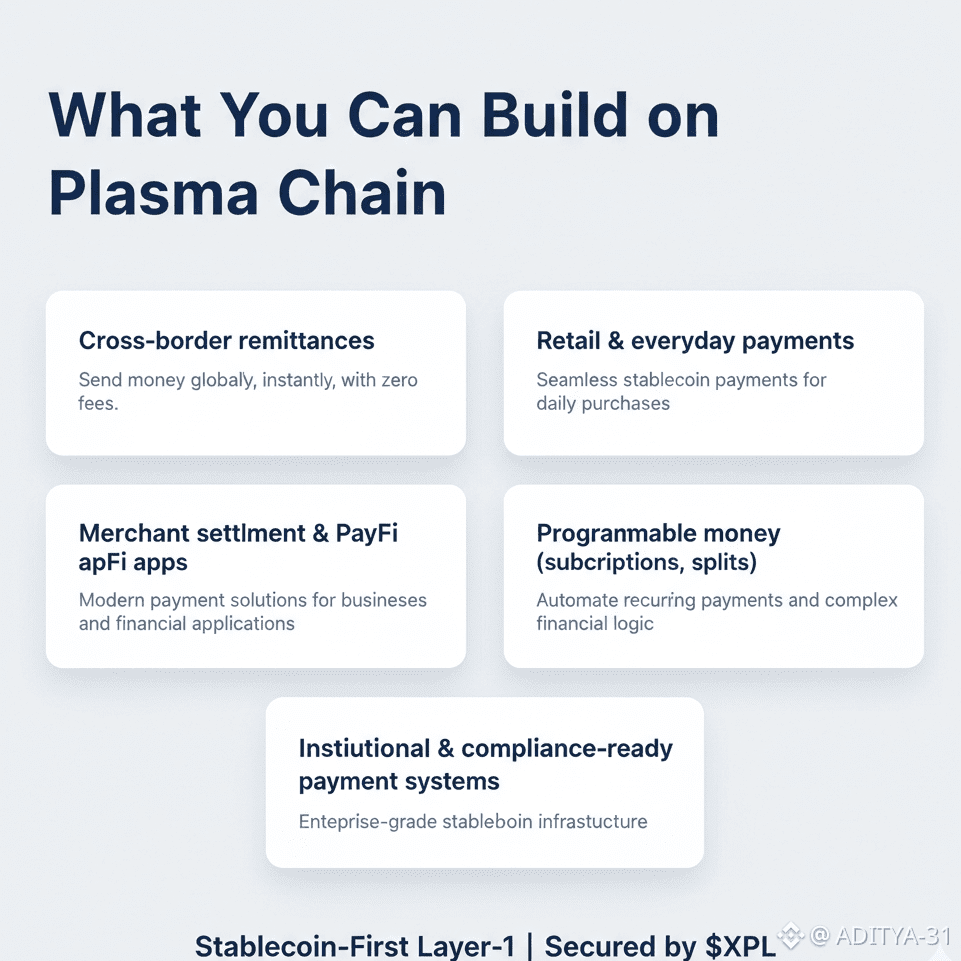

Plasma Chain ka primary design stablecoin payments aur global money transfer ke use cases ke liye hi hua hai — iske architecture, contracts, aur tooling sab isi direction me optimized hain. Yeh alag hai kyunki stablecoins yahan side project nahi, balki protocol-level use case hain, jisse developers real payment flows aur financial applications build kar sakte hain.

Stablecoin-Optimized Financial Rails

Plasma ek aisi blockchain hai jahan stablecoins ko “first-class” assets ke roop me treat kiya gaya hai, na ki general tokens ke category me. Is setup se simple remittances se leke merchant payments tak sab ka cost aur friction kam ho jata hai. Iska ek example hai zero-fee USDT transfers, jahan users ko native token rakhne ki zaroorat nahi padti sirf gas pay karne ke liye, aur transfers cheap aur fast hote hain.

Cross-Border Payments & Remittances

Plasma ka physical world impact tab sabse clear dikhta hai jab value ko borders ke paar bhejna ho. Stablecoin rails ko optimize karne se low-cost, fast, cross-border remittances possible hote hain — yeh un markets me khaaskar useful hai jahan traditional payment fees kaafi high hoti hain.

Retail & Everyday Payments

Stablecoins sirf big business ke liye nahi hain; Plasma me built apps everyday transactions bhi support kar sakte hain — coffee se lekar online purchases tak. Jaise hi wallet integrations aur pay-on-chain experiences develop hoti hain, everyday stablecoin use cases practical ho rahe hain.

Merchant Settlement & PayFi Apps

Businesses jo crypto accept karna chahte hain, Plasma unke liye settlement rails provide karta hai jahan funds sub-second me final hote hain aur cost predictable rehti hai. Yeh point-of-sale systems aur financial software ke liye attractive infrastructure banata hai.

Programmable Money & PayFi Tools

Plasma ke stablecoin-native contracts aur EVM compatibility se developers existing Ethereum tools se hi payment logic sirf simple transfers tak nahi, balki complex programmable money logic tak le ja sakte hain — jaise conditional payments, split settlements, subscription billing, aur more.

Integration With Liquidity and Data Systems

Stablecoin infrastructure tabhi useful hota hai jab liquidity deep aur connected ho. Plasma me partners jaise Aave aur Chainlink integrate ho chuke hain, jisse deep stablecoin liquidity aur market data feeds available hotey hain — yeh cross-chain financial apps, yield products, aur settlement systems ke liye foundation provide karta hai.

Institutional & Compliance-Ready Use Cases

Elliptic jaise compliance providers ke saath partnerships se Plasma ke rails over time regulated workflows aur institutional-grade payment tools ko bhi support kar sakte hain, yeh ensure karte hue ki compliant stablecoin flows large scale pe run ho sakey.

Summary: Plasma Chain ka use case stack broadly payments aur financial rails par centered hai — from stablecoin remittances and merchant settlement to programmable PayFi apps and compliant institutional systems. Yeh ek dedicated network hai jo stablecoin flows ko secure, scalable, and developer-friendly infrastructure par shift karta hai, without forcing users to navigate general-purpose chains that weren’t built for this task.