🔚 What Is Cycle Exhaustion?

Cycle exhaustion happens when a market trend runs out of energy after a long move — even though price may still be rising or falling.

The move continues…

but the fuel is gone.

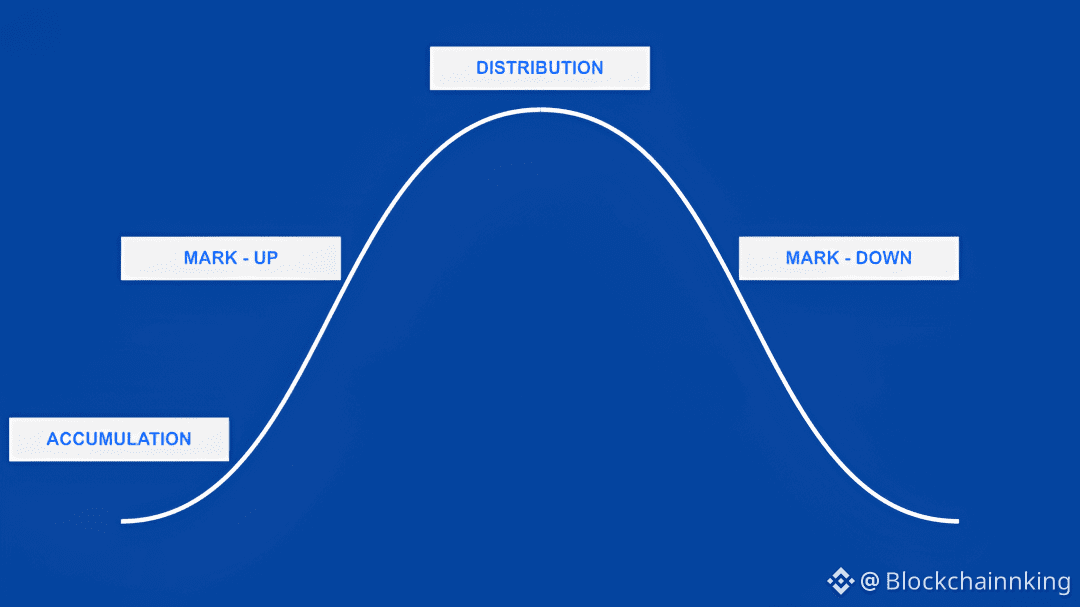

📉 How Cycle Exhaustion Forms

Price trends for weeks or months

Late traders enter due to FOMO or panic

Smart money starts distributing or covering

Momentum slows, volatility spikes

Trend eventually stalls or reverses

The market looks strong on the surface — but underneath, it’s tired.

🚨 Common Signs of Cycle Exhaustion

✔ Strong moves with declining volume

✔ Extreme bullish or bearish sentiment

✔ Parabolic price action

✔ Repeated rejection from highs/lows

✔ Good news but weak follow-through

🧠 Why Traders Get Trapped

Most traders enter at the end of the cycle, thinking the trend will continue forever.

Early money exits quietly.

Late money provides the liquidity.

🎯 Final Thought

Cycle exhaustion is not about timing the top or bottom — it’s about recognizing when risk outweighs reward.

When everyone is convinced the trend can’t end…

That’s usually when it does.

Stay alert. Follow structure, not emotion.

#WriteToEarnUpgrade #StrategyBTCPurchase #MarketRebound #BTCVSGOLD