Liquidity is one of those words that gets used so often in crypto that it starts to lose meaning. Every chain claims it. Every protocol points to charts. Every launch promises deeper pools. Yet when you strip the noise away, liquidity is not something you add later. It is not a layer you bolt on once products exist. Liquidity is the condition that determines whether financial products work at all.

This is why the recent shift around @Plasma is important in a way that goes beyond raw metrics.

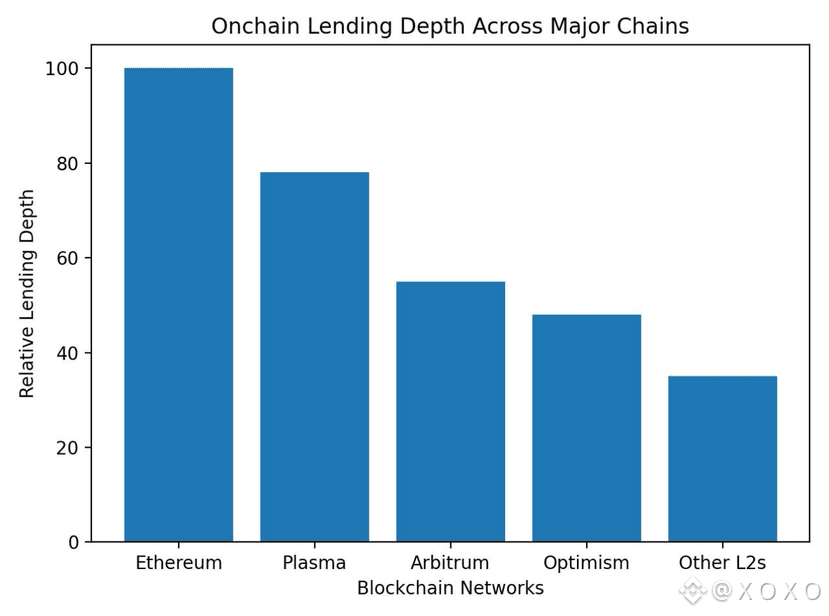

What Plasma has built is not simply another active DeFi environment. It has quietly become one of the largest onchain lending venues in the world, second only to the very largest incumbents. That fact alone would already be notable. However, what makes it more meaningful is how this liquidity is structured and why it exists.

Most chains grow liquidity backwards. Incentives attract deposits first, and then teams hope applications will follow. The result is often idle capital, fragmented across protocols, waiting for yield rather than being used productively. Plasma’s growth looks different. Its lending markets did not grow in isolation. They grew alongside usage.

The backbone of this system is lending, and lending is where financial seriousness shows up fastest. People can deposit capital anywhere. Borrowing is different. Borrowing means conviction. It means someone believes the environment is stable enough to take risk, predictable enough to manage positions, and liquid enough to exit when needed.

That is why lending depth matters more than TVL alone.

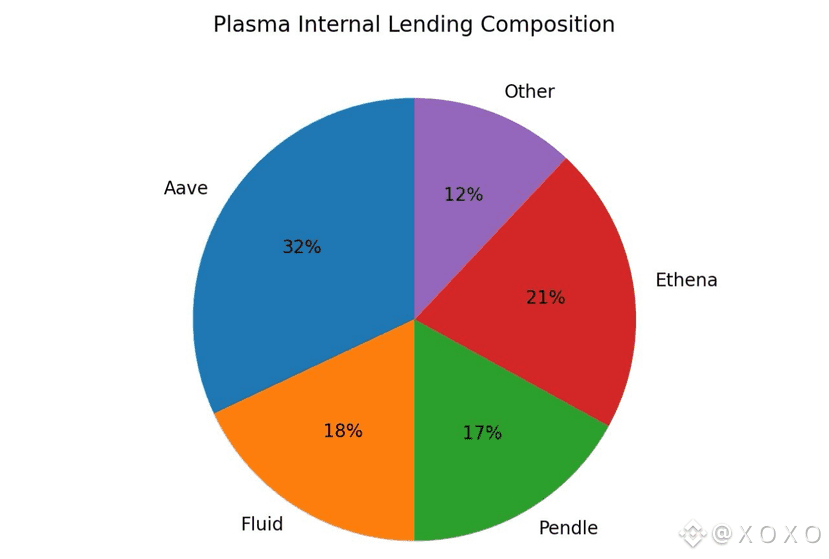

On Plasma, lending did not just become large. It became dominant across the ecosystem. Protocols like Aave, Fluid, Pendle, and Ethena did not merely deploy. They became core infrastructure. Liquidity consolidated instead of scattering. That concentration is a sign of trust, not speculation.

The most telling signal is stablecoin behavior. Plasma now shows one of the highest ratios of stablecoins supplied and borrowed across major lending venues. This is not a passive statistic. Stablecoins are not held for ideology. They are held for movement. When stablecoins are both supplied and borrowed at scale, it means capital is circulating, not sitting.

Even more important is where that stablecoin liquidity sits. Plasma hosts the largest onchain liquidity pool for syrupUSDT, crossing the two hundred million dollar mark. That kind of pool does not form because of marketing. It forms because traders, funds, and applications need depth. They need to move size without slippage. They need confidence that liquidity will still be there tomorrow.

This is where Plasma’s design choices begin to matter.

Plasma did not try to be everything. It positioned itself around stablecoin settlement and lending primitives. That focus shaped the type of users it attracted. Instead of chasing novelty, Plasma optimized for throughput, capital efficiency, and predictable execution. The result is a chain where lending does not feel fragile.

A lending market becomes fragile when liquidity is shallow or temporary. Borrowers hesitate. Rates spike. Liquidations cascade. None of that encourages real financial usage. Plasma’s lending markets have shown the opposite behavior. Liquidity stayed deep as usage increased. That balance is hard to engineer and even harder to fake.

What Kairos Research highlighted is not just size, but structure. Plasma ranks as the second largest chain by TVL across top protocols, yet its lending metrics punch above its weight. That tells us something important. Plasma is not just storing value. It is actively intermediating it.

Financial products do not live in isolation. Lending enables leverage, hedging, liquidity provision, and treasury management. When lending markets are deep, developers can build with confidence. They know users can borrow. They know positions can scale. They know exits are possible.

This is why Plasma’s message to builders is not empty. If you are building stablecoin-based financial primitives, you do not need promises. You need liquidity that already exists. You need lending markets that already work. Plasma now offers that foundation.

This is why Plasma’s message to builders is not empty. If you are building stablecoin-based financial primitives, you do not need promises. You need liquidity that already exists. You need lending markets that already work. Plasma now offers that foundation.

The difference between a chain that has liquidity and a chain that is liquidity is subtle but critical. Plasma is moving toward the latter. Its lending layer is no longer an accessory. It is the backbone.

My take is that Plasma’s rise is less about speed or novelty and more about discipline. It focused on one of the hardest problems in DeFi and solved it quietly. Liquidity followed because it had somewhere useful to go. That is how real financial systems grow. Not loudly, but structurally.