Dear family, I was explain this not as an expert, not as an investor, but as someone trying to make sense of what kind of systems we are slowly choosing to live with. I wasn’t chasing excitement. I was observing behavior. And the more I looked, the more I realized that the most important financial tools rarely feel dramatic. They feel steady. Familiar. Almost invisible.

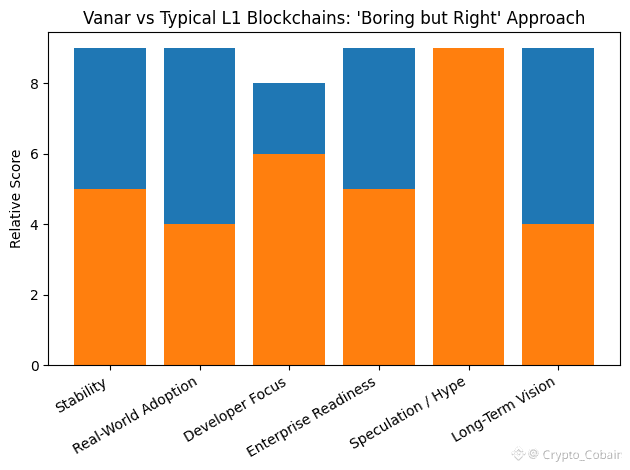

Vanar didn’t first register as a promise of growth or disruption. What caught my attention was something subtler: restraint. The sense that this system was designed not to impress, but to function. Not to speculate, but to support. That difference matters more than most people realize.

We often forget that money, at its core, is not meant to be thrilling. It is meant to be dependable. When you send value, you want certainty—not suspense. When you receive funds, you want clarity—not confusion. The systems we trust most in daily life succeed precisely because they don’t ask us to think about them. They just work.

Vanar feels aligned with that philosophy. It approaches blockchain less as a stage and more as infrastructure. Like plumbing or power lines, it aims to carry something essential without demanding attention. The design choices point toward calm efficiency: fast settlement, predictable outcomes, and an experience that shields users from unnecessary technical complexity.

This focus on simplicity is not a lack of ambition—it is discipline. Every extra feature adds friction. Every exposed layer of complexity increases the chance of error, misunderstanding, or exclusion. By prioritizing usability over excess, the system quietly signals who it is built for: real people, real businesses, real activity.

Good financial infrastructure grows from actual use cases. Payments that arrive on time. Cross-border transfers that don’t feel like a gamble. Business settlements that close cleanly and confidently. These are not flashy problems, but they are foundational. Systems that solve them well tend to last longer than those chasing short-term attention.

There is also a sense of neutrality here—an absence of pressure. A good financial system should not pull users into constant action or emotional decision-making. It should resist noise, not amplify it. Trust emerges through consistency, through showing the same reliability in quiet moments as in stressful ones.

What also stands out is respect—for existing tools, workflows, and builders. Progress doesn’t always mean replacing everything. Sometimes it means offering a stronger base beneath what already exists, allowing ecosystems to evolve naturally rather than forcing reinvention.

The more I reflect on it, the clearer the thought becomes: the best financial infrastructure eventually disappears from conversation. Not because it failed, but because it succeeded. It becomes background—quietly enabling exchange, supporting livelihoods, and moving value without drama.

And maybe that is the highest compliment a system like this can earn. Not excitement. Not headlines. But trust so steady that people stop noticing the system at all—because their lives are simply moving forward on top of it.