Why Most Blockchains Fail at the One Job That Actually Matters

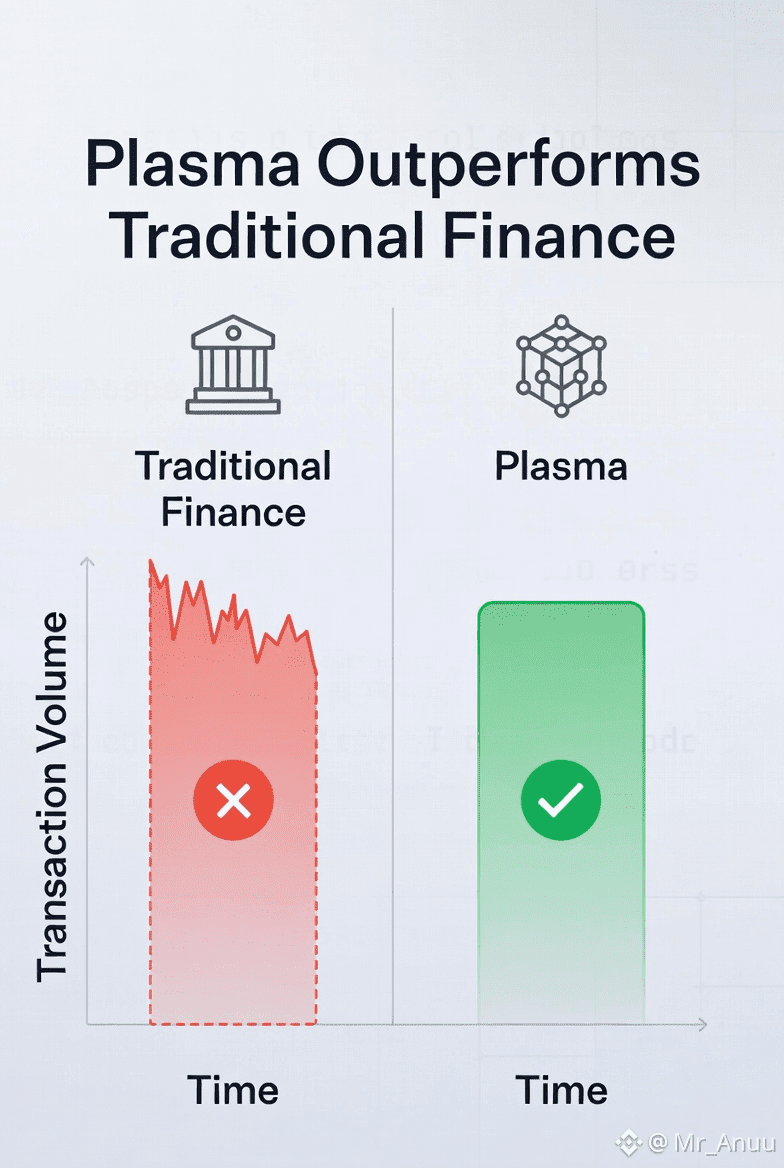

Blockchains love to advertise speed, NFTs, gaming, or “infinite scalability.” But real finance does not care about hype. It cares about settlement reliability. Payroll, treasury transfers, merchant payments, and cross-border flows need predictability under load. This is where most chains quietly break. Plasma does not try to entertain users. It tries to outperform banks at settlement — and that is a far harder problem.

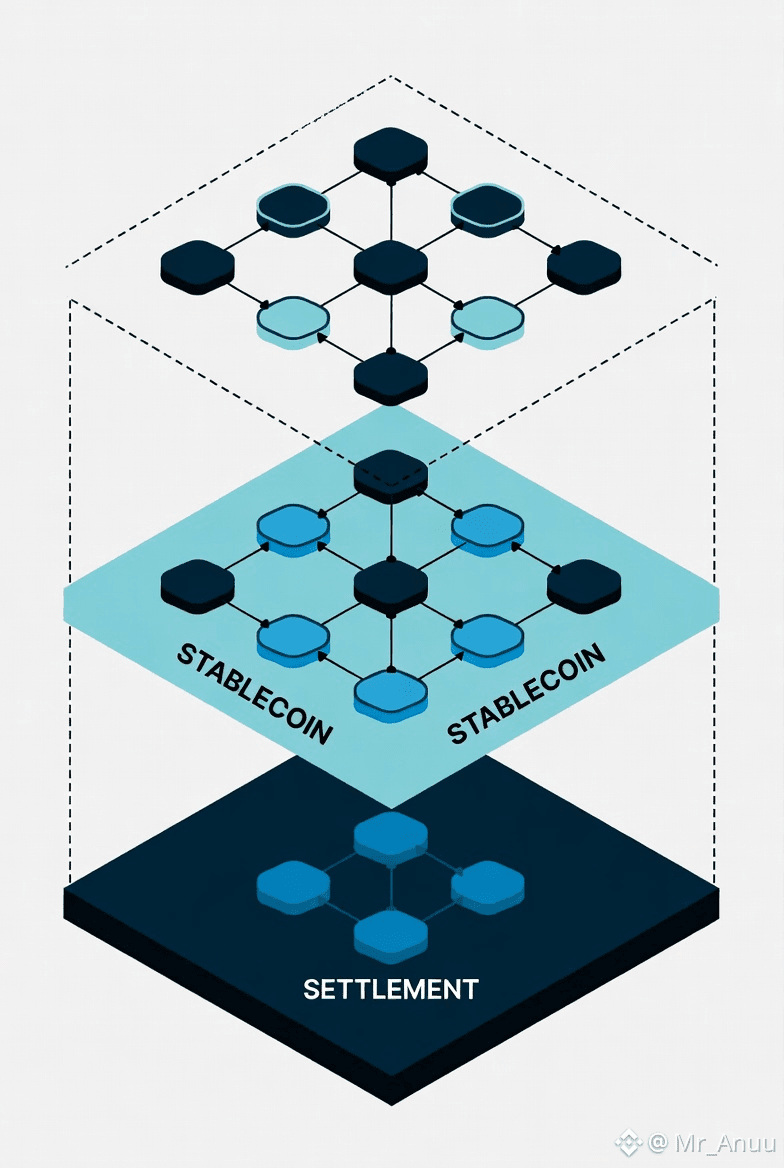

Plasma’s Design Philosophy: Remove Everything That Slows Money Down

Plasma is not a general-purpose chain by accident. It is by design. Every feature that introduces congestion, fee spikes, or unpredictability has been stripped away. What remains is a chain optimized for stablecoin movement at scale.No experimental VM clutter.No speculative priority traffic.Just clean, high-frequency value transfer.This minimalism is Plasma’s hidden strength.

Stablecoins Are the Real Users — Humans Are Secondary

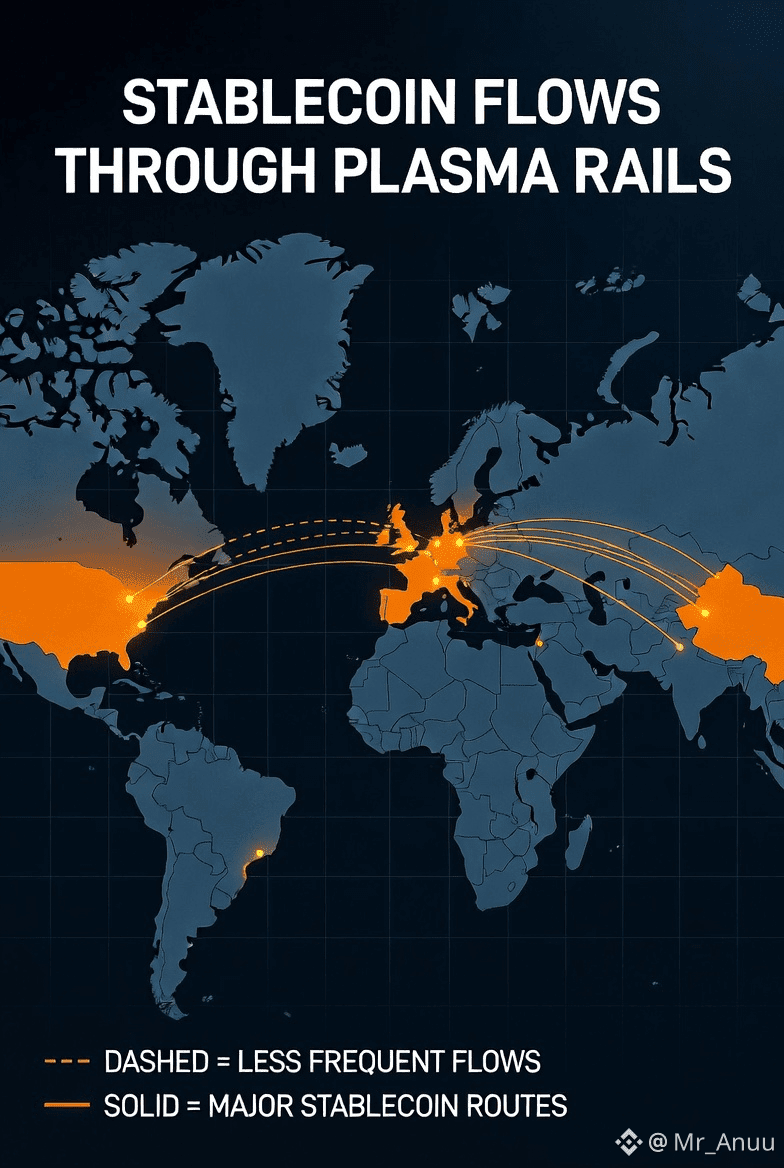

Most chains are built for developers. Plasma is built for money itself. Stablecoins do not speculate. They circulate. They demand constant uptime and consistent costs. Plasma treats stablecoins not as apps but as infrastructure clients.This flips the usual blockchain logic. Instead of asking “What can users build?” Plasma asks “What must money never fail at?”

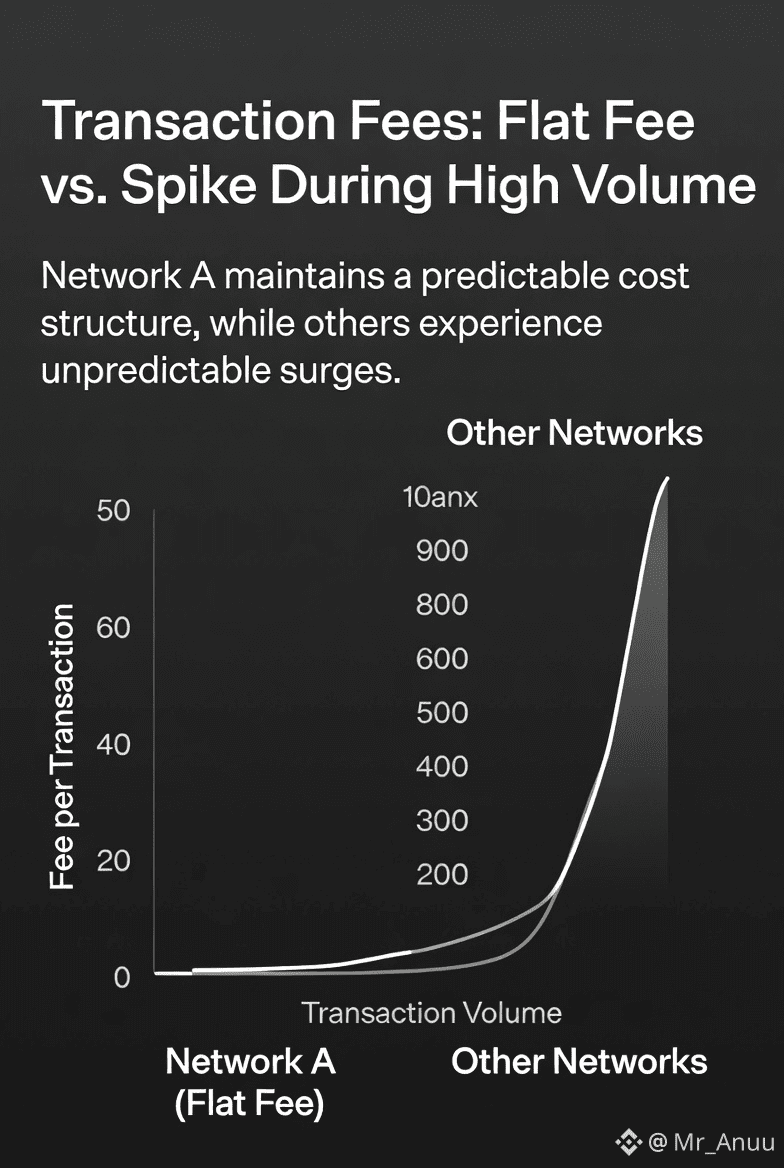

Fee Stability Is Not a Feature — It Is a Requirement

Low fees mean nothing if they spike under pressure. Plasma’s real innovation is not cheap transfers, but boringly consistent costs even when activity rises. For businesses, this matters more than raw TPS. Predictable fees enable budgeting, automation, and scale.Markets reward chains that behave like utilities, not casinos.

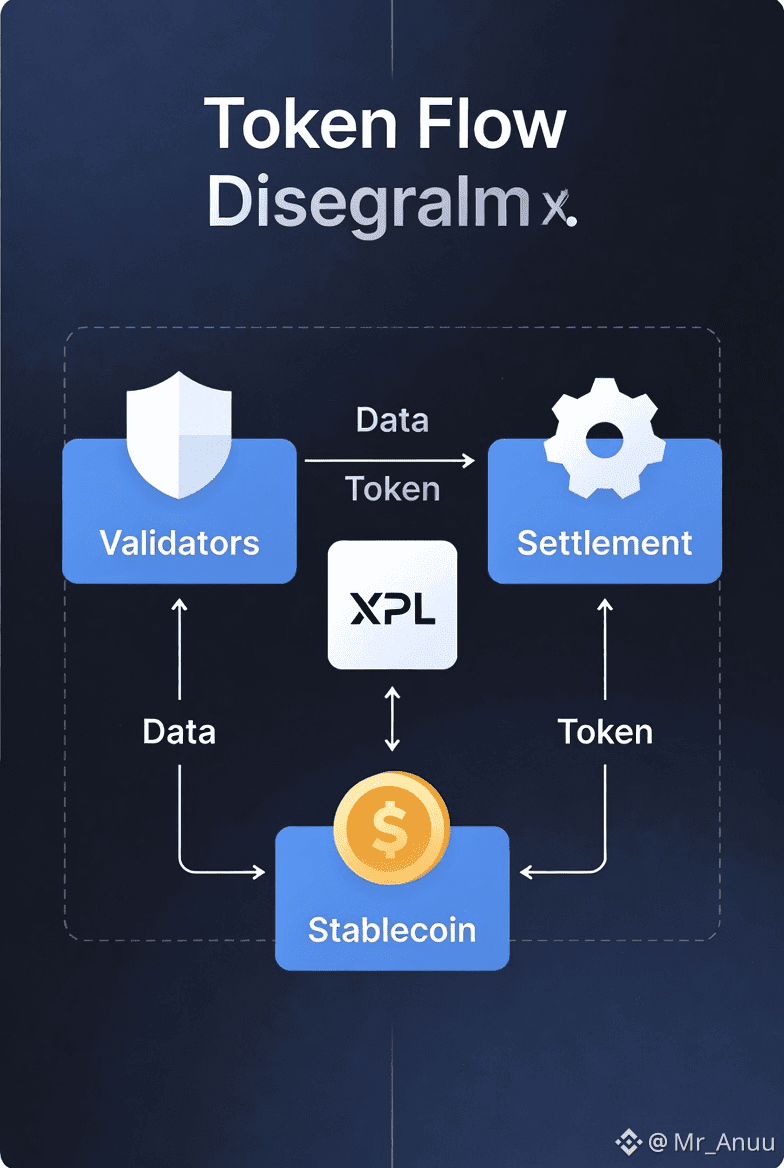

XPL’s Role Is Economic Gravity, Not Speculation Fuel

XPL is not designed to attract short-term hype. Its role is to secure and align settlement incentives. Validators are rewarded for reliability, not novelty. This creates an economic environment where uptime and consistency are more profitable than chaos.Over time, gravity forms around systems that do not break.

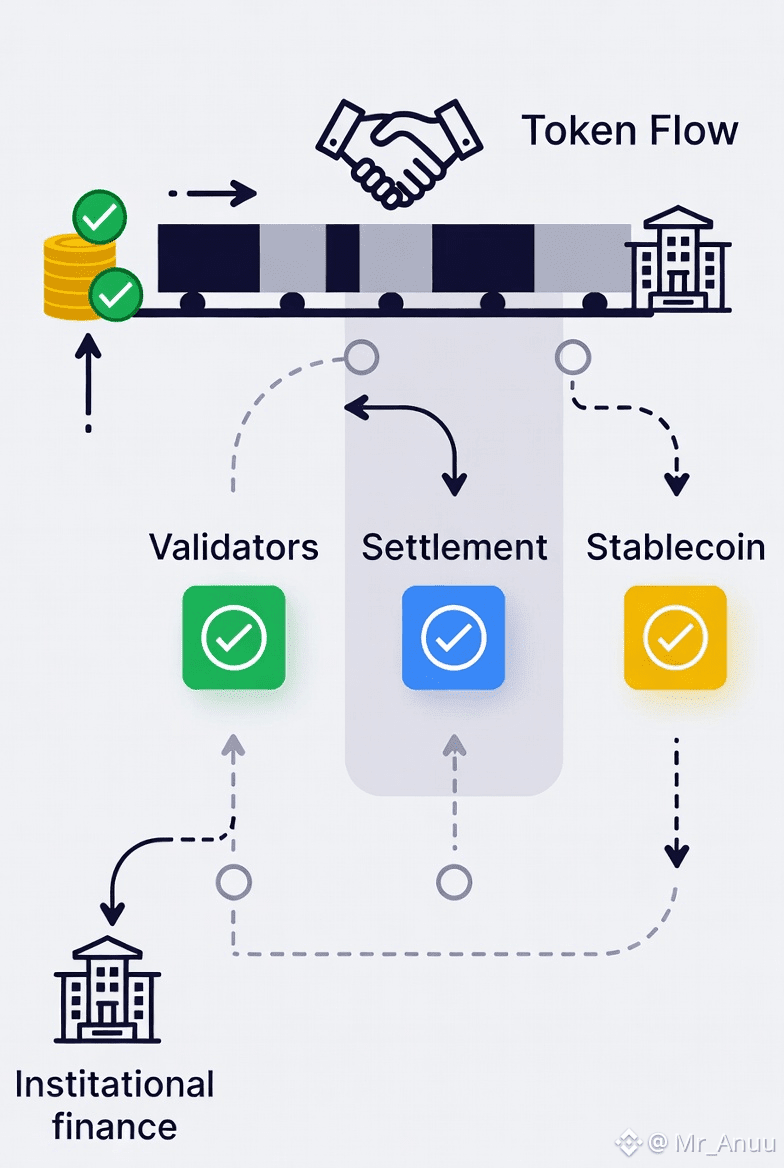

Why Plasma Quietly Targets Institutions Without Marketing to Them

Institutions do not chase chains. They adopt what already works. Plasma’s architecture mirrors how financial infrastructure evolves: silently, slowly, then everywhere. When stablecoin issuers and payment systems need a backbone that does not surprise them, Plasma becomes obvious without being loud.Adoption here looks boring — until it is irreversible.

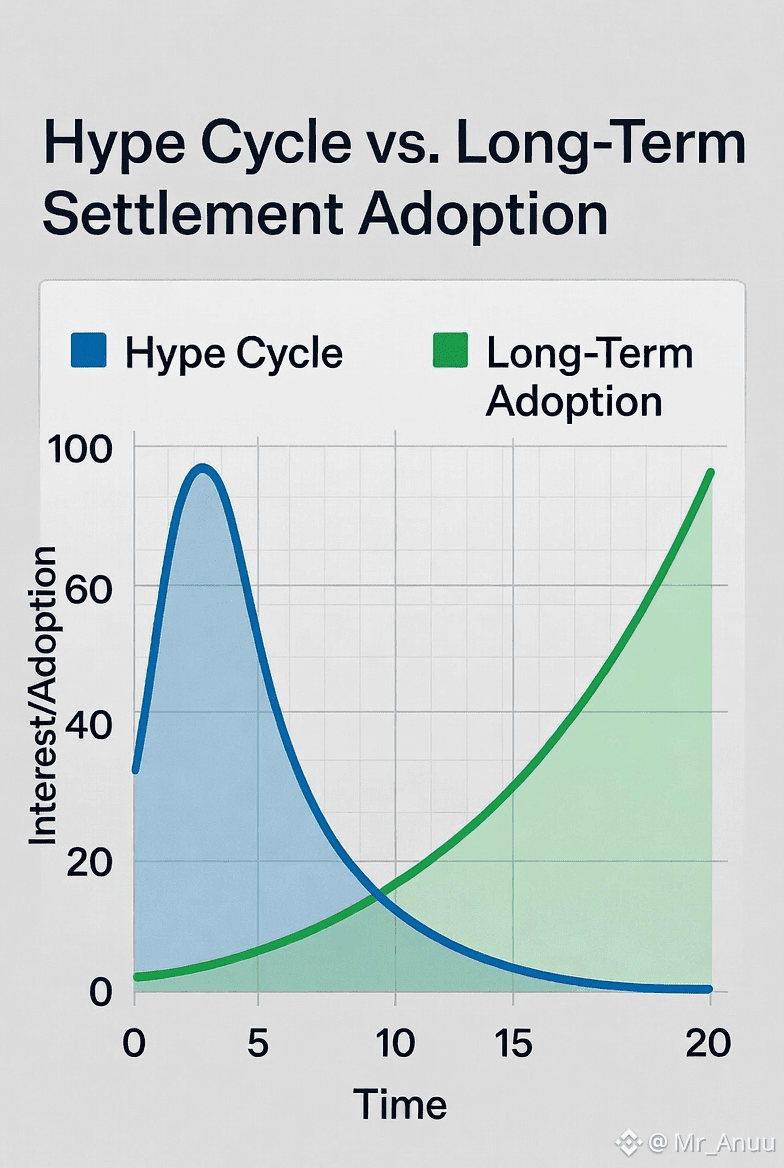

The Real Bet: Settlement Wins Before Apps Do

History shows that infrastructure captures value before interfaces. TCP/IP mattered before browsers. SWIFT mattered before fintech apps. Plasma positions itself at this layer — where usage compounds quietly and defensively.Speculation fades. Settlement remains.

Final Thought: Plasma Is Built for the World That Already Exists

Plasma does not promise a utopia. It serves the current financial reality: stablecoins moving daily, globally, under regulation and pressure. That realism is why Plasma feels less exciting — and more inevitable.Chains that chase attention burn fast.Chains that move money correctly endure.