Dusk,founded in 2018, increasingly feels less like a speculative Layer 1 project and more like a foundational piece of infrastructure that has been waiting for the conversation to mature.

Dusk is often described with terms like privacy blockchain or regulated finance Layer 1, but a more useful way to understand it is as a coordination layer that mirrors how modern finance actually operates. Real markets are not about hiding information; they are about deciding who gets to see what, when, and under what conditions. Markets rely on confidentiality to function smoothly, but they also rely on auditability to maintain trust. Dusk is built to address this balancing act with privacy as the default, not an afterthought, while still allowing verification in regulated contexts.

A Vision Rooted in Real Financial Needs

Most public blockchain systems are fully transparent by default. Every transaction, every balance, every contract call is visible to anyone. While this is useful for pure censorship resistance and trust minimization, it becomes a problem when financial institutions consider using blockchain for regulated assets. No serious issuer wants positions, counterparties, or internal structures visible on a public ledger to the world. Dusk’s architecture addresses exactly this problem by enabling privacy and compliance without sacrificing either.

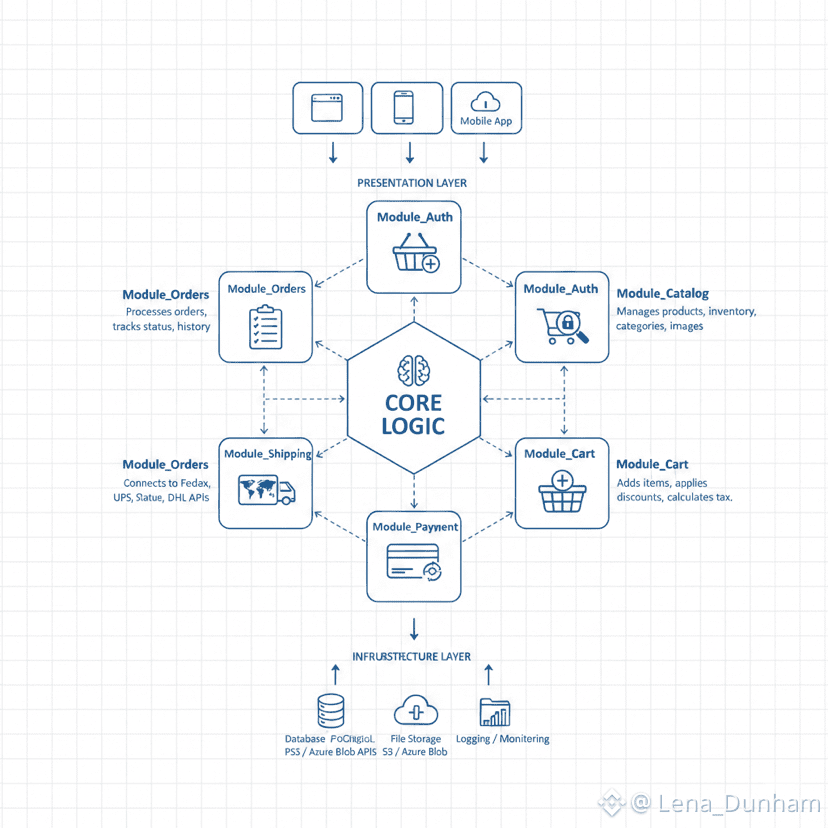

The protocol uses zero-knowledge cryptography and modular design to support confidential transactions and smart contracts that can operate under strict regulatory constraints. It lets institutions issue and manage tokenized securities and decentralized applications while enforcing legal requirements such as KYC/AML, reporting, and eligibility conditions as part of the protocol itself. This is critical if blockchain is to become more than a fringe financial technology.

Privacy as a Feature, Not a Flaw

It is important to distinguish between privacy that hides wrongdoing and privacy that protects sensitive but legitimate financial information. Dusk’s privacy model is designed with the latter in mind. Privacy here does not mean anonymity that evades law enforcement; it means selective disclosure so that only authorized parties see sensitive data. This is how regulated markets already operate off-chain, and blockchain applications need to mimic that behavior to gain institutional trust.

The use of zero-knowledge proofs allows Dusk to validate transaction correctness without exposing the underlying data publicly. This means businesses can automate compliance checks and internal workflows that would traditionally require expensive intermediaries, while regulators can still access the data they need when legally required. This blend of confidentiality and auditability is rare in blockchain and a reason many traditional players are now paying attention.

Tokenized Real-World Assets: From Concept to Deployment

One of the most important trends in blockchain today is the tokenization of real-world assets. These can include stocks, bonds, funds, or other regulated financial instruments. At first, tokenization was often framed as a futuristic experiment with unclear utility. Today, however, institutions are seriously evaluating whether on-chain settlement can reduce costs, shorten timelines, and lower operational risk. These benefits only materialize if platforms can protect sensitive information — another area where Dusk’s design shines.

Dusk’s modular architecture allows assets to live on chain while preserving privacy and compliance, which turns tokenization from a theoretical concept into something that can be deployed in real markets. These assets can behave the same way as their traditional counterparts, but with the added advantages of settlement finality, automation, and interoperability with decentralized applications.

Compliant DeFi and Institutional Adoption

Another major shift in the crypto landscape is the evolution of decentralized finance (DeFi) beyond purely permissionless and public systems to compliant DeFi that can coexist with regulation. This does not mean decentralization is abandoned. It means infrastructure must be capable of encoding rules without destroying composability or trust.

Dusk enables DeFi applications to be programmable and privacy-aware, allowing financial applications to enforce compliance boundaries in code. This introduces some friction compared with fully permissionless platforms, but it also introduces legitimacy. Builders on Dusk are typically focused on long-term sustainability and legal viability rather than short-term attention and viral user growth.

This philosophy matters as capital scales. Institutional players are not incentivized by headlines; they demand operational reliability, auditability, and risk controls. Dusk’s focus on privacy and compliance from the protocol layer up positions it well to meet these demands.

Sustainable Growth Over Hype Cycles

Many blockchain projects chase momentum and buzz, building speculative narratives to attract fast capital flows. Dusk takes a markedly different path. Its aim is to build infrastructure that may grow more slowly, but grows in a way that is sticky and durable.

Projects that are deeply embedded in regulated financial infrastructure do not get replaced easily. Once a regulated market starts issuing tokenized securities or compliant lending products on a platform, moving that infrastructure elsewhere is costly and risky. This stickiness is precisely what Dusk is targeting with its privacy-centric, compliance-enabled architecture.

Real-World Use and Products Emerging

Beyond theory, Dusk is beginning to roll out practical applications that demonstrate its vision. One example is the NPEX dApp, built in partnership with NPEX, a regulated multilateral trading facility in Europe. This integration brings regulated asset issuance, brokerage, investment products, and settlement workflows directly on chain under unified compliance. This marks a real step toward a decentralized market infrastructure where regulated assets can be issued, traded, and settled within a shared legal and technical framework.

Another example is Dusk Trade, a platform previewing access to compliant tokenized real-world assets. It offers users the ability to build and trade portfolios of securities that conform to EU regulations like GDPR, MiCA, and others, complete with standard onboarding and KYC processes. These are not future concepts; they are live initiatives showing how regulated markets might function on chain.

Market Context and Token Dynamics

Dusk also has a live market presence, with its native token DUSK listed on major exchanges including Binance US, expanding access to U.S. traders and institutions. The DUSK token is used for transaction fees, staking, and governance, integrating utility with network participation. On mainstream markets like Binance, DUSK has been trading around approximately $0.20 to $0.23 USD, with a market capitalization in the tens of millions range and strong daily volume, showing active trading and liquidity.

This trading activity reflects growing interest not just from retail investors, but also from institutions and developers who see Dusk as a key player in the next generation of regulated digital finance.

Challenges Remain, But So Does Purpose

Of course, nothing in blockchain adoption is guaranteed. Privacy-preserving systems are inherently complex, and that complexity can slow developer onboarding. Regulation is still fragmented across regions, and designing for global finance is never straightforward. Institutions move cautiously, and markets often demand fast results.

The big questions remain: Can Dusk maintain momentum while waiting for institutions to commit? Can it grow its developer and user ecosystem without compromising its core assumptions about privacy and compliance?

What stands out is that Dusk appears to have been built with these questions in mind. Its architecture is usable today rather than hypothetical, and its design choices suggest a network that expects to be tested rather than just admired.

Conclusion: A New Phase in Blockchain Adoption

If the next phase of blockchain adoption is defined less by disruption and more by coordination between decentralized systems and real world finance, then Dusk’s long term bet begins to make sense. It is not trying to replace traditional finance overnight. Instead, it is giving finance a place to operate on chain without pretending reality will bend to crypto’s ideals. Whether this approach becomes dominant or quietly essential is still uncertain, but the shift it represents is already underway.

#Dusk @Dusk $DUSK