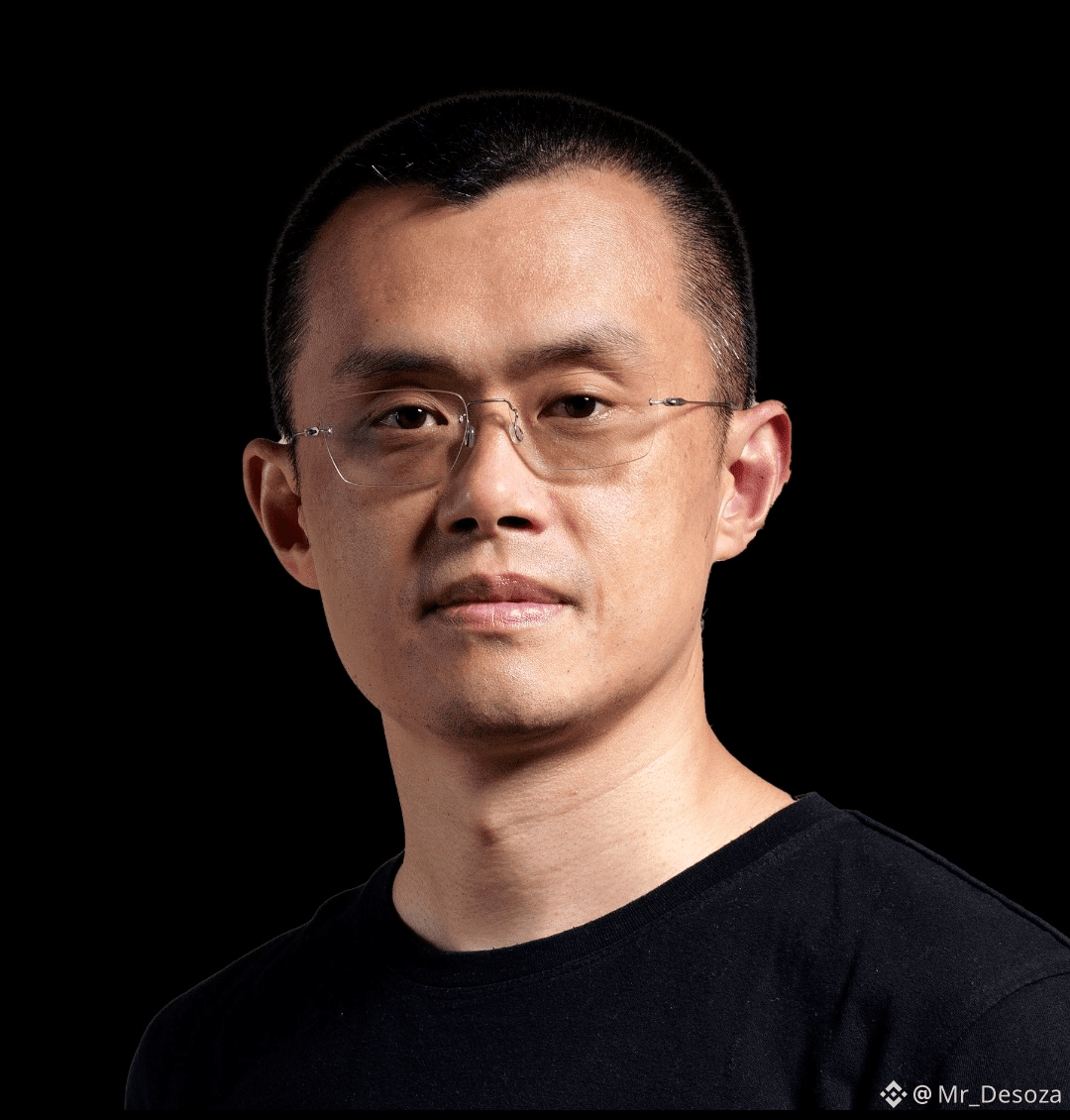

In a major development for the future of blockchain and global finance, Changpeng Zhao, widely known as CZ and the founder of Binance, has revealed that he is currently in talks with more than a dozen governments about tokenizing national and public assets. This statement has sent strong signals across the crypto, finance, and policy worlds, as it highlights how blockchain technology is moving beyond speculation and into the core systems of nations.

At its heart, tokenization means turning real-world assets into digital tokens on a blockchain. These assets could include land, real estate, government bonds, commodities, infrastructure projects, carbon credits, national reserves, or even parts of state-owned companies. Each token represents ownership or a claim on a real asset, making it possible to trade, track, and manage these assets in a digital, transparent, and highly efficient way.

CZ’s comment is significant because it confirms what many experts have been predicting for years: governments are no longer just “watching” crypto from the sidelines. Instead, they are actively exploring how blockchain can help modernize their economies, reduce inefficiencies, fight corruption, and open new channels for investment.

For many governments, traditional asset management systems are slow, opaque, and expensive. Paper-based records, outdated databases, and fragmented systems make it difficult to track ownership, value, and usage of national assets. Tokenization promises to change this by placing asset records on an immutable blockchain ledger. Once an asset is tokenized, its ownership history, transactions, and current status can be viewed in real time, reducing disputes and increasing public trust.

One of the biggest attractions for governments is fractional ownership. Through tokenization, a large asset like a highway project or a government-owned building can be divided into thousands or even millions of small digital tokens. This allows ordinary citizens, local businesses, and even foreign investors to participate with smaller amounts of capital. Instead of relying only on banks or large institutions, governments can raise funds directly from a broader investor base.

CZ has long argued that blockchain should be used as infrastructure, not just as a trading tool. His discussions with governments suggest that this vision is gaining acceptance. Rather than focusing only on cryptocurrencies like Bitcoin or stablecoins, these talks are about building long-term systems that integrate blockchain into public finance, asset management, and national development strategies.

Another powerful benefit of tokenization is liquidity. Many government assets are traditionally illiquid, meaning they cannot be easily sold or traded. Tokenization allows these assets to be traded 24/7 on digital platforms, unlocking value that was previously “stuck.” This could be especially useful for developing countries that own valuable assets but struggle to access global capital markets.

Transparency is another major driver. On a blockchain, every transaction is recorded and cannot be secretly altered. For governments facing public trust issues or corruption concerns, this level of transparency can be transformative. Citizens can see how assets are used, transferred, or monetized, while auditors and regulators gain real-time access to reliable data.

CZ’s involvement matters because of his experience building one of the world’s largest crypto ecosystems. Binance has worked across dozens of jurisdictions, interacted with regulators, and built blockchain tools that scale globally. Governments see value in engaging with someone who understands both technology and regulatory realities.

Importantly, CZ has emphasized that these discussions are not about replacing national currencies or undermining sovereignty. Instead, they are about using blockchain as a tool, similar to how governments adopted the internet decades ago. Tokenization can exist alongside existing legal and financial systems, enhancing them rather than destroying them.

Some governments are reportedly exploring tokenization for government bonds, which could dramatically simplify issuance and settlement. Instead of waiting days for bond transactions to clear, blockchain-based bonds can settle in minutes or even seconds. This reduces costs and lowers risk for both governments and investors.

Others are looking at tokenizing real estate and land registries, an area where disputes and fraud are common in many parts of the world. A blockchain-based registry can create a single, tamper-proof source of truth, reducing legal battles and increasing investor confidence.

There is also growing interest in natural resources. Tokenizing assets like minerals, energy reserves, or carbon credits allows governments to better track usage, enforce regulations, and participate in global sustainability markets. In the case of carbon credits, blockchain can prevent double-counting and fraud, a major issue in current systems.

Of course, challenges remain. Legal frameworks need to be updated to recognize tokenized assets. Governments must decide who controls the underlying infrastructure and how data privacy is protected. Cybersecurity, digital identity, and interoperability with existing systems are all critical questions that must be addressed.

CZ has acknowledged these challenges, often stating that regulation and collaboration are essential. Rather than pushing governments to move fast, his approach appears to focus on education, pilot programs, and gradual implementation. This cautious but forward-looking strategy makes tokenization more acceptable to policymakers who are naturally risk-averse.

Another important point is that not all governments are starting from the same place. Some already have strong digital infrastructure and clear crypto regulations, while others are still in early exploration phases. CZ’s talks reportedly range from advanced discussions on implementation to early-stage conversations about what tokenization even means.

The geopolitical implications are also noteworthy. Countries that successfully tokenize assets could gain a competitive advantage by attracting global capital more easily. This could reshape how infrastructure is funded, how public debt is managed, and how national wealth is shared among citizens.

For the crypto industry, this development marks a major shift in narrative. For years, crypto was often seen as anti-government or outside the system. Now, with governments actively engaging in tokenization talks, blockchain is being reframed as a nation-building tool rather than a threat.

Critics still warn about over-centralization if governments control tokenized systems, or the risk of surveillance if transparency is misused. These concerns are valid and underline the importance of thoughtful design. Tokenization must balance openness with privacy, and efficiency with individual rights.

Still, the direction is clear. When the founder of the world’s largest crypto exchange says he is working directly with governments on tokenizing assets, it signals that blockchain has entered a new phase of maturity. This is no longer just about startups and traders; it is about public institutions and national economies.

In simple terms, what CZ is describing is a future where governments manage assets the same way modern companies manage data: digitally, transparently, and efficiently. If these talks turn into real-world implementations, they could redefine public finance for decades to come.

While timelines remain uncertain, one thing is clear: tokenization is moving from theory to reality. And with experienced industry leaders engaging directly with governments, the bridge between blockchain innovation and public policy is getting stronger than ever.

#WEFDavos2026 #CZ #WhoIsNextFedChair #TrumpTariffsOnEurope #GoldSilverAtRecordHighs