How Dusk Foundation Makes Privacy-Preserving Reporting Work

Balancing privacy and transparency in finance? It’s a headache. Regulators want to see everything—every line, every number. But banks and regular people? They’d rather not put all their details on display. Usually, someone loses out. Either you overshare and risk privacy, or you hide so much that transparency disappears. Dusk Foundation didn’t accept that trade-off. Instead, they built a system where privacy and compliance work together. No more picking sides.

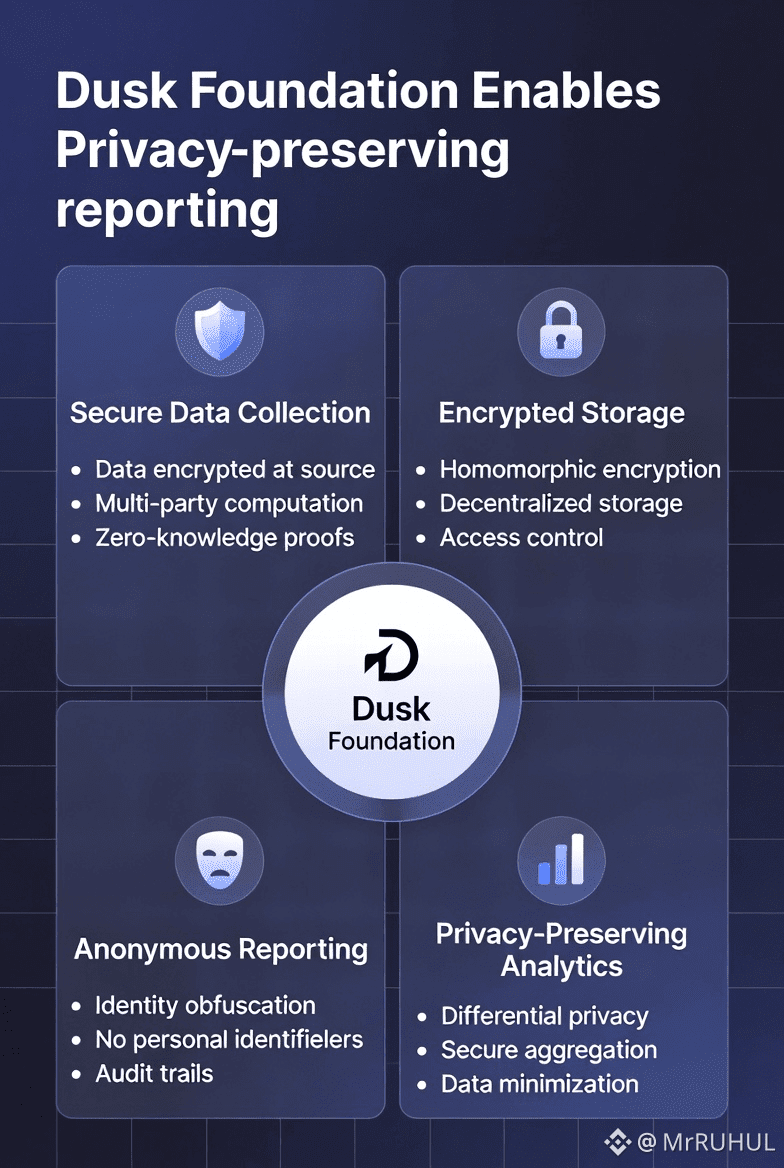

Dusk’s attitude is pretty simple: privacy and compliance aren’t opposites. They’re just two problems to solve. Most systems tack on reporting at the end as an afterthought. Dusk flips this. Reporting, privacy, and transparency are baked in from the start, using cryptography and clever engineering. The result? Reports that keep your secrets safe but still let people trust the numbers.

One of their biggest tools is zero-knowledge proofs, or ZKPs. These things are kind of magic. You can prove you followed the rules without actually showing your private data. For example, if a bank needs to show it meets capital requirements, Dusk lets it hand regulators a cryptographic proof—no need to open up the books. Regulators get their confirmation, and the bank keeps its sensitive info private. It’s all about proving you’re following the rules, not exposing everything you do.

Then you’ve got selective disclosure. Not every regulator needs every detail, and not all reports need to reveal the same information. Dusk’s system lets institutions share only what’s needed and nothing more. If you need to prove you followed a rule, great—just prove it. Full details stay hidden unless a real audit calls for it, and even then, only as much as the law requires. That cuts down on leaks and fits right in with privacy laws about data minimization.

Finality matters, too. A lot of blockchains leave you hanging—did that transaction really settle, or could it be reversed? Dusk fixes this with deterministic finality. Once it’s done, it’s done. Now you’ve got permanent records you can trust. Layer privacy proofs on top, and everyone—including regulators—can believe what they see.

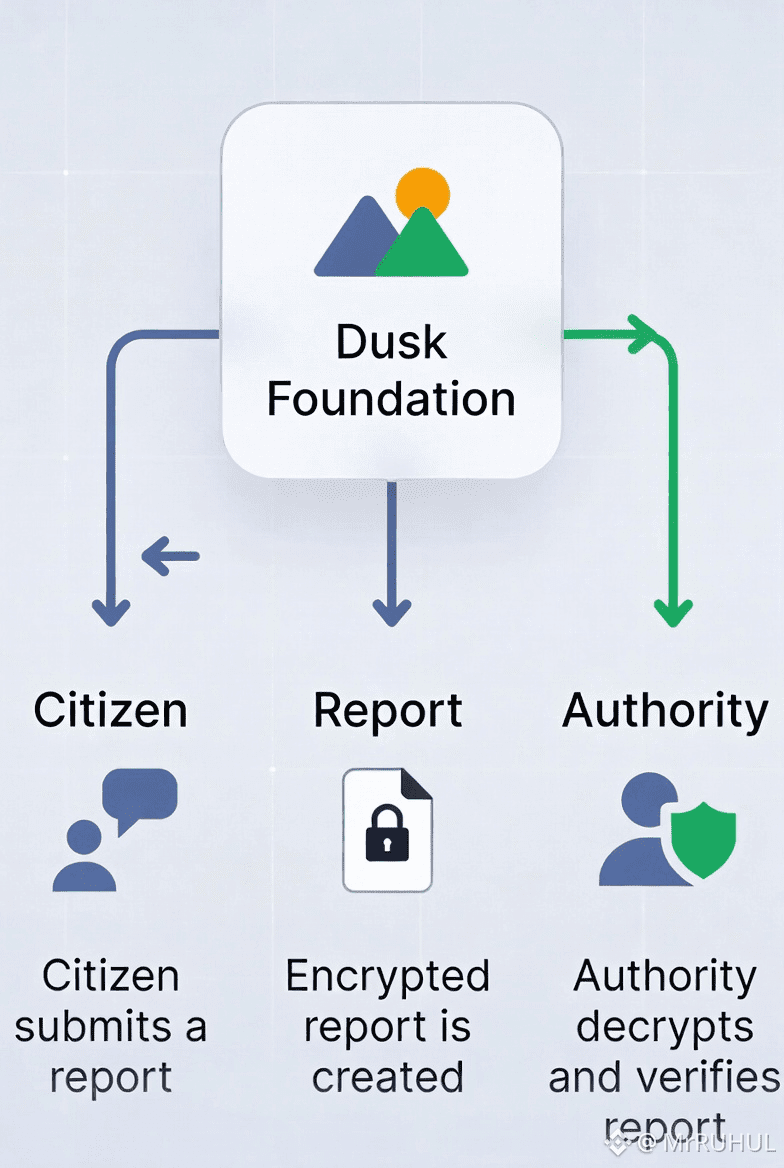

Identity is another puzzle. Dusk separates your identity from your transactions. You can prove you’re authorized without leaving your name all over the blockchain. Regulators can check who’s allowed to participate, but outsiders don’t get any personal info. It’s the oversight regulators want, without turning the whole system into a surveillance tool.

Laws change depending on where you are, and Dusk gets that. Their tech is flexible—reporting rules live in smart contracts and compliance modules that fit local regulations. When the rules change, institutions just update the contracts through governance. No need to rip apart privacy or collect extra data.

For banks and other institutions, this is a huge relief. No more wrangling spreadsheets, no risky email attachments, no panicking about leaks every time a report goes out. Instead, reports come straight from the blockchain, locked down with cryptography. They’re fast, verifiable, and don’t overshare.

In the end, Dusk builds trust on both sides. Regulators can count on the validity of the proof; institutions know their private details stay safe. That’s how you get people to actually use new technology—by making it work for everyone.@Dusk #Dusk $DUSK