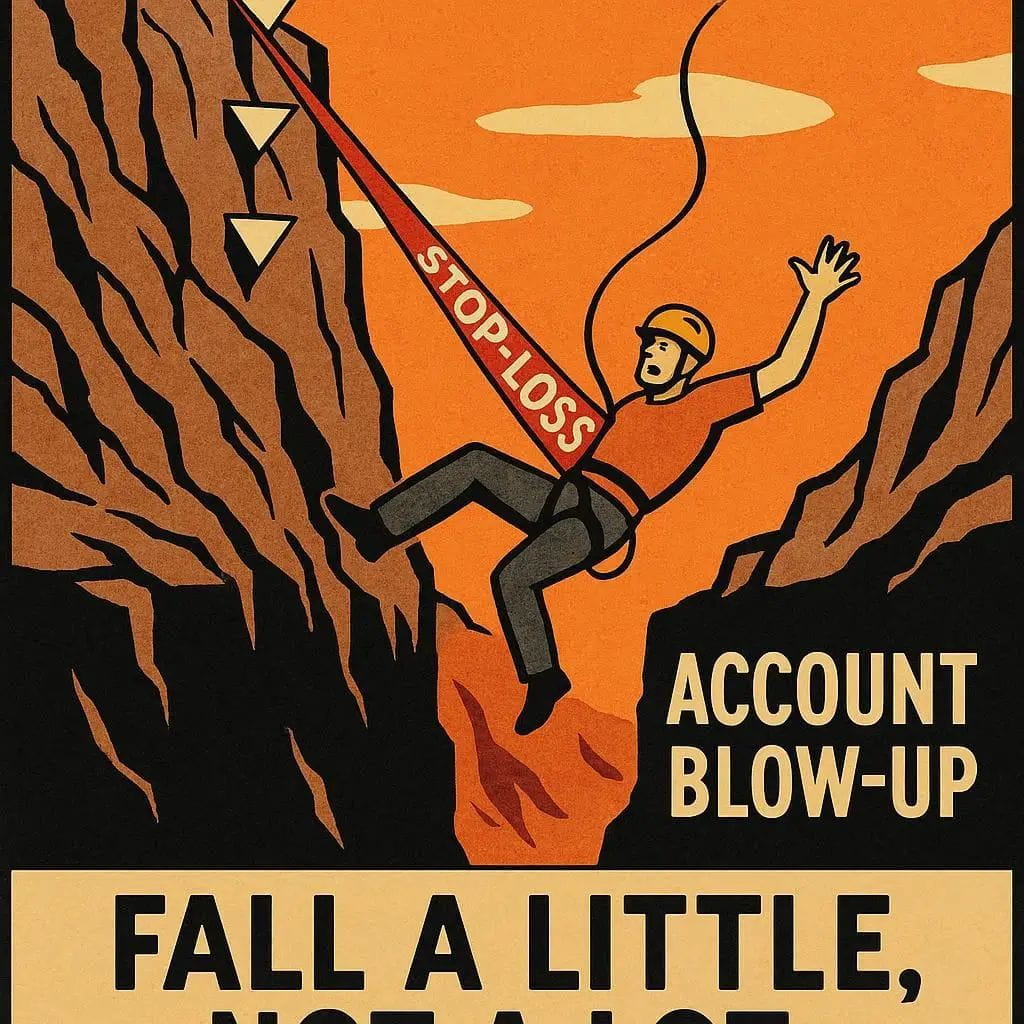

The "Stop-Loss Sandwich" - The Only Futures Advice That Matters

I've blown up two futures accounts. Not "down 50%" blown up. Zeroed. Gone. The second time hurt worse because I knew better. Now, after three years of not just surviving but actually growing a futures account consistently, I'll give you the only advice that matters. It's not about entries. It's not about leverage. It's about the three clicks you make before you ever open a position. I call it the Stop-Loss Sandwich, and it's saved me more times than I can count.

The Sandwich That Doesn't Taste Good But Keeps You Alive

Here's the recipe:

Top Bread: The Mental Stop

· This happens in your head, before you even open the app.

· "If price does X, I'm wrong." Period.

· This is non-negotiable. It's your conviction before the market tests it.

The Meat: The Actual Stop-Loss Order

· This gets placed THE MOMENT your position is opened.

· Not after. Not "I'll watch it." Immediately.

· This is an automated admission: "I could be wrong."

Bottom Bread: The Walk-Away Price

· This is a level beyond your stop-loss where you stop looking.

· If your stop gets hit, you close the app for an hour.

· No revenge trading. No "let me see what happens."

That's it. That's the whole system. Boring? Yes. Life-saving? Absolutely.

Why This Works When Everything Else Fails

It fights the three demons of futures trading:

Demon 1: "It'll come back"

· The automated stop-loss doesn't hope. It acts.

· I've watched positions recover after my stop was hit 100+ times.

· I don't care. The rule kept me alive to trade another day.

Demon 2: "Just one more trade to make it back"

· The walk-away price forces a cool-down.

· The one hour away is often when you realize the market changed.

· Revenge trading has destroyed more accounts than bad analysis.

Demon 3: "I'll move my stop"

· The mental stop established BEFORE the trade is your anchor.

· Moving stops is how $500 losses become $5,000 losses.

· Your future self will thank your past self for being stubborn.

The hard truth: Your entry doesn't matter nearly as much as your exit. A mediocre entry with a great exit makes money. A great entry with a terrible exit destroys accounts.

How to Build Your First Real Sandwich

Step 1: Before You Open Binance

Pick one pair. Let's say $BTC .

Ask: "Where would BTC need to trade for me to admit my thesis is wrong?"

Write that number down on actual paper.

That's your Mental Stop.

Step 2: The Moment Your Position Opens

Place your Actual Stop-Loss Order 1-2% beyond your mental stop.

Why beyond? Because liquidity, because Binance's matching engine, because reality.

Set it as a Stop-Market order, not Stop-Limit. You want out, not a fight.

Step 3: Set Your Walk-Away Alarm

Calculate a price 2% beyond your stop-loss.

Set a price alert at that level.

When it hits: Close app. Literally. For one hour.

The discipline is in the stacking. Each layer protects the next.

The Math That Will Scare You Straight

Let's talk about the recovery trap:

· Lose 10% of your account? You need 11% gain to recover.

· Lose 20%? Need 25% gain.

· Lose 50%? Need 100% gain.

· Lose 70%? Need 333% gain.

The Stop-Loss Sandwich prevents the slide. It's not about avoiding losses—everyone has losses. It's about keeping them small enough that recovery is possible tomorrow, not next year.

My rule: No single trade can risk more than 1-2% of my futures account. Ever. If that means smaller position size, so be it. I'm here to trade next month, not be right today.

What Happens When You Actually Follow This

Week 1: You'll hate it. You'll watch stopped-out trades reverse. You'll feel "If only I hadn't used the stop..."

Week 2: You'll notice something. Your account isn't down 30%. It's maybe down 3%. Or up 2%. The volatility is gone.

Week 3: You'll have your first "thank god" moment. A trade goes violently against you. Your stop saves you from a 15% loss. You close the app. Come back an hour later. The market is still crashing. You breathe.

Month 2: You start analyzing your stopped trades. You notice patterns. "I keep getting stopped on support breaks." That's valuable data! That's learning!

Month 3: You realize you're not trading to be right anymore. You're trading to survive. And somehow, surviving turns into growing.

---

The One Exercise That Changed Everything

Every Sunday night, I review my stopped trades from the week. Not my winners—my stops.

I ask three questions:

1. Was my mental stop logical?

2. Did my actual stop execute properly?

3. Did I honor the walk-away?

If I can answer yes to all three, it's a successful trade—even if it lost money. That mindset shift took me from futures gambler to futures trader.

Try it this week. Make one trade using the Stop-Loss Sandwich. Just one. Even if it's a tiny position. Experience the process.

Comment if you've ever had a stop save you from disaster. What did it teach you?

Good futures trading isn't about catching every move. It's about surviving every move you don't catch.

#TradingPsychology #RiskManagement #Futurestrader #StopLossStrategy #AccountProtection #TradingRules #Discipline #BinanceFutures #FuturesTrading #Crypto #RiskManagement #StopLoss #Binance #Trading #Advice #Survival