$ETH weekly chart is showing an almost identical structure to its previous bullish cycle. All major technical signals are aligning again, suggesting that ETH may be preparing for a strong upside move in the coming weeks.

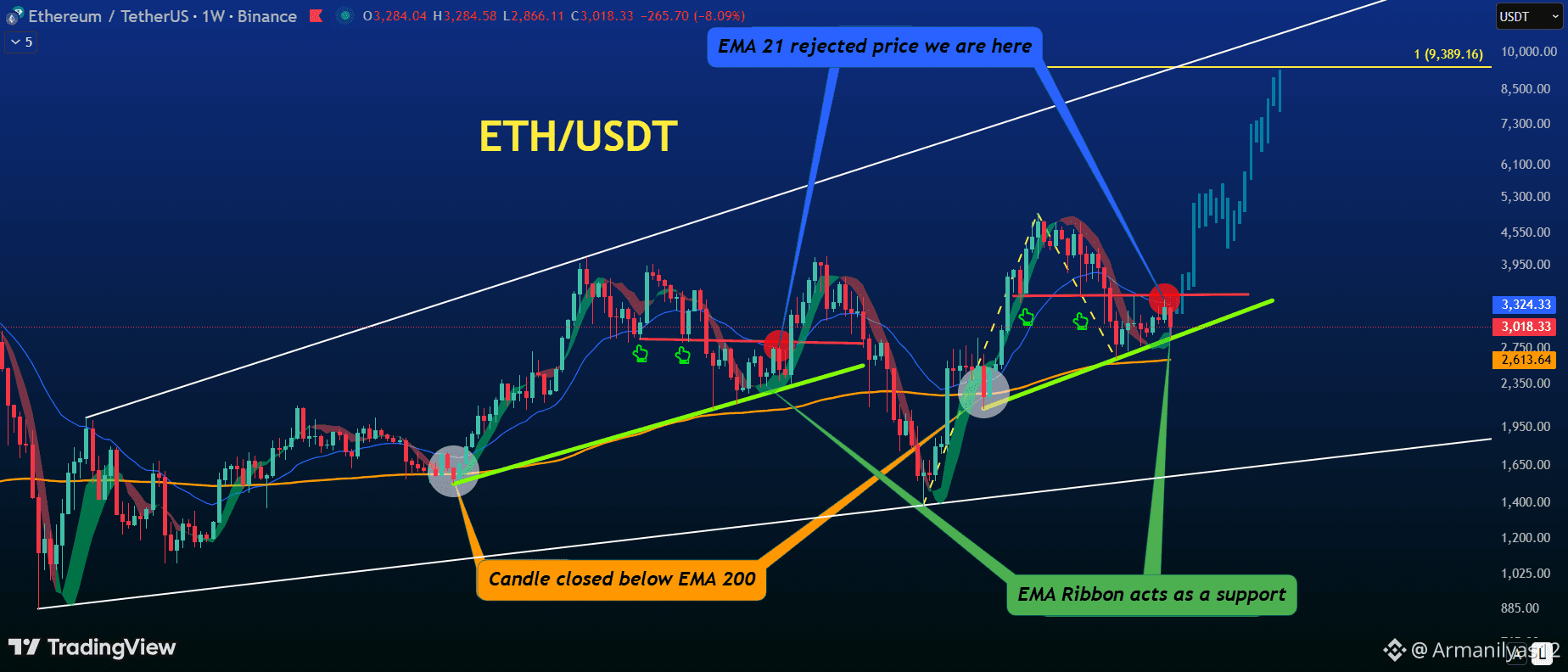

1️⃣ EMA-200 Breakdown + Immediate Recovery

In the previous cycle, ETH printed a single red weekly candle below EMA-200, then immediately reversed and started a strong upward trend.

Today, we see the exact same behavior:

One red candle closed below EMA-200

Price recovered quickly

Structure is repeating

This is a powerful multi-cycle bullish signal.

2️⃣ EMA21 & EMA Ribbon Behavior on ETH (Important Observation)

#ETH is currently trading between two dynamic levels:

🔸 EMA 21 — Acting as Resistance

Price is repeatedly getting rejected from the EMA21, showing short-term momentum weakness.

🔸 EMA Ribbon — Strong Support Zone

On the downside, the green EMA Ribbon continues to provide solid support. Every dip into the ribbon is being bought up, preventing deeper correction.

📈 Historical Behavior (Very Important)

Last time #ETH was in this same structure:

EMA Ribbon support did NOT break

EMA 21 broke to the upside

ETH continued its trend and went on to make a new high

Current structure is developing similarly, with the ribbon holding firm again

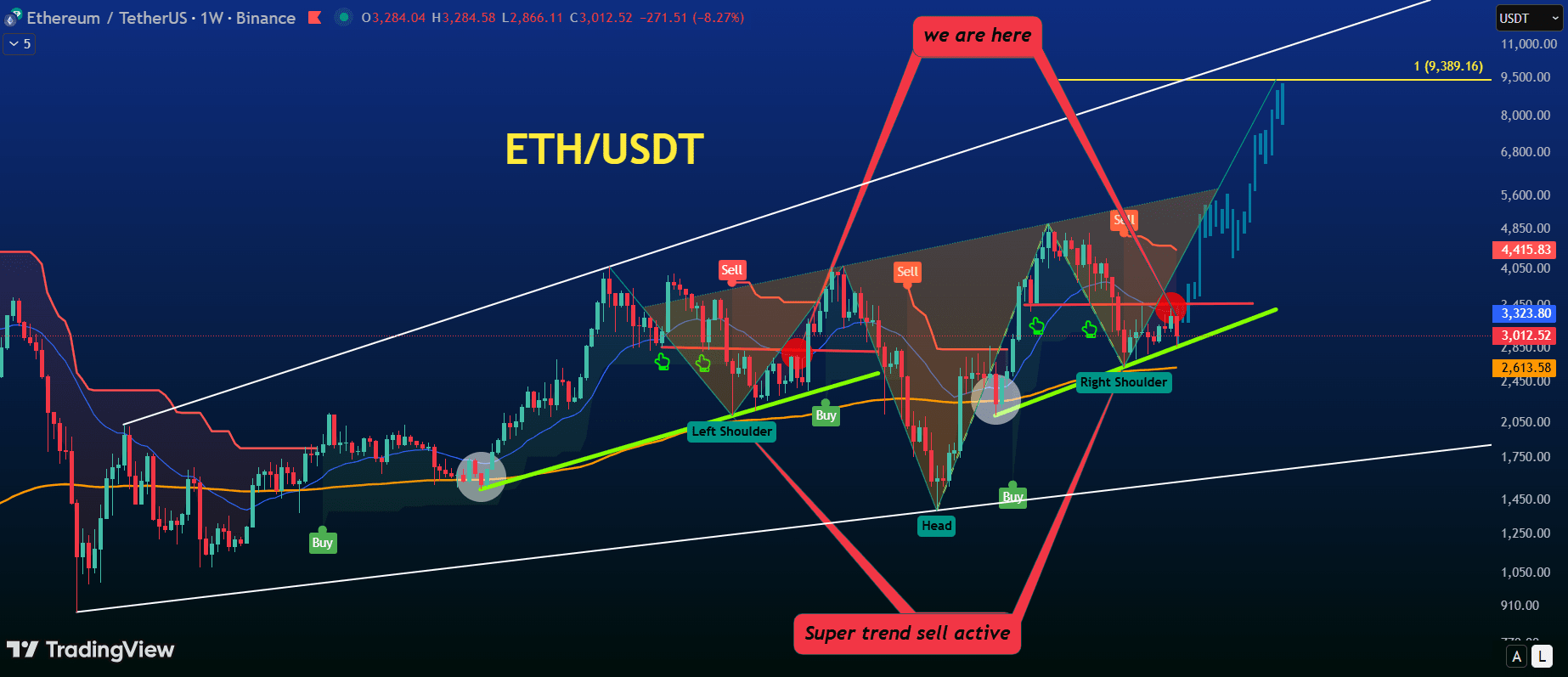

3️⃣ Support Break → SuperTrend Sell → Bottom Formation

Previously:

ETH created a local support

Broke it

Activated a SuperTrend Sell Signal

Formed a swing low afterward

Now the same sequence has repeated:

Support created

Broken

Sell signal activated

Low printed exactly at the trendline

These fractals rarely repeat without continuation.

4️⃣ Trendline From the Breakdown Candle Holding Strong

A trendline drawn from the candle that closed below EMA-200 acted as the main support in the previous cycle.

ETH has now bounced from the same type of trendline, confirming identical behavior.

Support is reacting precisely as before.

5️⃣ No EMA-200 Retest Before New High

In the earlier cycle:

After reclaiming EMA-21

ETH never revisited EMA-200

Price exploded to a new high

Today:

ETH reclaimed structure

EMA-200 remains untouched

Pattern looks identical

6️⃣ Inverse Head & Shoulders Structure Aligning With Macro Support

Alongside all bullish confluences, ETH is forming a clean Inverse Head & Shoulders pattern on the higher timeframe.

The Left Shoulder, Head, and Right Shoulder are developing exactly at key structural levels:

The Left Shoulder formed after the initial breakdown phase

The Head created the deeper liquidity sweep

The Right Shoulder is forming above the EMA Ribbon, showing strong buyer interest

The Neckline is positioned at the same horizontal resistance where EMA-21 is currently rejecting

This alignment strengthens the bullish case.

Historically, when ETH develops an IHS with EMA Ribbon holding as support, the breakout above the neckline triggers a sharp upside continuation.

If this IHS completes and ETH breaks the neckline, the next move can mirror the previous cycle—leading to a strong bullish impulse and a new All time high.

📌 Final Expectation: Bullish Expansion Inbound

If this fractal continues its historical behavior, ETH may be heading toward:

👉 2–3 weeks of strong bullish momentum

👉 A new All time high formation

👉 Major upside breakout following resistance clearance

Ethereum is repeating its most bullish macro structure — and the next move could be explosive.

💛 If You Found This Analysis Valuable…

If you enjoy my work and want to support my analysis, please consider:

👍 Liking this post

🔁 Sharing it with your community

⭐ Following me for more chart breakdowns

💬 Leaving a comment to boost visibility

Your support motivates me to bring even deeper, high-quality technical analysis for ETH, BTC, and the entire crypto market.

Thank you for being here. 💛🚀

#NFA✅ #ETH🔥🔥🔥🔥🔥🔥