#TrendingHot #TrendingInvestments #AXSUSDT #AXSUSDT

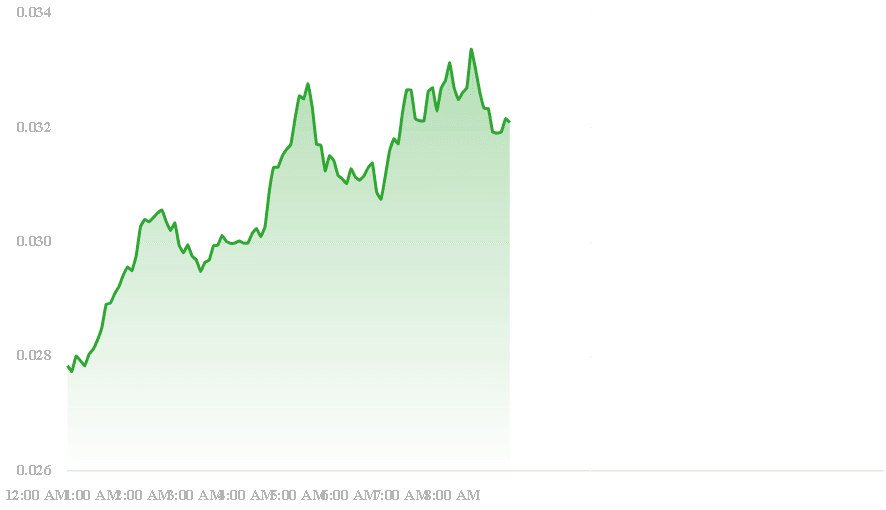

Axie Infinity (AXS) continued its bullish resurgence on January 21, 2026, maintaining strong momentum after a breakout through a critical resistance zone earlier in the week. The AXS/USDT pair posted notable gains, reflecting renewed investor interest in the GameFi sector.

Price Performance & Market Data

AXS is trading in the $2.4–$2.7 range on major exchanges, maintaining elevated levels above the $2.00 mark that recently acted as key resistance.

24-hour trading volume remains robust — exceeding typical ranges seen in recent months — demonstrating high liquidity and active participation from traders.

The token has posted double-digit percentage gains in the last 24 hours, aligning with broader bullish sentiment across mid-cap altcoins.

Catalysts Driving Today’s Bullish Bias

Breakout Above Key Technical Levels: AXS has decisively cleared the long-standing $2.00 threshold, which has flipped into support. This breakout has reinforced bullish momentum and attracted fresh trading interest.

High Trading Volume: Observers note a surge in volume accompanying the price rise, often interpreted as confirmation of trend strength.

GameFi Sector Rotation: Liquidity rotating into blockchain gaming tokens, including AXS, suggests renewed confidence in gaming-oriented digital assets.

Tokenomics Developments: Recent ecosystem upgrades and changes in token emission schedules — including efforts to reduce inflationary pressure — are contributing to narrative strength.

Technical Structure & Key Levels

Support: The $2.00–$2.20 zone now functions as a foundational support range; a sustained break below this level could signal short-term retracement.

Upside Target: Analysts and technical models point to potential resistance near $3.00 if bullish momentum persists.

Momentum Indicators: RSI on several exchanges is elevated, reflecting strong buying pressure, but also hinting at possible near-term overextension.

Market Risks & Caution Signals

Despite the positive price movement:

On-chain metrics show mixed signals, with some data indicating rising exchange net inflows — a classical sign of short-term selling pressure accumulation.

Active user metrics on the Ronin network remain below historical highs, highlighting challenges in user engagement outside price speculation.

Futures open interest is elevated, suggesting speculative bets are high and liquidation risk may increase in volatile market conditions.

Outlook Summary

Short-Term: Bullish momentum is intact, with potential follow-through toward $3.00 if support levels hold and volume remains high.

Mid-Term: Critical to monitor exchange flows and network usage metrics for confirmation of sustainable demand.

Risk Management: Traders should watch for potential pullbacks if short-term overbought conditions persist or if net inflows accelerate.