Dusk Network offers unique benefits for token custody and private asset transfers, focusing on privacy and compliance for regulated financial markets. By combining decentralization with real-world regulatory requirements, Dusk bridges the gap between traditional finance and blockchain technology.

Privacy by Design

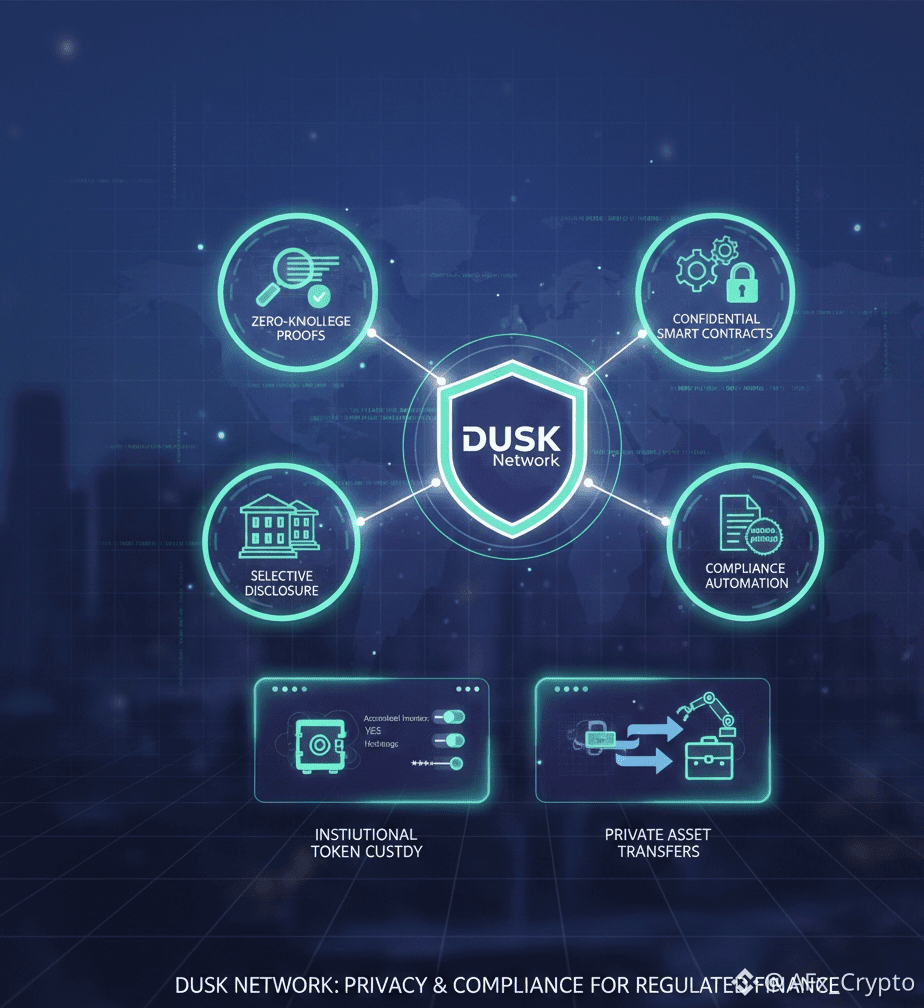

Unlike many public blockchains where all transaction details are fully transparent, Dusk integrates privacy at the protocol level. Using zero-knowledge proofs (ZKPs), users can prove the validity of transactions without revealing sensitive data, such as amounts, sender, or recipient.

This privacy-first approach ensures that businesses and institutions can use blockchain technology without exposing proprietary or confidential information.

Confidential Smart Contracts

Dusk supports privacy-preserving smart contracts, allowing complex financial agreements to be executed on-chain while keeping sensitive details hidden. Institutions can leverage blockchain for automated contracts, predictive settlements, or financial workflows without revealing client strategies or internal processes.

This opens the door for regulated financial players to adopt blockchain safely, without sacrificing confidentiality.

Selective Disclosure

One of Dusk’s standout features is selective disclosure. By default, most data remains private, but it can be selectively shared with authorized parties, such as regulators, when legally required.

This balance ensures compliance with KYC/AML rules while maintaining the privacy of users and institutions, a key concern for regulated financial markets.

Compliance Automation

Dusk embeds compliance directly into its protocol. Identity verification, eligibility rules, and permissioning are built-in, allowing applications to meet regulatory requirements automatically.

This design ensures that Dusk-based applications are both composable and interoperable, enabling innovation without regulatory friction.

Institutional-Grade Settlement

The network is built for fast and deterministic finality, essential for financial products that require reliable settlement times and irreversible ownership changes.

By prioritizing speed and certainty, Dusk provides a blockchain infrastructure that meets institutional standards, making tokenized assets practical for real-world financial operations.

Tokenization of Regulated Assets

Dusk is specifically designed to facilitate tokenization of regulated assets, including security tokens, equity instruments, and debt products. Businesses can issue compliant digital assets and access global liquidity, opening new avenues for digital finance adoption.

This capability transforms traditional financial products, making them more accessible, transparent, and efficient on-chain.

Bridging Blockchain and Traditional Finance

By combining decentralization with privacy, compliance, and legal certainty, Dusk creates a framework where blockchain technology meets the needs of regulated financial markets.

For businesses and institutions looking to adopt blockchain safely, Dusk provides a secure, compliant, and efficient foundation for private asset transfers, tokenized assets, and confidential smart contracts.