What DuskTrade Is

DuskTrade is Dusk Network’s first major real‑world asset (RWA) application, launching in 2026 as a security-trading and investment platform.

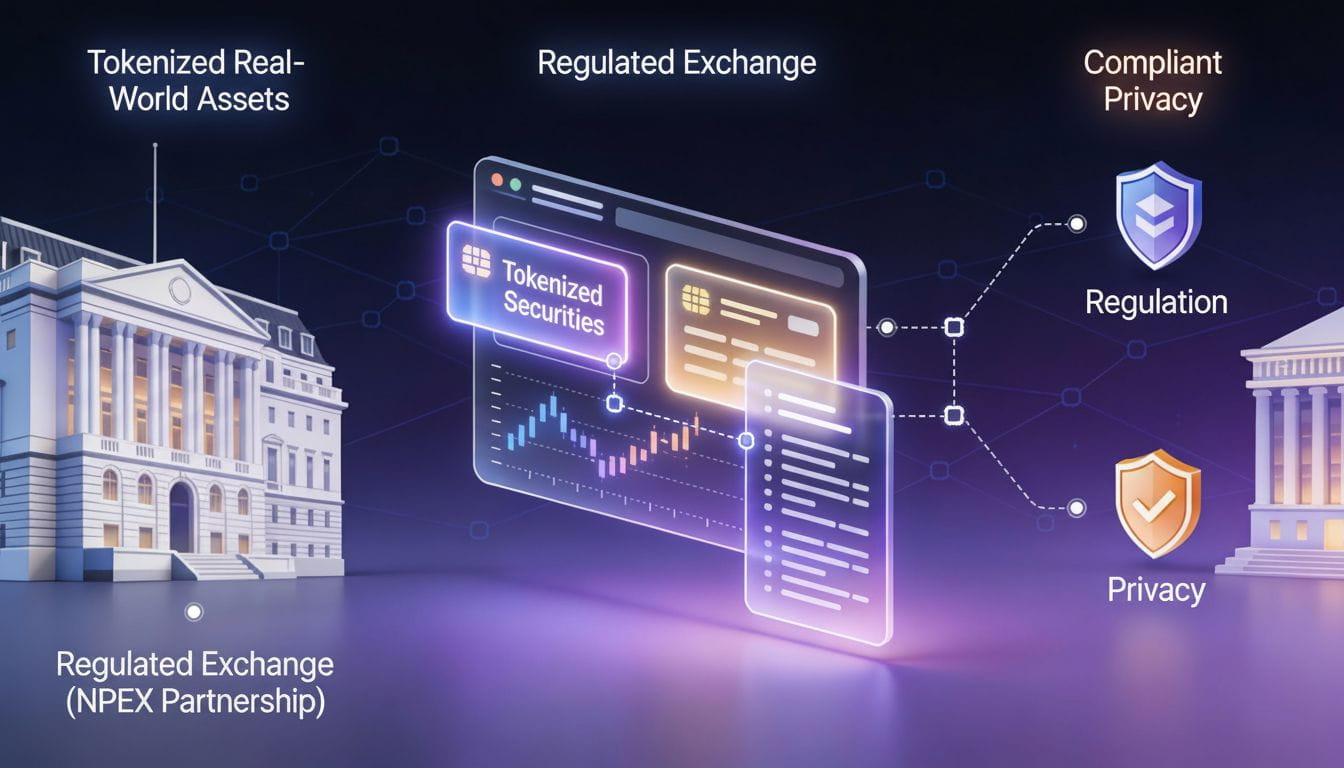

It is being developed together with NPEX, a Dutch stock exchange licensed as a Multilateral Trading Facility (MTF) and broker, which gives DuskTrade a strong regulatory backbone from day one.

➡️ Why The NPEX Partnership Matters:-

NPEX is an established, supervised exchange in the Netherlands that already operates under EU financial regulations, including strict rules around market integrity and investor protection.

By plugging Dusk’s blockchain into NPEX’s licensed infrastructure, DuskTrade becomes one of Europe’s first blockchain‑powered security exchanges able to issue, trade, and settle regulated instruments on-chain.

➡️ The Scale: €300M+ In Tokenized Assets:-

DuskTrade’s launch roadmap targets more than €300 million worth of securities being tokenized and brought on‑chain, including equities, bonds, and similar financial products.

This is not a sandbox pilot; it is meant to be a production‑grade venue where real companies raise capital and investors trade tokenized shares under clear rules.

➡️ How DuskTrade Works For Users:-

For investors, DuskTrade is designed to feel like a modern digital broker: you sign up, pass compliant checks, and can then buy and sell tokenized securities that settle almost instantly.

These assets live as tokens on Dusk Network, which allows features like 24/7 markets, programmable rules (for things like eligibility or lockups), and the potential to use tokenized positions in DeFi‑style products in the future.

➡️ Why Blockchains And RWAs Fit:-

Tokenizing real‑world assets turns previously slow and fragmented markets into programmable ledgers where ownership can be split, traded, and tracked with high transparency.

This can lower costs by cutting out layers of intermediaries, shorten settlement from days to seconds, and open access to investors who were previously locked out by minimum ticket sizes or geography.

➡️ Dusk’s Edge: Compliance Plus Privacy

Dusk Network is built specifically for regulated finance, blending zero‑knowledge cryptography with compliance features so that transactions can remain confidential while still being auditable by authorized parties.

For DuskTrade, this means institutions can trade in size without exposing sensitive order details to the entire world, yet regulators and auditors can still verify that everything follows the rules.

➡️ What DuskTrade Could Unlock:-

For companies, DuskTrade offers a way to issue securities on-chain, tap into a broader pool of investors, and automate many back‑office processes like corporate actions, interest payments, or redemptions.

For the broader market, it is a concrete step toward an RWA ecosystem where on‑chain finance is not just about speculation, but about real businesses, regulated products, and institution‑grade infrastructure.