What is Plasma Chain?

Plasma Chain is a Layer 1 network built for stablecoin payments, enabling fast, secure, and borderless digital transactions at global scale. Instead of repurposing general-purpose blockchains, it focuses entirely on stablecoins, which is crypto’s largest use case after Bitcoin.

The network introduces features such as zero-fee USDT transfers, customizable gas tokens, and confidential transaction options. Together, these innovations reduce friction for users and developers, making payments simpler, cheaper, and more flexible than on traditional blockchain infrastructures.

With stablecoins already exceeding hundreds of billions in supply and trillions in transaction volume, Plasma targets the role of settlement infrastructure. Its combination of high throughput, deep liquidity, and EVM compatibility offers a foundation for internet-scale financial applications and payments.

The network is structured around several core components:

Consensus Layer (PlasmaBFT): Validators stake XPL and finalize blocks within seconds, providing instant, irreversible confirmation through Byzantine Fault Tolerant consensus.

Execution Layer (EVM-Compatible): Plasma runs Ethereum’s Reth engine in Rust, allowing existing Solidity smart contracts to deploy seamlessly at higher performance.

Bitcoin Anchoring: Plasma periodically stores cryptographic checkpoints in Bitcoin’s ledger, making history alteration nearly impossible without rewriting Bitcoin itself.

Native Bitcoin Bridge: BTC moves into Plasma as pBTC using decentralized verifiers, enabling secure deposits and withdrawals without custodial control.

Zero-Fee Stablecoin Transfers: Everyday USDT transfers incur no fees, with a protocol paymaster sponsoring gas while filtering spam through verification.

Custom Gas Tokens: Users pay fees directly in USDT or BTC, automatically converted into XPL without extra costs or hidden charges.

Confidential Payments: An optional privacy layer enables hidden transaction details while still allowing selective disclosure when audits or compliance require it.

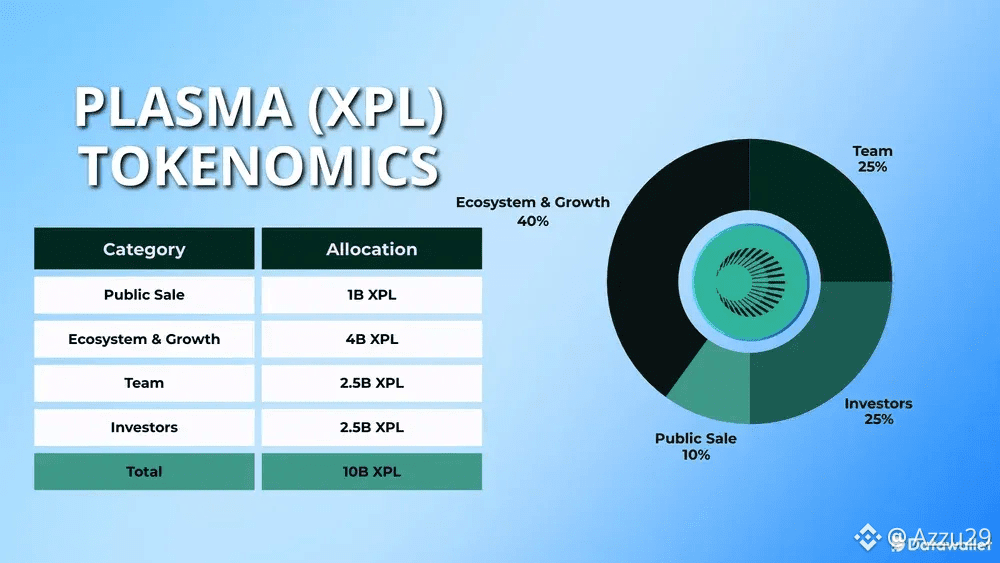

XPL Tokenomics

XPL is the native token of Plasma Chain, powering consensus, network security, and economic incentives. Its fixed supply of 10 billion tokens follows distribution mechanics that encourage quick early adoption.

Here’s a breakdown of XPL allocation and distribution:

Public Sale (10%): 1 billion XPL distributed July 2025 through a time-weighted vault sale; non-US unlocked immediately, US tokens restricted 12 months.

Ecosystem & Growth (40%): 4 billion XPL for liquidity, incentives, and partnerships; 800 million unlocked immediately, 3.2 billion vest monthly over three years.

Team (25%): 2.5 billion XPL allocated to founders, developers, and employees; one-year cliff, remaining vests monthly across the following two years.

Investors (25%): 2.5 billion XPL for early backers and strategic partners; identical vesting schedule as team allocation with one-year cliff and two-year linear release.

Beyond distribution, XPL is central to Plasma’s Proof-of-Stake consensus where validators stake tokens to secure the chain and earn rewards. Inflation begins at 5% annually and decreases to 3% over time, partially offset by transaction fee burns under EIP-1559.