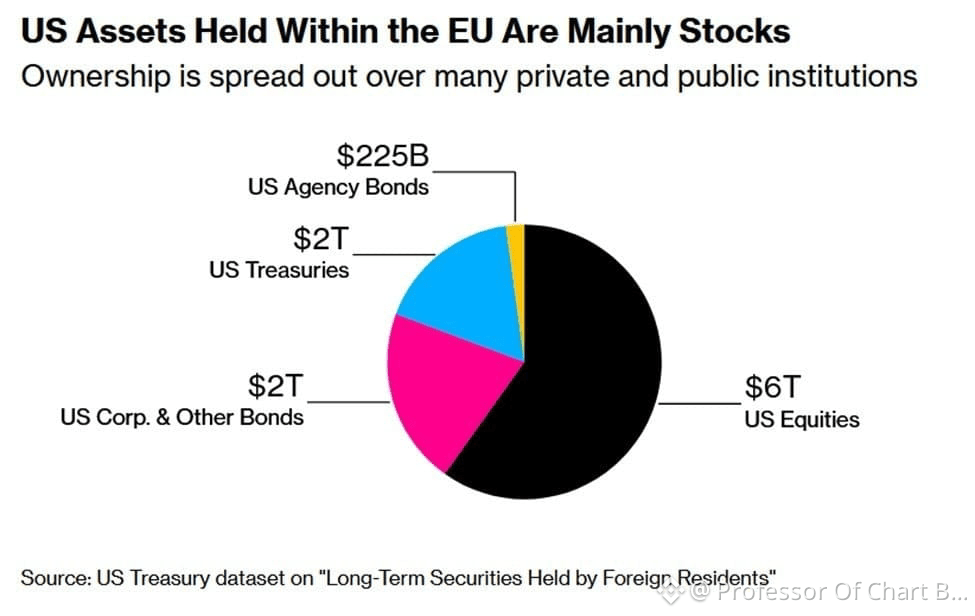

EU investors now hold a record ~$10 TRILLION in U.S. assets — and that leverage cuts both ways.

Where the money sits 👇

• 🟡 $6T in U.S. equities (58% of EU exposure)

• 🟡 $2T in U.S. Treasuries (19%)

• 🟡 $2T in corporate & other bonds

• 🟡 $225B in U.S. agency bonds

Zoom out further and it gets bigger 👀

When you include the UK, Norway, and Switzerland, Europe controls ~40% of all foreign U.S. Treasury holdings. #TrumpTariffsOnEurope

So yes — talk of Europe “selling U.S. bonds” sounds scary…

But here’s the reality 👇$XRP

If Treasuries dump, European sovereign bonds fall even harder.

Unwinding this exposure doesn’t hurt America alone — it boomerangs straight back into Europe’s own bond markets. $ICP

📌 Europe is financially tied to the U.S. like never before

📌 Selling pressure = self-inflicted damage

📌 This is leverage — but also a trap

Global markets aren’t just trading headlines anymore.

They’re trading interdependence.

And that’s why this story matters 🔥$SUI