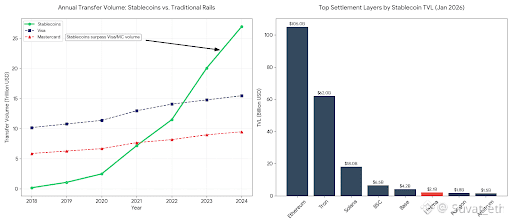

As blockchain adoption matures, one truth has become increasingly clear: stablecoins are the dominant real-world use case of crypto. They are used for cross-border payments, remittances, merchant transactions, on-chain treasury management, and increasingly by institutions seeking faster and more transparent settlement. Plasma is built on this foundation, positioning itself as a Layer 1 blockchain purpose-built for stablecoin settlement rather than a general-purpose network.

Traditional Layer 1 blockchains were designed around volatile native tokens and speculative activity. While stablecoins run on top of them, the underlying infrastructure often introduces friction through unpredictable fees, slow settlement, and poor user experience. Plasma takes a different approach by designing every layer of the protocol around stablecoins as the primary unit of value.

At the execution layer, Plasma offers full EVM compatibility through Reth, a high-performance Ethereum execution client. This ensures that developers can deploy existing Ethereum smart contracts with minimal modification, while retaining access to familiar tools, wallets, and developer frameworks. By staying aligned with the EVM, Plasma avoids ecosystem fragmentation while optimizing performance for payments and settlement.

Finality is a critical requirement for financial infrastructure, and Plasma addresses this through PlasmaBFT, a Byzantine Fault Tolerant consensus mechanism delivering sub-second finality. In contrast to probabilistic confirmation models, Plasma provides deterministic settlement, making it suitable for retail payments, merchant checkout, and institutional transaction flows where certainty and speed are essential.

Plasma’s most defining feature is its stablecoin-first economic model. On most blockchains, users must hold a volatile native token to pay gas fees, creating unnecessary complexity and financial risk. Plasma eliminates this friction by enabling gasless USDT transfers and allowing stablecoins themselves to be used for transaction fees. This makes on-chain payments more intuitive and predictable, particularly for non-crypto-native users and businesses.

Security and neutrality are reinforced through Bitcoin-anchored security. By anchoring key security components to Bitcoin, Plasma aims to benefit from Bitcoin’s long-standing reputation for decentralization, censorship resistance, and neutrality. For a settlement layer intended to support regulated financial activity and large-scale value transfer, this design choice enhances long-term trust and resilience.

Plasma is designed to serve a clear and growing audience. Retail users in high-stablecoin-adoption regions benefit from fast, low-cost, and simple transfers. Institutions, fintech companies, and payment processors gain access to instant finality, predictable fees, and infrastructure aligned with compliance requirements. Developers, in turn, can build payment rails, programmable wallets, treasury systems, and settlement applications on a protocol optimized for stablecoins from the ground up.

Rather than competing across every narrative in crypto, Plasma focuses on what already works. Stablecoins are becoming the backbone of digital finance, and Plasma’s goal is to provide the infrastructure that allows them to move globally with speed, certainty, and neutrality.@Plasma #Plasma $XPL