.

💡 What Could This Mean for $BTC ?

If traditional markets top out while inflation and debt pressure continue:

📈 Bitcoin could see a final parabolic move before a large correction later.

Not fear — just cycle behavior.

Every bull market ends the same way:

Extreme greed

Everyone becomes a “long-term investor”

Exit liquidity appears

🛡️ My Personal Strategy

❌ No blind FOMO in 2026

✅ Start taking profits on strength

👀 Watch macro signals closely

💰 Gradually rotate into stablecoins near cycle highs

2026 might not be the year to buy everything

it might be the year to protect what you already made.

💬 What’s your plan?

Are you holding through 2026 no matter what…

or preparing for a smart exit near the top?

Let’s discuss 👇🔥