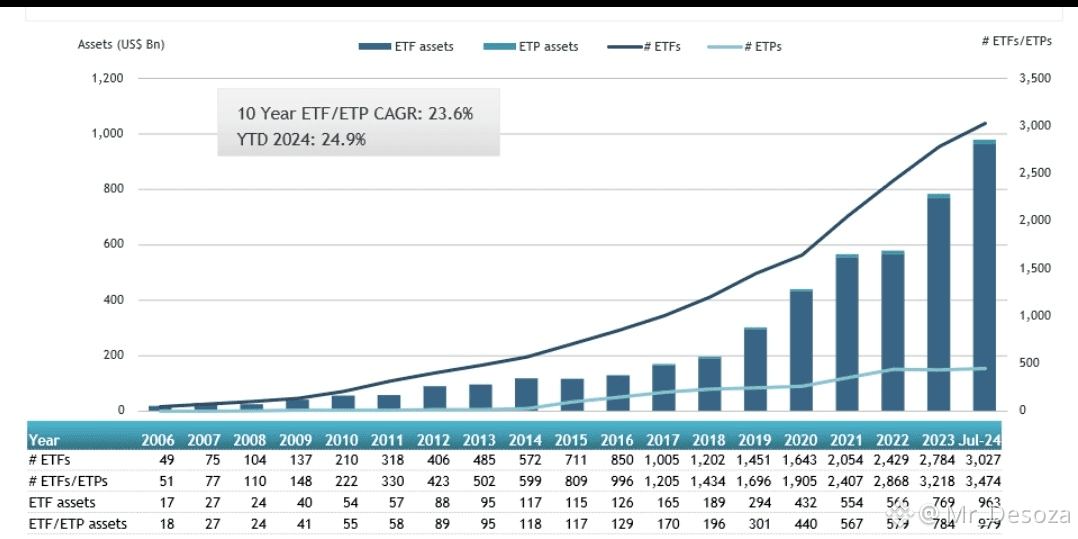

The Thailand Securities and Exchange Commission (Thailand SEC) has announced plans to issue formal guidelines to support crypto Exchange-Traded Funds (ETFs) — a move that could reshape the digital asset landscape across Asia.

This is not just another policy update. This is a strong signal that Thailand wants to be a serious player in the global crypto economy. By creating clear rules for crypto ETFs, regulators are opening the door for institutional investors, traditional funds, and everyday investors to gain exposure to crypto in a safer and more familiar way.

Crypto ETFs allow people to invest in digital assets without directly holding tokens or managing wallets. That means less fear, fewer technical barriers, and more confidence — especially for big money players who need regulation and transparency before stepping in.

Thailand’s decision shows a major shift in mindset. Instead of pushing crypto to the sidelines, authorities are choosing structure over suppression. Clear guidelines help protect investors, reduce fraud, and encourage innovation — all at the same time.

What makes this even more exciting is the timing. Across Asia, countries are waking up to crypto’s potential. With Hong Kong, Singapore, and now Thailand making progressive moves, Asia is rapidly becoming a global crypto powerhouse. Capital, talent, and innovation are flowing east.

For the crypto market, this could mean:

More trust and legitimacy

Increased liquidity and adoption

Stronger participation from global investors

A bridge between traditional finance and digital assets

Thailand embracing crypto ETFs sends a powerful message: crypto is not a trend — it’s infrastructure for the future.

The next wave of growth may not come from hype, but from regulation done right.

Asia is coming. The crypto era is evolving. And Thailand just raised the flag.

#WEFDavos2026 #TrumpCancelsEUTariffThreat #WhoIsNextFedChair #GoldSilverAtRecordHighs #BTCVSGOLD