Dusk is a Layer 1 blockchain capable of supporting real-world financial infrastructure while preserving privacy and enabling regulatory compliance. In a world where public blockchains often expose sensitive data and struggle to meet institutional requirements, Dusk aims to be the missing piece that bridges traditional finance and decentralized technology — making tokenized securities, compliant DeFi, and institutional-grade digital assets a reality.

At its core, Dusk isn’t just another smart contract platform or a crypto payment network. It is a blockchain specifically designed for regulated markets, backed by zero-knowledge cryptography, modular architecture, and compliance primitives built into the protocol itself. This powerful combination enables institutions, enterprises, and developers to issue, trade, settle, and manage real-world financial assets (RWAs) on-chain without sacrificing confidentiality or legal obligations.

In many ways, Dusk represents the future of decentralized finance where privacy and compliance are not at odds, but two sides of the same infrastructure coin. Let’s take a deep dive into what makes Dusk unique, how it works, and why it matters.

Rethinking Blockchain for Real-World Finance

Most public blockchains today — whether Bitcoin, Ethereum, or others — were built around transparency and decentralization. While these qualities are invaluable for censorship resistance and trustless networks, they create tension when applied to traditional financial use cases. Institutional markets require:

Confidential transaction details (e.g., trade amounts, counterparty positions)

Data privacy compliant with regulations like GDPR

Selective auditing for regulators and compliance officers

KYC/AML enforcement and disclosure where appropriate

Deterministic, fast settlement compatible with market infrastructure

Public blockchains typically disclose every transaction detail, which is incompatible with these needs. Centralized ledgers inside financial firms keep everything private, but they lack the benefits of decentralization: transparency for regulators, verifiable settlement, automation, and composability with other systems. Dusk was designed to reconcile these competing priorities.

Privacy by Design, but Compliant by Default

Rather than exposing transaction details publicly, Dusk uses zero-knowledge proofs (ZKPs) to validate transaction correctness without revealing sensitive data. These techniques — including efficient ZK proof systems — allow participants to prove statements on-chain while keeping the underlying values confidential. Institutions can prove they own assets, comply with regulations, and settle trades without leaking strategic or proprietary information.

But privacy in Dusk isn’t absolute anonymity like privacy coins such as Monero or Zcash. Instead, it is selective transparency: the protocol supports confidential balances and transfers that regulators or authorized parties can audit when legally required. This is crucial for regulated markets where compliance isn’t optional.

In practice, this means users and institutions can choose between:

Public transactions for open flows

Shielded transactions for confidentiality

Selective disclosure for regulators and auditors as required by law

Such flexibility reflects how financial markets operate in the real world: privacy for competitive information, but accountability for oversight.

Modular Architecture Designed for Institutional Use

One of Dusk’s key technical advantages is its modular blockchain architecture, which separates settlement, execution, and privacy features into specialized components tailored for different needs.

DuskDS – Settlement & Data Layer

DuskDS serves as the foundation of the network, handling consensus, data availability, settlement, and privacy-enabled transaction models. It uses the Succinct Attestation consensus protocol — a proof-of-stake (PoS) design optimized for deterministic finality and efficient settlement, which is essential for financial use cases where late reversals are unacceptable.

DuskEVM – Execution Layer

DuskEVM provides Ethereum Virtual Machine compatibility, allowing developers to build and deploy Solidity-based smart contracts with the added benefit of privacy tools. This means established tooling and developer ecosystems from Ethereum can be reused, lowering the barrier to adoption.

DuskVM – Privacy First Smart Contracts

For highly confidential applications, DuskVM enables ZK-friendly smart contracts typically written in languages like Rust and compiled to WebAssembly (WASM). These contracts can process private transactions or other sensitive logic without exposing internal state publicly.

The modular design gives developers the flexibility to choose the right level of privacy and execution environment for their use case — whether it’s tokenizing a corporate bond or running a compliant automated market maker.

Real Use Cases: Where Dusk Shines

Dusk’s combination of privacy and compliance isn’t just theoretical — it unlocks real use cases that traditional public blockchains struggle to achieve.

1. Tokenized Securities

One of the most compelling applications for Dusk is the on-chain issuance and trading of tokenized securities. Under regulatory frameworks like the EU’s MiFID II, MiFIR, MiCA, and the DLT Pilot Regime, securities such as equities, debt, funds, and structured products can be natively issued on the Dusk blockchain. These tokenized assets carry built-in compliance rules, allowing automated enforcement of obligations like KYC, dividend distribution, voting rights, and reporting.

Through partnerships with licensed entities — such as the Dutch NPEX (a regulated multilateral trading facility) and MiCA-compliant stablecoin issuers like Quantoz — Dusk’s infrastructure is already being used to experiment with fully compliant tokenized asset markets.

2. Institutional DeFi

Decentralized finance doesn’t have to exclude institutions. With privacy-aware smart contracts and permissioned controls built in, Dusk enables institutional lending, staking, and AMMs that respect compliance frameworks. Confidential lending pools or regulated derivatives platforms can operate without exposing sensitive position data publicly.

3. Payments & Settlement

Dusk’s fast finality and confidential transaction capabilities make it an ideal platform for payments and settlement rails — especially in systems where counterparties demand confidentiality. Settlement of tokenized assets can occur nearly instantly, bypassing the multi-day delays and manual reconciliation of legacy systems.

4. Digital Identity & Compliance

Dusk also includes self-sovereign identity solutions like Citadel, which allows users to prove identity or compliance (e.g., KYC/AML) without revealing sensitive personal information. This selective disclosure model integrates identity verification directly into the protocol layer — an essential feature for regulated finance.

DUSK Token: Fueling the Network

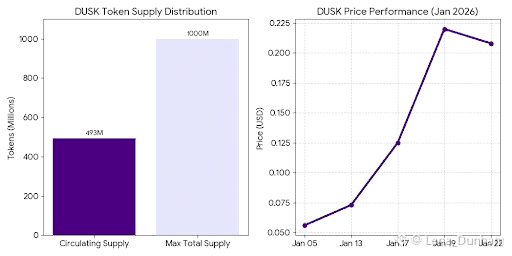

The DUSK token ($DUSK) is the native currency that powers the entire Dusk ecosystem. According to the latest live data from Binance, DUSK is trading at approximately $0.2059 USD, with a market capitalization of about $101.5 million USD, a circulating supply near 493 million tokens, and a max supply of 1 billion DUSK. Daily trading volumes on Binance exceed $80 million USD, reflecting robust liquidity and market participation.

DUSK isn’t just a speculative asset — its utility is directly tied to the network’s operations:

Gas fees: DUSK is used to pay for transaction execution and smart contract interactions on DuskEVM and DuskVM.

Staking: Token holders can stake DUSK to participate in consensus and secure the network via the PoS mechanism.

Governance: DUSK holders can participate in protocol governance decisions, shaping future upgrades, policies, and resource allocation.

Collateral & RWA integration: As real-world asset issuance grows, DUSK may also play roles in collateralization, compliance verification, and ecosystem incentives.

This integration of utility with core network functions creates a natural demand for the token as applications and institutional participation grow.

Market Momentum and Institutional Interest

In early 2026, DUSK has seen notable market movements tied to increasing institutional narratives. Recent price action included surges driven by renewed interest in tokenized assets and mainnet development milestones, with trading volumes spiking in correlation with these fundamentals.

Beyond price data, the market narrative around Real-World Assets (RWA) and regulated finance has elevated Dusk’s profile among investors who see it as a foundational solution for bridging blockchain and traditional financial systems. As regulatory frameworks like the EU’s MiCA continue to come online, networks like Dusk that align with these standards are gaining strategic relevance.

Challenges and the Road Ahead

No project is without challenges. Dusk must continue to build partnerships with regulated entities, integrate compliance standards across jurisdictions beyond Europe, and grow its developer ecosystem to realize its full potential. Regulatory landscapes are evolving, and technology must adapt while remaining secure, scalable, and interoperable.

Yet, Dusk’s focus on privacy + compliance positions it uniquely in the blockchain landscape — especially as institutional adoption and tokenization of traditional assets become more mainstream. Its modular architecture, zero-knowledge infrastructure, and real-world utility make it one of the most interesting “RegDeFi” platforms in the market today.

Conclusion: Privacy and Compliance as Infrastructure

Dusk’s vision goes beyond decentralized finance as a concept; it aims to redefine how financial markets operate by marrying privacy, compliance, and decentralization in a single blockchain platform. By enabling confidential smart contracts, compliant asset tokenization, and institutional-grade financial infrastructure, Dusk has laid the groundwork for on-chain markets that reflect real-world requirements not just speculative ones.

As global financial systems evolve toward digital assets and regulatory clarity grows, platforms like Dusk could play a central role in ushering in a new era of regulated decentralized finance where privacy and compliance aren’t obstacles but core strengths.#Dusk @Dusk $DUSK