Dusk is a Layer‑1 blockchain optimized for privacy, compliance, and regulated DeFi the backbone for institutional use cases on chain.

Rather than chasing purely speculative narratives, Dusk’s technology and ecosystem are built around practical utility for real world assets (RWAs), institutional issuances, and financial markets regulated by strict legal frameworks like those in Europe. But what exactly makes Dusk unique in the crowded landscape of blockchains? To understand this, we need to unpack not just its technology, but its purpose, market context, and potential future trajectory.

Origins and Core Vision

Although many blockchains arose from decentralized finance or permissionless public ledgers, Dusk was born out of a very explicit need: to create a blockchain capable of supporting regulated financial infrastructure. This means instead of being optimized for crypto speculation or gaming, Dusk was engineered to meet institutional standards — privacy, compliance with regulations like MiFID II and MiCA in the European Union, and auditability where necessary.

At its heart, Dusk aims to make it possible for companies, financial institutions, and even end users to issue, trade, settle, and manage tokenized securities and real‑world assets on chain while still satisfying legal and privacy obligations that traditional finance demands. This has traditionally been a barrier to blockchain adoption by banks, exchanges, and regulated markets, where on‑chain transparency could conflict with confidentiality obligations or regulatory reporting. Dusk solves this not by sidestepping compliance but by baking it into the protocol itself — a form of what’s sometimes called “Regulated Decentralized Finance” (RegDeFi).

A Layer‑1 Designed for Financial Markets — Not Just Token Transfers

Unlike many blockchains that prioritize decentralized applications in gaming or decentralized finance at large, Dusk’s architecture is tailored to financial markets infrastructure (FMI). The blockchain combines high privacy with regulatory requirements, enabling institutions to interact with tokenized equities, bonds, and other RWAs in a way that satisfies external compliance checks while preserving confidential balance details.

Privacy With Purpose

Public blockchains like Bitcoin and Ethereum expose transaction details by design. While this transparency is valuable in many contexts, it poses a problem for financial institutions that need privacy for positions, balances, and transaction histories. Dusk addresses this via zero‑knowledge cryptography (ZKPs) and dual transaction models that let users choose between public and shielded modes. These tools allow private transactions that can still be audited by authorized parties if needed — a balance rarely achieved in other Layer‑1 ecosystems.

Modular Architecture

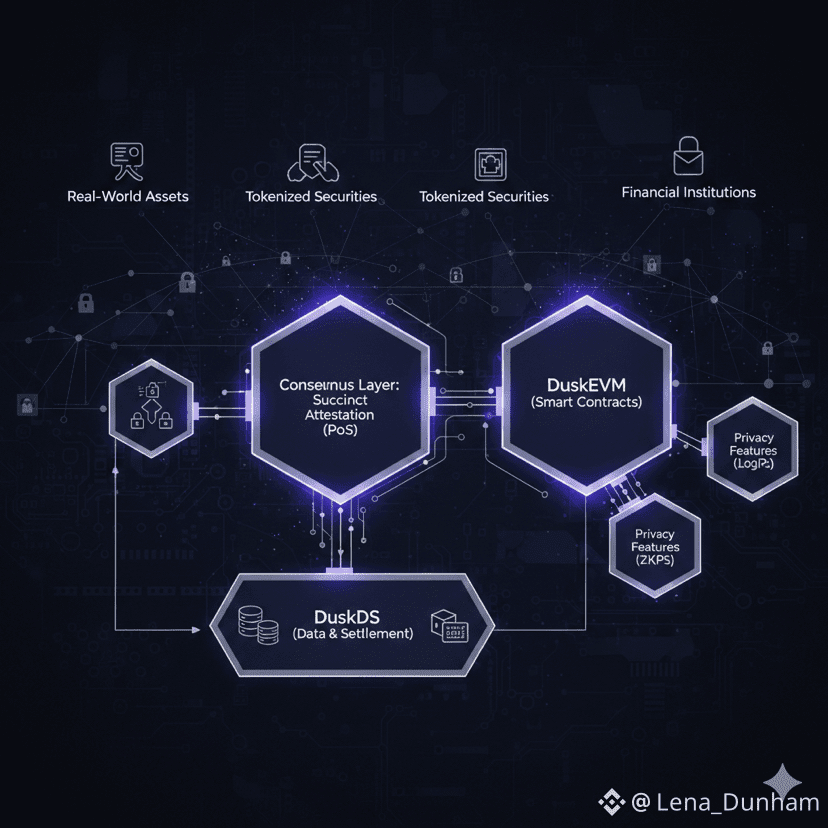

Dusk’s architecture separates different concerns in a modular way:

DuskDS (Data & Settlement): The foundation for settlement and data availability.

DuskEVM: An Ethereum Virtual Machine–compatible layer where smart contracts run with optional privacy and compliance features.

Consensus Layer: Known as Succinct Attestation, a variant of Proof of Stake (PoS) optimized for performance and fast finality, critical for financial settlement use cases.

This modular approach allows developers to build sophisticated financial applications while maintaining privacy, regulatory hooks, and auditability — essentially making every application capable of operating in a permissioned yet decentralized environment.

Real‑World Use Cases: From Tokenized Securities to Compliant DeFi

Where Dusk becomes most compelling is in how it enables real‑world financial products and workflows on blockchain:

1. Tokenized Securities and RWAs

Dusk’s infrastructure allows institutions to tokenize assets — stocks, bonds, funds, or other securities — in a way that follows EU regulations such as MiFID II and MiCA. This means a regulated exchange or a licensed financial intermediary can issue on chain digital securities that inherit regulatory classification and compliance controls.

This capability is transformative because it removes frictions found in traditional systems — settlement can be nearly immediate (vs days in legacy markets), custody is handled natively on chain, and transparency/auditability is built into the ledger.

2. Confidential and Compliant Smart Contracts

While most blockchains allow smart contract execution, Dusk’s contracts can be fully privacy‑preserving using cryptographic technologies that hide sensitive details but still enable enforcement of compliance logic — for example, enforcing whitelists, limits, or KYC/AML obligations directly in the contract.

3. Regulated DeFi and Financial Primitives

DeFi primitives like lending, automated market makers (AMMs), or structured products can be deployed on Dusk with compliance guards in place. This means that lenders and borrowers operate in a system that respects legal frameworks without exposing their entire position history to public scrutiny.

4. Privacy‑Preserving Identity

Dusk’s tools such as Citadel enable self‑sovereign identity and verifiable credentials, where digital identity data can be proven without exposing underlying personal details — an essential requirement for on‑chain KYC/AML compliance.

The DUSK Token: Fueling a Regulated Blockchain Economy

The DUSK token is the native cryptocurrency that powers the entire Dusk ecosystem. It is used for:

Transaction fees — Users pay DUSK for executing transactions and smart contracts on the network.

Staking and consensus — Validators stake DUSK to secure the network and earn rewards.

Governance participation — Token holders can vote on upgrades and governance proposals.

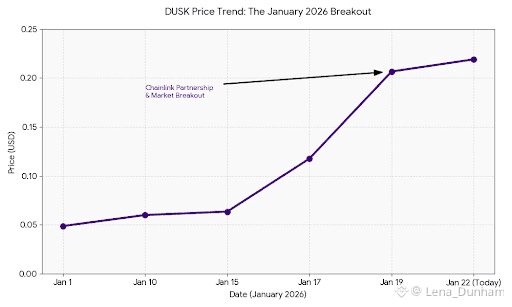

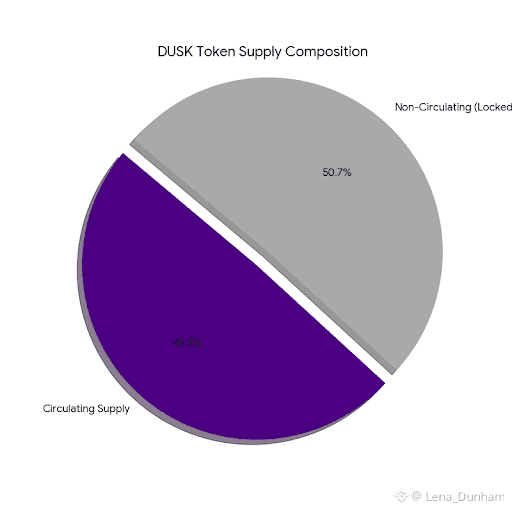

As of early 2026 data from Binance shows that DUSK trades at around $0.216 per token with a market cap exceeding $100 million and strong 24‑hour trading volumes nearing $88 million, reflecting active market interest and liquidity. The circulating supply sits near 493 million tokens, with a total max supply of 1 billion DUSK, meaning roughly half the tokens are currently in circulation — which may impact future supply and price dynamics.

Market Context and Adoption

Dusk’s positioning at the intersection of privacy, compliance, and real‑world finance has drawn attention from institutional participants that previously viewed public blockchains as unsuitable for regulated markets. Strategic moves such as listings on major exchanges including Binance US (with pairs like DUSK/USDT) expand accessibility for institutional and retail investors alike, offering deeper liquidity and regulatory comfort.

Moreover, Dusk has engaged in partnerships with regulated entities such as Dutch stock exchange NPEX and MiCA‑compliant issuers like Quantoz, enabling tokenized real‑world assets on chain. These integrations demonstrate that Dusk is not only a technological experiment but a middleware between traditional finance and blockchain innovation.

Challenges and Industry Context

Even with its strong positioning, Dusk faces several industry challenges:

Regulatory Complexity: While designed for compliance, evolving regulations across jurisdictions remain a moving target.

Competition: Projects like Polkadot, Ethereum/Layer‑2s, and other privacy‑focused chains (e.g., Oasis, Aztec) compete for similar mindshare in privacy and institutional use.

Institutional Adoption Lag: Real institutions often move slowly compared with crypto innovators — full adoption of blockchain infrastructure can take years.

Yet these challenges also highlight Dusk’s strategic relevance — by building compliance into the fabric of the protocol, it stands a better chance of syncing with real‑world regulatory timelines rather than forcing platforms to retrofit controls later.

Looking Forward A Compliant Future on Blockchain

Dusk’s mission isn’t modest: it’s building “blockchain infrastructure for real regulated financial markets.” In doing so, it questions an important assumption in the blockchain space that decentralization must come at the cost of compliance and privacy. With Dusk, those features can coexist.

By combining zero‑knowledge privacy, institutional compliance, modular design, and a growing ecosystem of partnerships, Dusk signals a future where blockchain isn’t just for DeFi token swaps or NFTs it becomes a core layer of global financial infrastructure that regulators and institutions can trust. For anyone following the evolution of the crypto economy from curiosity to utility, Dusk represents a compelling bridge between traditional finance and Web3 innovation.