#BTC

rejected from the expected zone of $98K and is now trading around $90K after getting a bounce from $87K. So what will be next move of

#Bitcoin

?

To predict next move we will analyze three main things:

The chart

Macro Events And Data

On Chain Data

1. Technical Setup

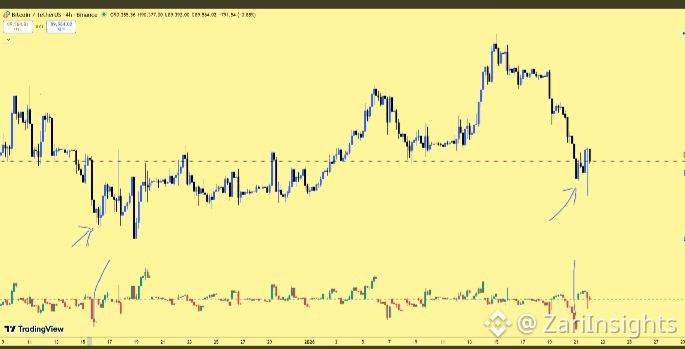

Look at the chart.

$BTC

is currently trading at $90,000.

The Trap: $98k wasn't just a resistance, it was a "Bull Trap." Late longs punished, expecting $100k immediately, but the market wasn't ready.

The Law: “Never Buy On Resistance.” When price crashes through a support level (like $90k), that floor becomes a ceiling.

Current Status: $90k has flipped from Support → Resistance. Until we close a 4H candle above this green box, the bears are technically in control of the immediate trend.

2. Fundamental

Why did BTC dump from $98k? It wasn't random.

The market hates uncertainty. The sharp sell-off to $87k correlates perfectly with the "Greenland Tariff".

The Event: President Trump’s announcement of escalating tariffs on European allies (linked to the Greenland dispute) triggered a sell off.

The Reaction: Algos sold first. Humans panic-sold second. This geopolitical news is what printed that large red candle.

The Reality: While the news are bearish, notice how the price bounced at $87k? That shows the market sees this as a political negotiation, not a structural failure of Bitcoin.

3. On-Chain Data

We can see this move on-chain.

The Flush: In the last 24 hours, over $600 Million in Longs were liquidated.

What This Means: The market just kicked off all the over-leveraged gamblers who bought the top. The "open interest" has reset.

Spot Demand: While derivatives traders were getting wrecked, Spot CVD (Cumulative Volume Delta) showed aggressive buying at the $87k lows (spike in delta volume and absorbed by next one candle ). Smart money used the Tariff panic to fill their bags.

4. The Execution Plan

Trading is not about guessing it's about reaction.

Scenario A (The Reclaim): We need a confirmed 4H Candle Close > $90,032. This proves the bulls have absorbed the selling pressure.

Target: Once $90k is support again, the road to $94k is thin (low resistance).

Scenario B (The Rejection): If we keep wicking into $90k and failing, we are heading back to test the $87k demand zone.

The leverage is flushed. The bad news (Tariffs) is priced in. Now we wait for the $90k reclaim. Patience pays.

#Btc #MarketRebound #binancesquare $BTC

BTCUSDTPerp89,555.6-0.32%

BTCUSDTPerp89,555.6-0.32%