Let me write this the way I actually think about it — not as a developer, not as a promoter, but as someone trying to understand where real blockchain ecosystems are forming and where narratives are just noise.

When people talk about new chains, they usually focus on one thing: price.

But ecosystems aren’t built by charts.

They’re built by applications, infrastructure, liquidity, and real users.

That’s why I started looking deeper into the Plasma ecosystem map — not to find the next pump, but to understand whether Plasma is building something that can actually survive beyond speculation.

And what I found was interesting.

The First Thing I Noticed: Plasma Isn’t Trying to Do Everything

Most new chains try to become:

• DeFi hub

• NFT hub

• Gaming hub

• AI hub

• Meme hub

All at once.

Plasma is doing something different.

Instead of chasing every narrative, it’s focusing on one core identity:

Payments + stablecoins + real financial infrastructure.

That immediately changes the type of ecosystem you attract.

You don’t attract hype projects.

You attract builders who care about reliability.

The Core Layer: Plasma as a Stablecoin-First Chain

At the center of the ecosystem map is Plasma itself — designed as a chain optimized for:

• High-speed transactions

• Very low fees

• Stablecoin settlement

• Payments at scale

This is not a chain built for experiments.

It’s built for money moving all day, every day.

That’s important because payment infrastructure behaves very differently from DeFi speculation. It needs uptime, predictability, and deep liquidity.

This is why Plasma’s base layer matters more than people realize. It’s not trying to compete with Ethereum in complexity — it’s trying to become something closer to a financial rail.

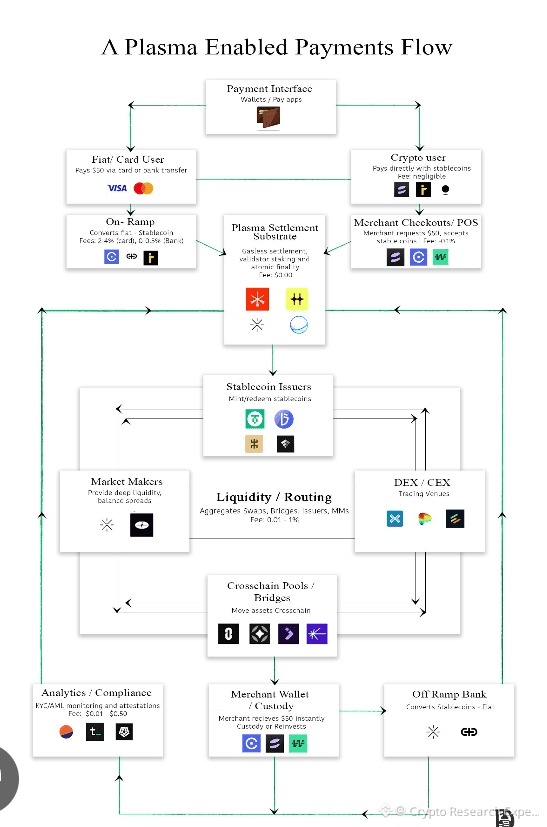

The Liquidity Layer: Where Money Actually Flows

One of the strongest signs of a healthy ecosystem is how liquidity is structured.

In Plasma’s case, the ecosystem map shows:

• Stablecoin issuers

• Liquidity providers

• Payment routing systems

• On-chain settlement tools

This is where Plasma becomes interesting from a market perspective.

Most chains depend on volatile tokens for activity.

Plasma is designing around stablecoins as the default unit of account.

That means:

• Merchants can price normally

• Apps don’t worry about volatility

• Users don’t feel like they’re gambling just to use the chain

This is how real financial networks grow — quietly, steadily, without hype.

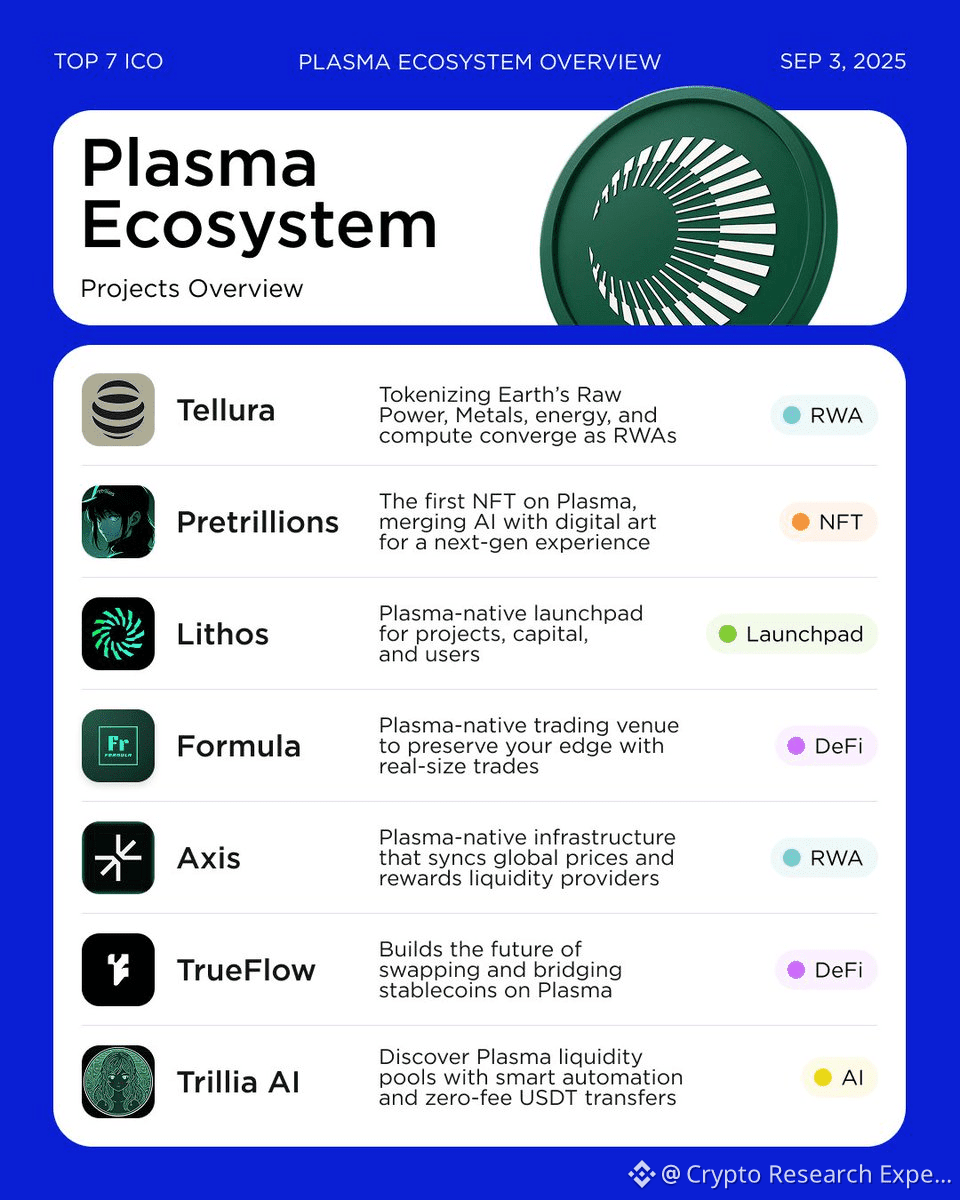

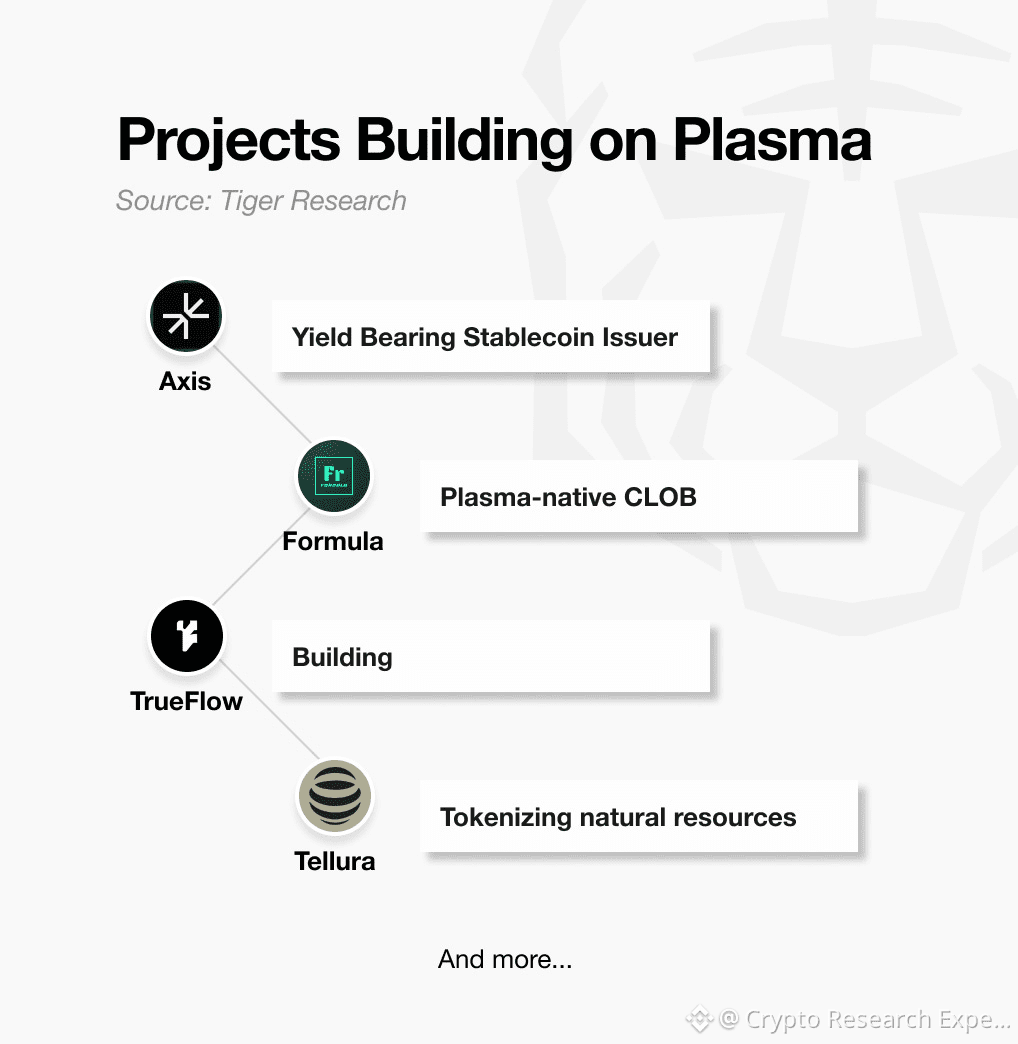

The Application Layer: Real Use Instead of Narrative

What impressed me most is the type of applications appearing in the Plasma ecosystem.

Instead of meme games and short-term farming protocols, you see:

• Payment gateways

• Remittance tools

• Merchant settlement systems

• Cross-border transfer apps

• On-chain treasury tools

These are not exciting on Crypto Twitter.

But they are exactly the tools that:

• Businesses use

• Institutions care about

• Regulators understand

This tells me Plasma isn’t optimizing for attention.

It’s optimizing for adoption.

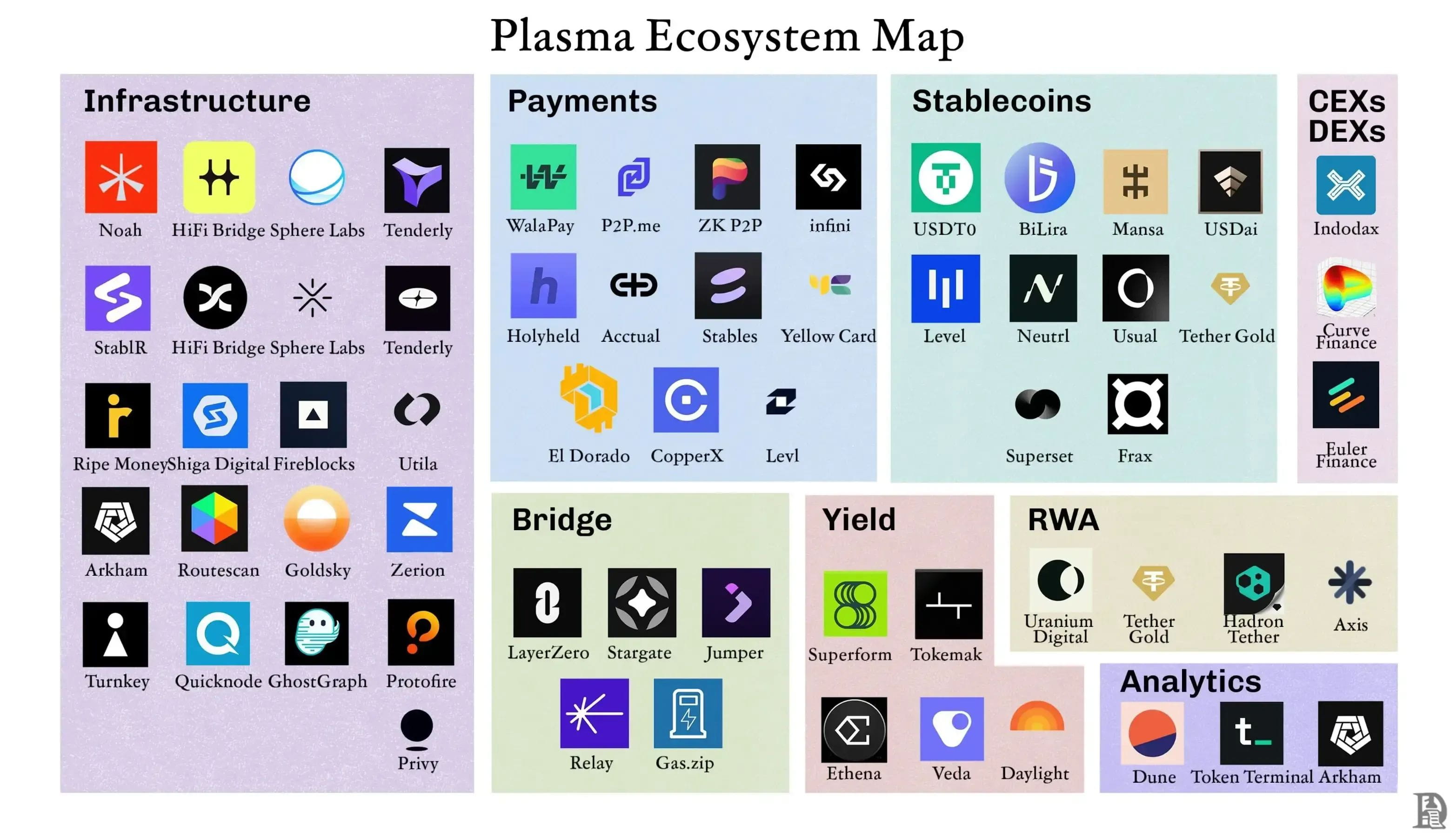

The Infrastructure Layer: The Quiet Backbone

Every strong ecosystem has an invisible layer that nobody talks about.

Plasma’s map includes:

• Indexing services

• Wallet providers

• Compliance tooling

• Settlement engines

• Data availability services

This matters more than most people realize.

Because when institutions or payment companies enter crypto, the first question they ask is not:

“How fast is the TPS?”

They ask:

“Can we monitor it?”

“Can we audit it?”

“Can we control risk?”

Plasma seems to be building this layer early — before mass adoption.

That’s rare.

The Stablecoin Strategy: Plasma’s Real Advantage

Here’s where my perspective really shifted.

Plasma is not just “compatible” with stablecoins.

It is designed around them.

This is a huge difference.

Most chains treat stablecoins as just another asset.

Plasma treats them as the foundation of the ecosystem.

That changes everything:

• Liquidity becomes more stable

• Fees become predictable

• Volatility risk drops

• Real commerce becomes possible

In simple terms:

This is how you build a chain that banks, fintechs, and payment companies can actually use.

The Ecosystem Map as a Signal

When I look at Plasma’s ecosystem map as a whole, one thing becomes clear:

This is not a hype ecosystem.

There are no dozens of meme tokens.

No artificial farming layers.

No attention-seeking launches.

Instead, it looks like:

• A payment network

• A settlement layer

• A stablecoin hub

• A financial infrastructure stack

That tells me something important.

Plasma is not trying to win the next cycle.

It’s trying to exist five cycles from now.

My Honest Take

Let me be very honest.

Plasma will probably never be the loudest project not like others. But, it's now mean that plasma is not working plasma has a worth and work

It may never trend every week.

It may not attract retail mania.

It may not produce 100x memes.

But ecosystems like this are often the ones that:

• Get institutional partnerships

• Become invisible infrastructure

• Handle massive volume quietly

• Survive long bear markets

And in crypto, that is where the deepest value usually hides.

Final Thought

When people ask me how to judge an ecosystem, I always say:

Don’t look at price.

Don’t look at followers.

Don't look at hype.

Look at:

• Who is building

• What they are building

• And who will realistically use it

Plasma’s ecosystem map tells a very clear story.

This is not an entertainment chain.

This is a financial network in formation.

And those are rare.

Now I’m curious 👇

Do you think payment-focused chains will matter more than DeFi chains in the next phase of crypto?

Or will speculation always dominate?