I recently had an experience that highlighted just how outdated financial settlement still is. A dividend I was expecting to hit my account arrived three days late. In 2024, with instantaneous information and digital systems, this felt absurd. Trades and financial movements happen in milliseconds, yet the actual flow of capital remains tied to a system built decades ago. The T+2 settlement cycle, where trades or dividends settle two business days after the economic event, was once reasonable. Today, it feels like a relic, adding friction, unnecessary risk, and cost to markets that should be far more efficient.

Blockchain technology promised a solution, but most implementations focused on speculation, trading, and tokenized value. Real-world financial operations, like compliance, corporate actions, and settlement, were largely ignored. That is why networks like Dusk are so significant. Dusk approaches the problem differently, not as a layer for token trading, but as a programmable financial infrastructure that can automate complex operations like dividend distributions while preserving privacy.

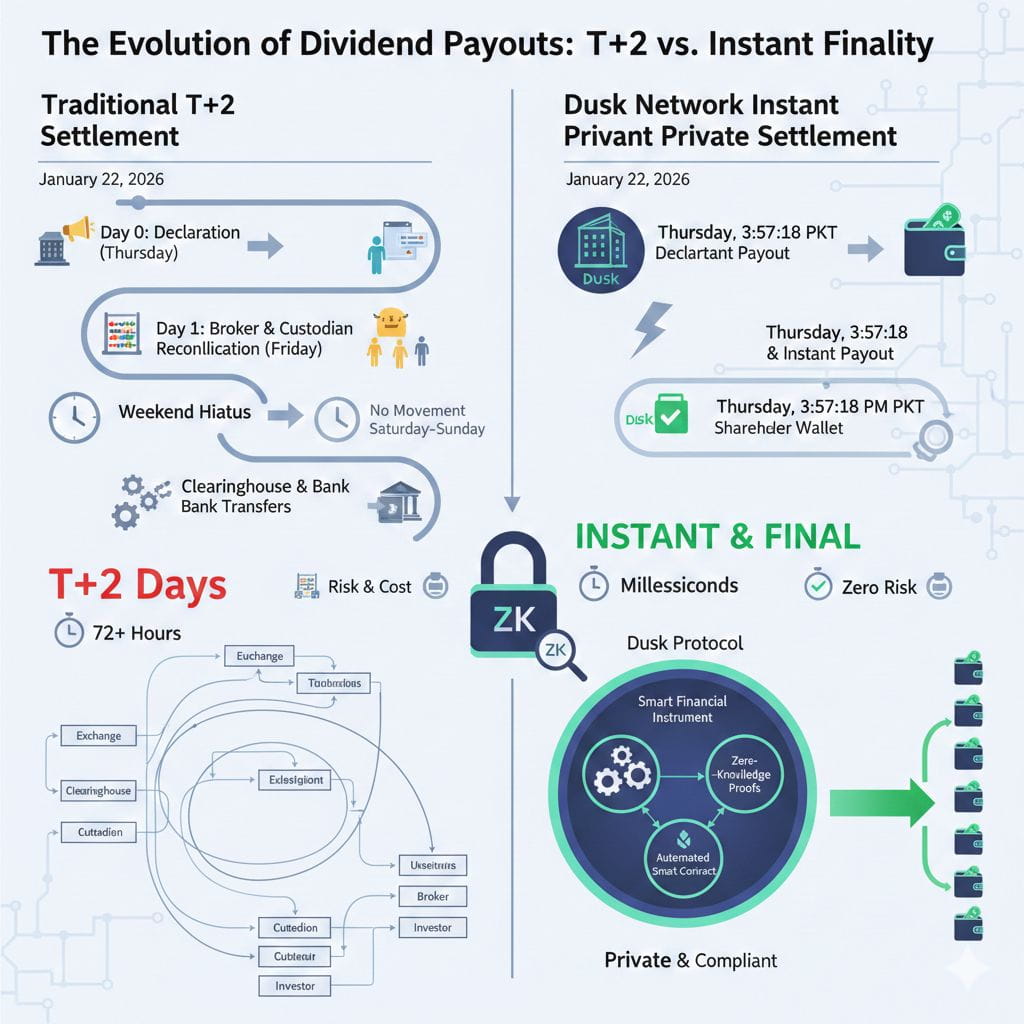

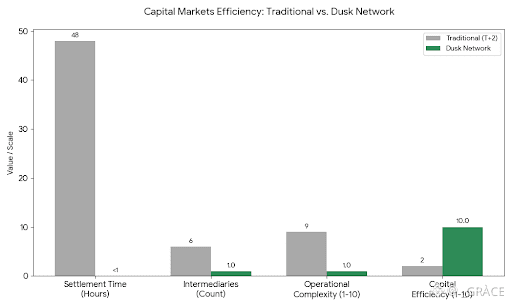

In traditional markets, settlement is layered and slow. A trade executes on an exchange, passes through clearinghouses, custodians, and settlement systems, and only then do funds or securities reach their rightful owners. Each intermediary adds delay, cost, and operational complexity. Dusk reimagines this entire process. On Dusk, ownership and transfer logic coexist in a single protocol, and financial actions, such as distributing dividends, are executed automatically and instantly. The network enforces rules directly, removing the need for multiple reconciliation steps and middlemen. Settlement is no longer separate from ownership; it happens simultaneously.

One of the most striking aspects of Dusk is its ability to combine privacy with speed. Traditional thinking often assumes that protecting financial confidentiality inevitably slows processes. On Dusk, advanced cryptographic techniques, including zero-knowledge proofs, ensure that transactions and corporate actions are validated correctly without exposing sensitive shareholder information. Regulators and auditors can confirm correctness, while individual holdings remain private. This balance of confidentiality and real-time execution addresses one of the biggest limitations of legacy financial systems.

Consider a company issuing shares on Dusk. These are not simple tokens; they are smart financial instruments with embedded compliance, transfer restrictions, and dividend entitlements. When a dividend is declared, the network executes the distribution automatically. Eligible shareholders receive their payment instantly, in compliance with regulatory requirements. There are no reconciliation layers, no T+2 delays, and no intermediaries. Each transaction is final, verifiable, and private. Dusk turns what used to be a slow, error-prone process into a precise, high-efficiency operation.

The implications extend beyond dividends. Corporate actions like stock splits, rights offerings, mergers, and spin-offs traditionally require coordination across multiple systems, each introducing delays and potential errors. On Dusk, these actions can be encoded directly into the protocol. When the conditions for a corporate action are met, Dusk adjusts holdings automatically, without manual intervention. This deterministic execution reduces operational risk, accelerates liquidity, and ensures consistency across participants.

From an economic perspective, the advantages are profound. Financial institutions spend enormous resources on reconciliation, exception handling, and back-office operations. These functions, while essential in legacy systems, are mostly overhead. On Dusk, many of these roles either evolve into strategic oversight or become unnecessary entirely. Custody shifts from record-keeping to stewardship, brokers focus on client engagement rather than instruction routing, and regulators monitor cryptographic proofs instead of auditing spreadsheets. By embedding the rules of finance directly into the network, Dusk streamlines operations and removes unnecessary friction.

Skeptics may point out that regulators will resist blockchain-based settlement. That is a valid concern, but Dusk is designed with compliance as a first-class feature. Tax obligations, residency rules, and shareholder restrictions are enforced by the protocol itself. This is not about bypassing regulations; it is about integrating them into the system so that compliance is automatic, verifiable, and consistent. Networks like Dusk demonstrate that privacy, speed, and regulatory adherence can coexist in a single architecture.

The real benefit becomes clear when considering risk and capital efficiency. Traditional T+2 settlement leaves funds and securities in limbo for days, creating counterparty risk and fragmented liquidity. With Dusk, settlement is deterministic and instantaneous. Capital becomes available immediately, allowing firms and investors to deploy resources faster and respond to market conditions in real time. Ownership and economic entitlement are inseparable, eliminating the delays that have historically slowed financial markets.

Experiencing frictionless settlement changes expectations. Once you see payments and corporate actions executed instantly and privately, delays feel unacceptable. Dusk sets a new baseline for efficiency. While other industries have long embraced real-time systems for communication, logistics, and media, financial markets have remained tethered to outdated processes. Networks like Dusk prove that settlement doesn’t need to lag behind information, it can match or even exceed the speed of decision-making.

The architecture of Dusk also makes large-scale automation possible. Consider the sheer volume of corporate actions, dividend payments, and cross-border settlements handled daily in global markets. Traditional systems require enormous staff and coordination to manage this flow. By encoding these operations into the protocol, Dusk reduces errors, minimizes human intervention, and ensures consistency across participants. The network acts as both ledger and executor, merging recording, calculation, and distribution into a single step.

Furthermore, privacy-preserving automation unlocks opportunities for complex financial products that would otherwise be too risky or costly to administer. Shareholders retain confidentiality, but the network still enforces compliance, tracks entitlements, and finalizes payments instantly. Operations that once required multiple layers of approval and validation are reduced to automated, auditable events. For firms and investors, this is a paradigm shift. Dusk demonstrates that efficiency, privacy, and regulatory compliance are not competing priorities they can coexist within the same system.

The broader impact on financial culture is significant. Market participants accustomed to delays, manual reconciliation, and operational friction will quickly recognize the advantages of instantaneous settlement. Legacy systems will appear cumbersome, expensive, and slow. New expectations will emerge, and efficiency will become the standard rather than the exception. Networks like Dusk show that settlement can be fully integrated, automated, and precise.

The promise of Dusk and similar networks is not theoretical. Pilot implementations have demonstrated the feasibility of real-time, privacy-preserving settlement. By combining advanced cryptography, automated compliance, and programmable financial instruments, Dusk redefines what capital markets can achieve. Delays, manual processing, and reconciliation efforts are no longer inevitable. Financial infrastructure can evolve into a system that is as fast, reliable, and precise as the information it is based on.

Ultimately, the transition toward networks like Dusk is about more than speed. It’s about redefining how financial obligations are managed and executed. Capital can flow instantly, compliance is enforced automatically, and operational risk is minimized. Markets become more resilient, cost-efficient, and capable of supporting complex financial instruments without manual intervention. The era of high-precision, automated, and privacy-preserving settlement is here, and it delivers on the original promise of blockchain: a financial system built for the speed and complexity of the modern world.