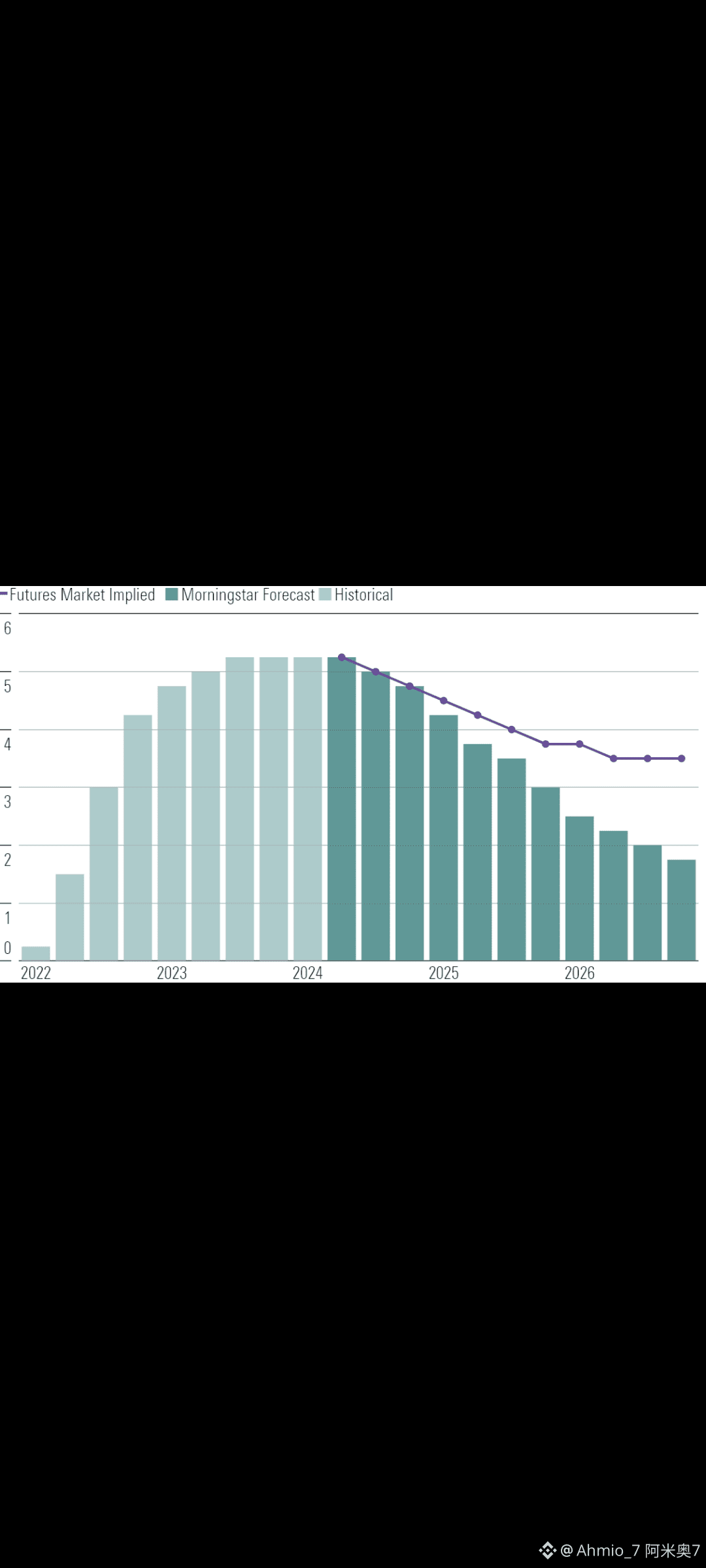

Investment managers increasingly expect the Federal Reserve to cut interest rates three times by 2026. This view is based on clear economic signals and long term policy trends. The goal is to support growth while keeping inflation under control.

Inflation has cooled from its peak. Price pressure is no longer spreading across the economy. Supply chains are more stable. Energy costs are less volatile. These shifts give the Fed more room to ease policy over time.

Economic growth is also slowing. Consumer spending remains steady but no longer strong. Business investment is cautious. Companies are focused on efficiency not expansion. This reduces the risk of overheating and supports the case for rate cuts.

The labor market remains healthy but cracks are forming. Hiring is slower. Job openings are falling. Wage growth is easing. This balance helps the Fed move toward lower rates without risking sharp unemployment.

Three rate cuts by 2026 would signal a gradual approach. The Fed wants to avoid sudden moves. A slow path allows markets to adjust. It also protects financial stability.

For investors this matters. Lower rates usually support equities. Growth stocks benefit the most. Bonds also gain as yields fall. Long term bonds tend to perform better in easing cycles.

Cash returns may decline. Investors holding large cash positions could see lower yields. This may push capital back into risk assets over time.

Investment management strategies should remain flexible. Focus on quality assets. Diversification remains critical. Avoid chasing short term moves.

The expected rate cuts are not guaranteed. Data will drive decisions. Inflation or geopolitical shocks could delay easing. Still the base case remains clear.

By 2026 a lower rate environment is likely. Investors who# plan ahead can manage risk and capture opportunity in a changing policy cycle.