Markets move on anticipation, not confirmation.

And right now, global politics is adding fuel to crypto volatility.

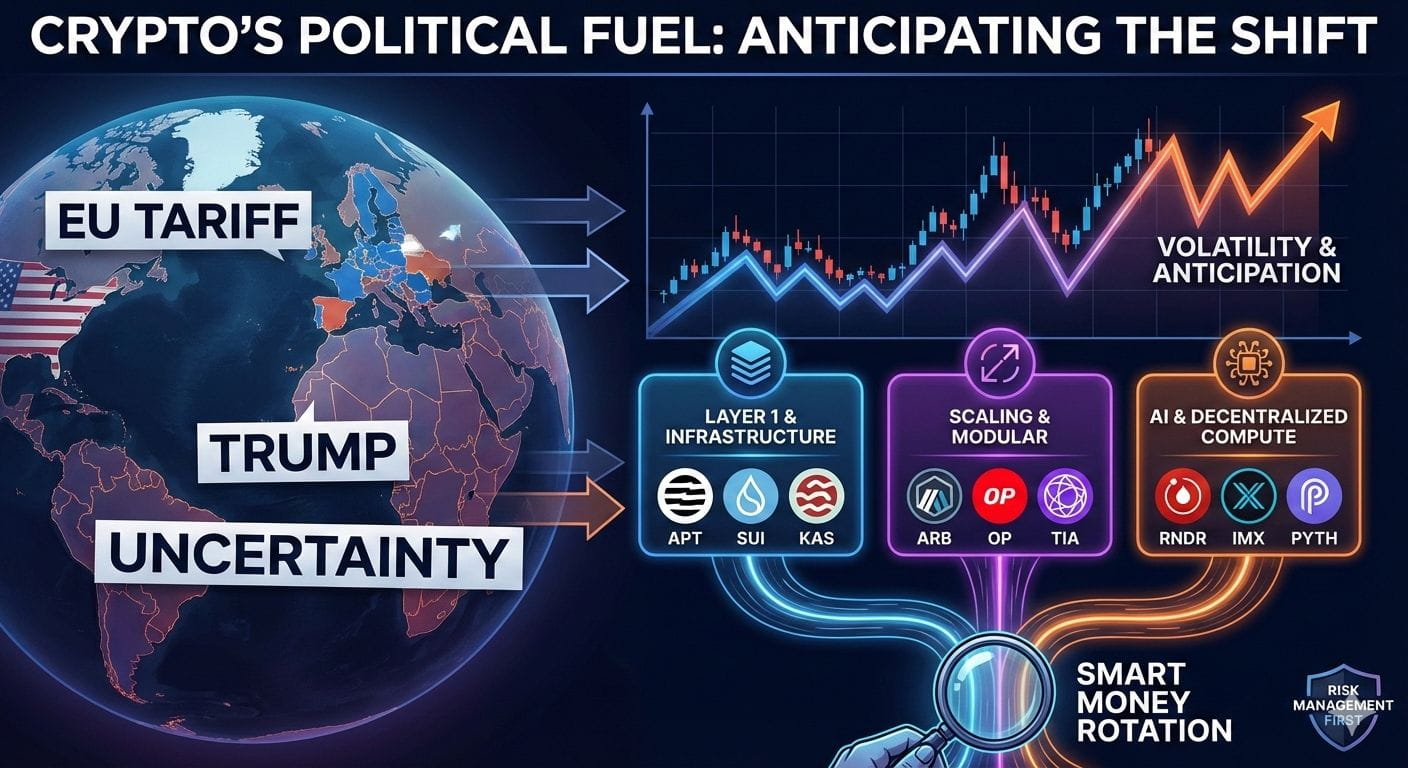

With renewed EU tariff threats and political uncertainty around Trump, smart money is already rotating into specific crypto sectors — and specific coins.

Here’s a clear, no-hype breakdown 👇

🌍 WHAT’S REALLY HAPPENING

• Trade tensions increase global uncertainty

• Traditional markets feel pressure

• Crypto reacts as a neutral, global asset class

But not all coins benefit equally.

Some attract capital, others bleed liquidity.

🎯 CRYPTO COINS TO WATCH CLOSELY

🔹 Layer 1 & Core Infrastructure

These usually gain strength during macro stress:

• APT (Aptos) – Strong ecosystem growth

• SUI (Sui) – High-performance L1 narrative

• SEI (Sei) – Optimized for trading infrastructure

• KAS (Kaspa) – PoW + scalability interest rising

🔹 Scaling & Modular Blockchains

When uncertainty rises, scalability narratives heat up:

• ARB (Arbitrum) – Ethereum scaling leader

• OP (Optimism) – Long-term rollup adoption

• TIA (Celestia) – Modular blockchain demand increasing

🔹 AI & Decentralized Compute

Tech wars + tariffs push interest here 👇

• RNDR (Render) – Decentralized GPU power

• IMX (Immutable) – Gaming + infrastructure play

• PYTH (Pyth Network) – Real-time data for DeFi

⚠️ IMPORTANT RISK NOTES

I’m personally doing the following:

• No blind buying

• No heavy leverage

• Scaling entries slowly

• Taking partial profits into strength

Macro-driven moves are fast and emotional.

Risk management matters more than predictions.

🧠 FINAL THOUGHT

Political noise doesn’t destroy crypto — it reshuffles winners.

The real edge is not reacting late,

but understanding which coins benefit from global stress.

👉 Are you positioned for volatility… or waiting for confirmation?

#crypto #altcoins #bitcoin #Macro #BinanceSquare