January 2026 felt different for DUSK. After a long stretch of quiet price action, the token suddenly moved—hard. Within weeks, it was up several hundred percent. That alone isn’t unusual in crypto. What was more interesting was the shift in how people started talking about it. The conversation moved away from short-term speculation and toward actual usage. The obvious question now is whether this move reflects a genuine institutional inflection point, or if it’s simply another fast cycle of momentum and FOMO playing out.

The argument for DUSK isn’t built on hype. It comes from where the project sits. Privacy, compliance, and real-world asset tokenization rarely coexist cleanly, especially in Europe’s regulatory environment. DUSK was designed for that narrow intersection. As regulation tightens and institutions become more selective about which chains they touch, that positioning matters. Price can overshoot, sure, but the underlying logic behind the narrative shift didn’t appear out of nowhere.

Looking at the chart, the move has been undeniably aggressive. As of January 22, 2026, DUSK is trading near $0.23 after roughly a 500% rise over the past month. Volatility is elevated, and momentum indicators like RSI are firmly in overbought territory. That doesn’t mean the trend is over, but it does mean risk is high. The $0.17 to $0.20 range has become an important zone. Holding it would suggest the market is willing to accept these levels. Losing it would likely change the tone quickly.

It’s also worth being clear about what’s driving the short term. A large part of this move looks like speculative capital rotating into narratives that were previously ignored. That kind of flow can push price far beyond what fundamentals justify, at least temporarily. It also works in reverse. Pullbacks can be sharp, and timing matters more than conviction in phases like this.

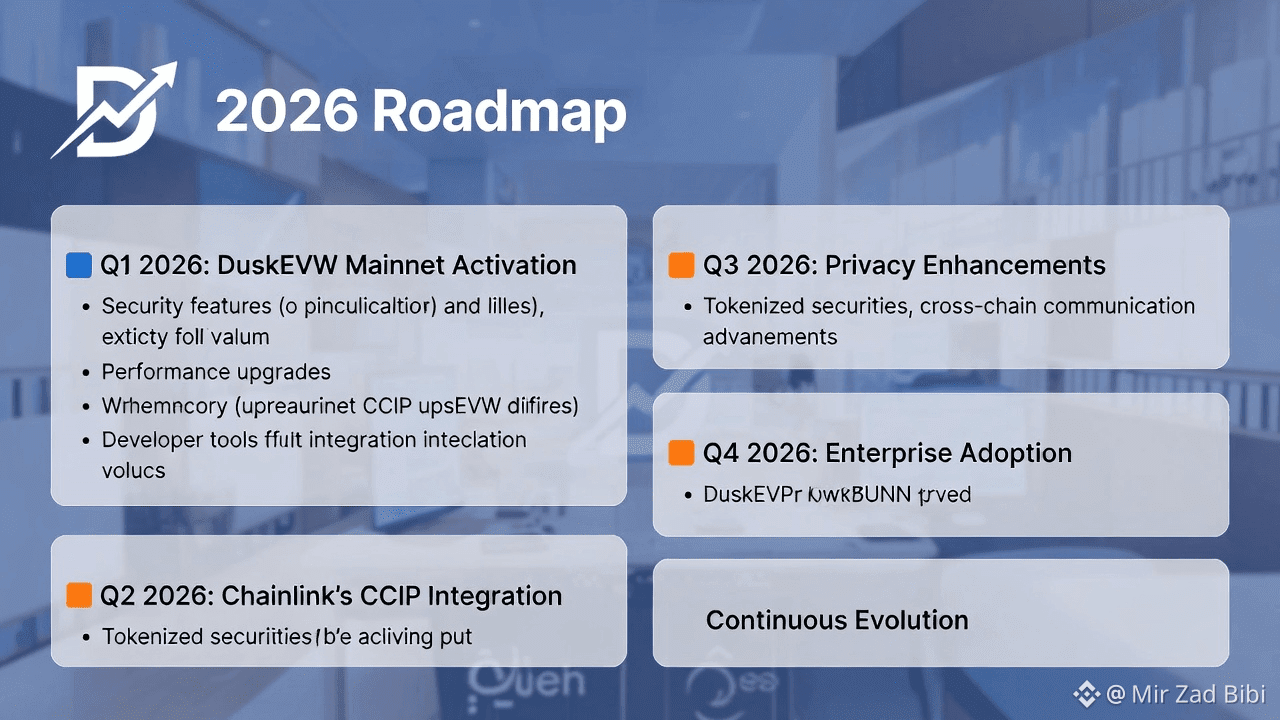

Where the story starts to firm up is the 2026 roadmap. The mainnet activation earlier in January was a real milestone, bringing DuskEVM live and opening the door to broader interoperability. The integration with Chainlink’s CCIP adds another layer, making cross-chain functionality possible for tokenized securities. This isn’t flashy infrastructure, but it’s the kind institutions actually care about—reliable, boring, and functional.

The most tangible catalyst remains NPEX. Plans to onboard more than €200 million in tokenized equities and bonds onto the DUSK network during 2026 move the discussion from theory to execution. If that rollout happens as expected, it creates real settlement activity and sustained network usage. That’s the difference between a compelling idea and a working system.

Dusk Pay is another piece of the picture, expected to launch in Q1 2026. It’s positioned as a MiCA-compliant stablecoin payment network for B2B settlements. Payments don’t attract the same attention as tokenized securities, but they tend to create consistent volume. If adopted, it adds a quieter but meaningful layer of utility.

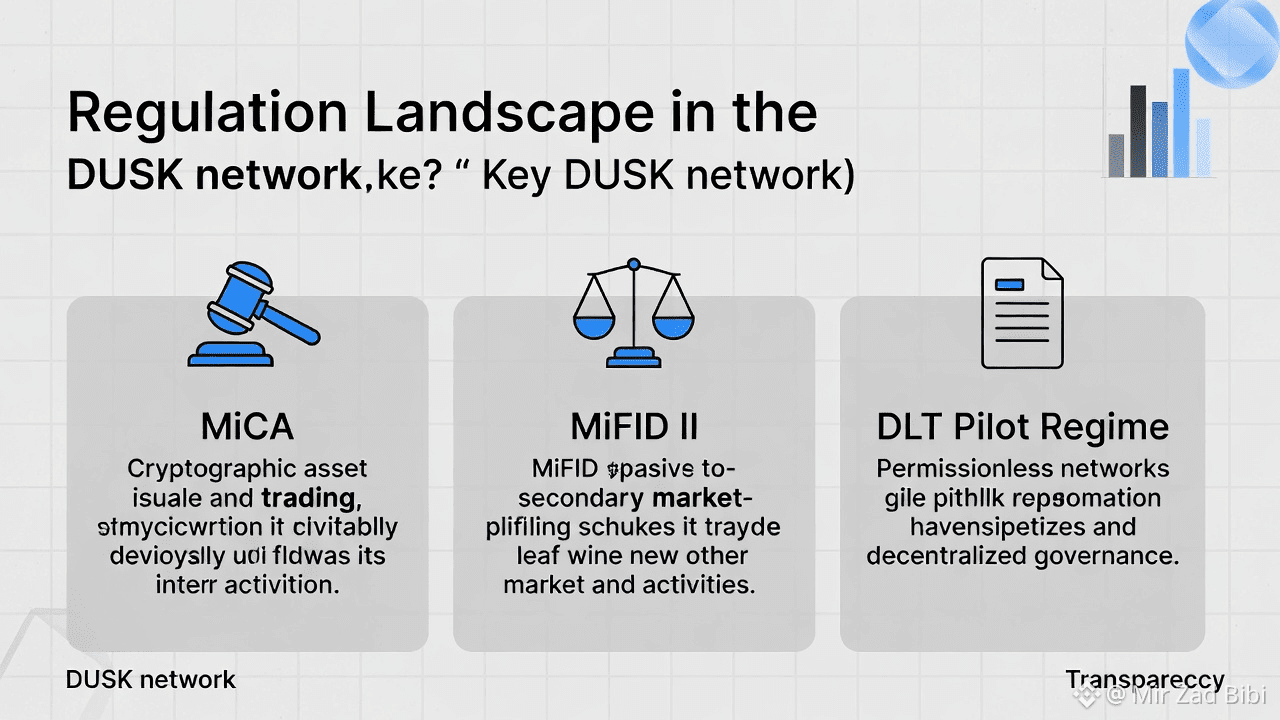

Regulation is the thread running through all of this. DUSK wasn’t adjusted for compliance later—it was built with it from the beginning. Frameworks like MiCA, MiFID II, and the DLT Pilot Regime are reflected directly in how the network operates. Privacy exists, but within boundaries. Transparency is available, but not forced. For institutions, that balance isn’t philosophical. It’s practical.

That design creates a kind of protection. Fully transparent chains like Ethereum are powerful, but running private, regulated financial activity on them often means complicated off-chain workarounds. DUSK handles much of that at the protocol level. It doesn’t guarantee adoption, but it removes a major friction point.

From an investment standpoint, the long-term case is simple. The DUSK token derives value from actual usage—fees, staking, and securing the network. If tokenized assets grow on DUSK, demand grows naturally. The opportunity is real, but so is the risk. Institutional adoption takes time, and delays or missed milestones would be felt quickly by the market.

DUSK enters 2026 with more attention, higher expectations, and less room for error. Whether the market has already priced in too much remains open. For now, the clearest signal won’t come from price alone, but from execution—especially around NPEX and live institutional activity. That’s where the story either holds up or starts to unravel.