As of January 22, 2026, the economic world is reeling from a "Doctrine Shift" that has redefined American fiscal policy. Speaking at the World Economic Forum in Davos, President Donald Trump codified his administration's new mandate: “The Deficit Ends Now.”

This policy represents a radical departure from traditional trade, moving the U.S. toward a system where tariffs are no longer just bargaining chips, but a permanent pillar of national revenue.

1. The "Zero" Target: A 24-Month Countdown

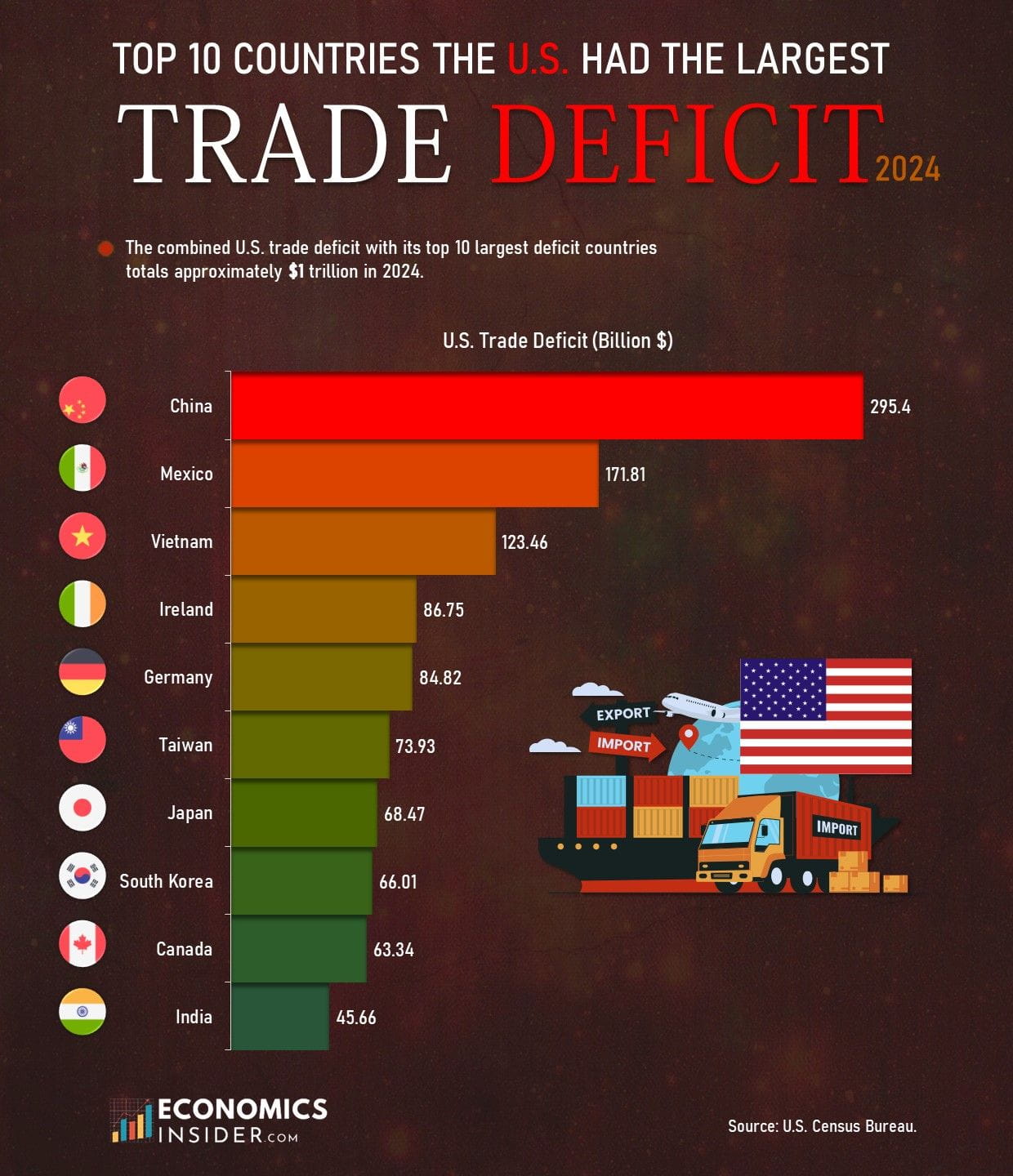

The core of the new doctrine is the Zero Deficit Mandate. By invoking national emergency powers regarding "unbalanced trade," the administration has set a hard deadline of December 2026 to bring the U.S. trade deficit to zero.

The strategy is built on Economic Sovereignty. The goal is a "build in America or pay to enter" model. The U.S. is enforcing a Reciprocal Trade framework where tariffs on specific nations have escalated, particularly in light of recent geopolitical friction over Greenland, with threats of 25% levies on certain European allies.

2. The $DOGE "Chainsaw": Shrinking the Bureaucracy

While trade deficits are handled at the borders, the internal budget deficit is being dismantled by the Department of Government Efficiency (DOGE).

Led by Elon Musk and Vivek Ramaswamy, DOGE has achieved the fastest reduction in the federal workforce since the end of World War II. In less than a year, the administration has eliminated approximately 271,000 federal positions—a 9% decline in the total workforce. While spending on entitlements like Social Security and Medicare remains a challenge for a balanced budget, the "rightsizing" of the bureaucracy has already slashed billions in administrative overhead.

3. The Revenue Revolution: Tariffs as the New Tax

The administration is pivoting toward a "Revenue Replacement" model. By collecting hundreds of billions in tariff income, the White House is exploring what they call the "Great Tax Swap"—using import duties to potentially reduce or eliminate federal income taxes for domestic producers and citizens.

"You don't negotiate from weakness—you enforce from strength." — Official White House Statement, January 2026.

4. Market Impact: gold, $BTC , and Global Jitters

The aggressive move toward a debt-free U.S. has created significant market turbulence:

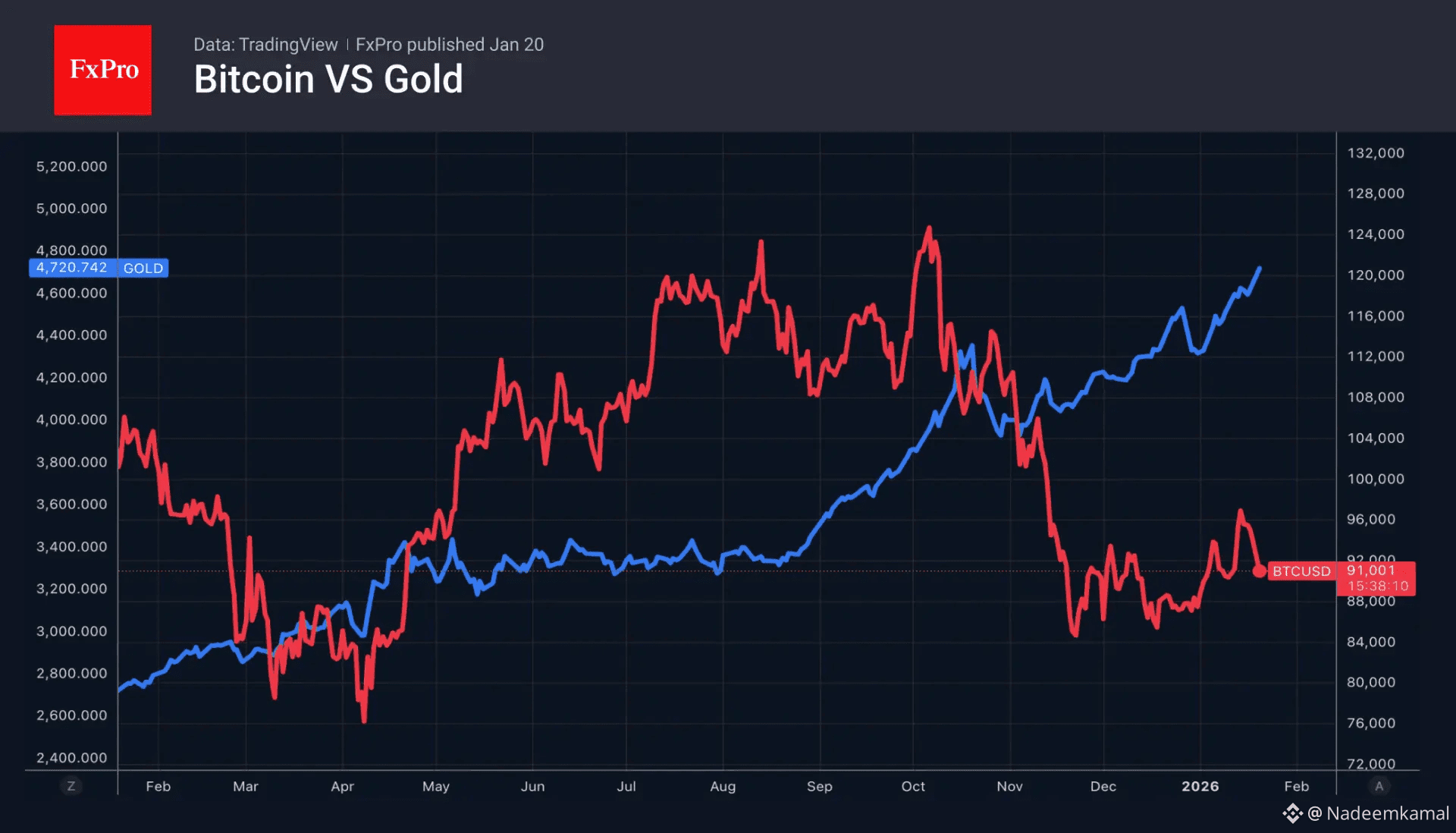

Gold's Hyper-Run: Gold hit a record high of $4,818/oz today as investors flee to safe havens amid the escalating trade tensions with Europe.

Bitcoin ($BTC): Bitcoin is currently feeling the "Macro-Shock," trading near the $90,000 support level. While it remains a digital store of value, it is battling the short-term liquidity flight into precious metals.

Geopolitical Jitters: Stock markets have seen sharp rotations as the "Pax Americana" of free trade ends, replaced by a high-stakes era of Economic Nationalism.

The Bottom Line: Is the World Ready?