I’m looking at the Dusk Network in 2026 as something that has quietly crossed a line most blockchains never manage to reach. For years, crypto kept promising institutions a future where everything is faster, cheaper, and global—but it never really answered the uncomfortable question of privacy versus regulation. Dusk didn’t try to dodge that problem. Instead, it built its entire identity around solving it.

What stands out immediately is that Dusk Network didn’t rush. Since 2018, it stayed in development while hype cycles came and went. By January 2026, that patience paid off. The network is no longer a theory or a test environment; it’s a live Layer 1 settlement chain designed specifically for regulated finance. Not DeFi cosplay, not experimental pilots—actual financial infrastructure that understands how institutions operate in the real world.

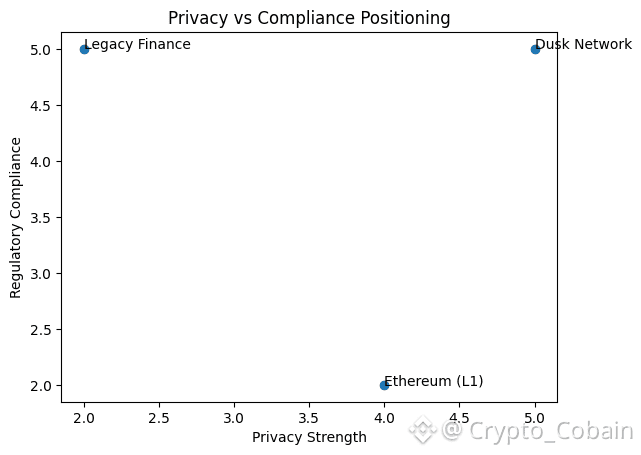

I see Dusk as a blockchain that assumes regulation is not the enemy. Europe’s MiCA framework isn’t treated like an obstacle here; it’s treated like a design requirement. That single mindset shift changes everything. Instead of public-by-default ledgers that later bolt on compliance tools, Dusk starts from the assumption that privacy, auditability, and legal oversight must coexist.

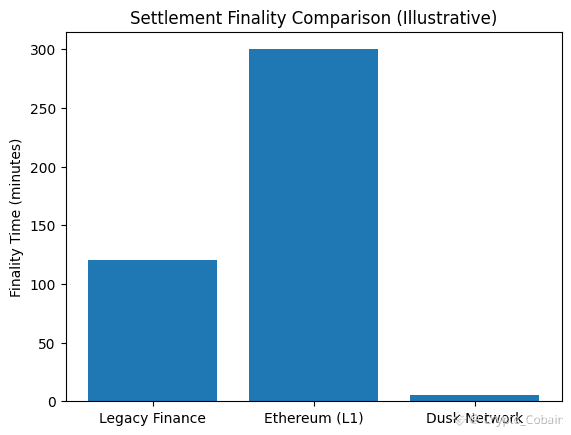

Under the hood, the architecture feels deliberately pragmatic. Execution, settlement, and data availability are separated so the network doesn’t choke on its own complexity. When the DuskDS upgrade went live at the end of 2025, it effectively turned the chain into a high-performance settlement rail. Transactions finalize in seconds, costs stay predictable, and the system behaves more like modern market infrastructure than a speculative crypto network. For institutions used to slow, expensive legacy settlement systems, this is a meaningful shift.

Privacy is where Dusk truly separates itself. Instead of exposing balances and transaction histories to everyone, assets move as private “notes.” I think of it like sealed financial envelopes moving through a transparent conveyor belt. You can see that something moved, you can verify it was valid, but you can’t peek inside unless you’re authorized. That’s the heart of Dusk’s “auditable privacy” model. Regulators can audit. Institutions can comply. Users don’t get publicly doxxed by default.

This matters even more for tokenized securities. The Zedger and XSC standards turn compliance into code rather than paperwork. Rules about who can trade, when they can trade, and under what conditions are enforced automatically. It’s not trust-based—it’s protocol-based. That’s a big psychological shift for traditional finance, and honestly, one of the reasons Dusk feels credible instead of aspirational.

From a security standpoint, the consensus model is clearly built for seriousness, not experimentation. Settlement finality is immediate. Once a block is confirmed, it’s done. No waiting. No probabilistic assumptions. For high-value assets like bonds or equities, this isn’t a “nice to have”—it’s mandatory. I see this as one of the strongest arguments for Dusk being used beyond crypto-native use cases.

The dual virtual machine approach also feels smart rather than flashy. On one side, there’s a native zero-knowledge environment built specifically for private logic. On the other, there’s EVM compatibility to avoid isolating developers. That bridge matters. It means existing Ethereum developers can move over without relearning everything, while still benefiting from privacy and compliance features that Ethereum simply doesn’t offer at the base layer.

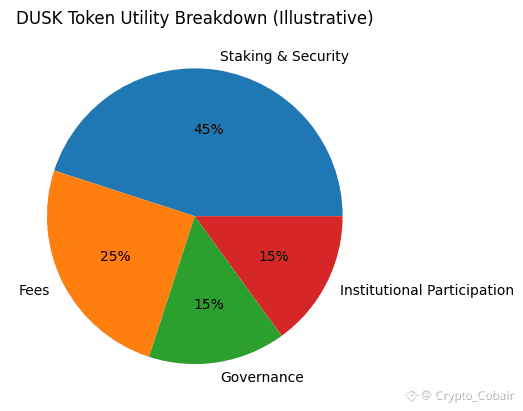

Economically, the DUSK token finally makes sense in 2026. It’s not just a fee token anymore; it’s the backbone of security, governance, and institutional participation. Staking rewards are structured to favor long-term commitment without letting a handful of whales dominate the network. The elastic staking design feels intentionally defensive, designed to keep the chain decentralized even as larger players enter.

Where things get especially real is on the institutional side. The partnership with NPEX isn’t just a logo on a website. A €300 million pipeline of tokenized securities is not marketing—it’s execution. This is the kind of number that forces the market to take a project seriously. Add interoperability through Chainlink, and suddenly those assets aren’t trapped on a single chain. Liquidity can move, pricing stays reliable, and the system starts to resemble a global financial network rather than a closed ecosystem.

Stablecoin settlement completes the picture. With regulated euro-denominated digital cash available, trades don’t need to exit the blockchain to finish. Issuance, trading, and settlement all happen in one compliant environment. That’s a full financial stack, not just another protocol.

Market behavior around DUSK in early 2026 has been loud, fast, and emotional. Prices moved aggressively, speculation exploded, and attention surged. But beneath that noise, I notice something different from past cycles. The interest isn’t only retail hype—it’s infrastructure curiosity. Institutions don’t care about memes; they care about reliability, compliance, and risk reduction. Dusk speaks their language.

When I step back and look at the bigger picture, I don’t see Dusk trying to replace everything. I see it carving out a very specific role: private, regulated, programmable finance. That’s a massive market, and it’s only getting larger as governments clarify rules instead of fighting the technology.

If Dusk continues executing without sacrificing its core principles, I believe its model of auditable privacy will become a reference point for the next generation of financial blockchains. Not because it’s loud—but because it works.