You all know I’ve been watching this project closely for years now, and I want to take a minute to talk about where Dusk Network is at right now because what’s happening with this ecosystem is something special. Dusk has always been one of those cryptos that sits under the radar for many people, but with the way things are unfolding in 2026, this isn’t some obscure altcoin anymore. This is a project carving out a genuinely unique niche at the intersection of privacy, compliance, and real-world finance.

Let me break down everything that’s going on, what it means for the network, and why folks in our community are starting to pay attention.

Mainnet: From Theory to Reality

Late 2025 and early 2026 were huge for Dusk. After nearly six years of steady development, the Dusk Network finally activated its mainnet. That’s a big milestone, not just for the team but for the entire blockchain space. This wasn’t another testnet launch with limited functionality. This was the moment Dusk went from being a promising concept to a fully operational blockchain capable of handling real-world use cases.

With the mainnet live, Dusk now supports privacy-preserving smart contracts and protocols that aim to bring traditional financial instruments onchain while still respecting regulatory requirements. This matters because it shifts Dusk from just being “a privacy blockchain” to something far more applicable in real economic activity.

Privacy That Works With Regulators

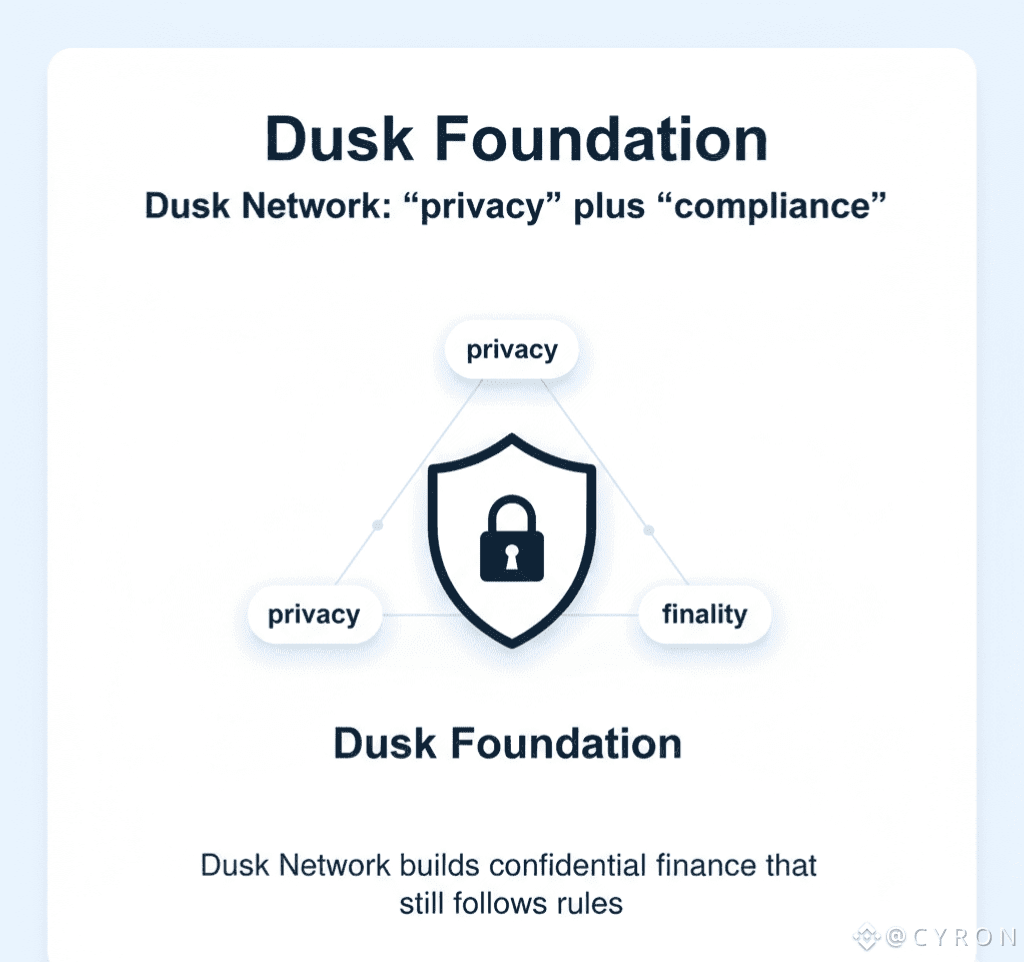

What sets Dusk apart from a lot of other privacy-focused cryptos is the way it balances confidentiality with regulatory compliance. We’ve all seen coins like Monero or Dash get flak because regulators see them as too opaque. Dusk tackles that tension head-on by building privacy directly into the protocol in a way that still allows for auditable transactions when they need to be reviewed by licensed institutions or authorities.

This makes the network appealing not just to privacy purists but to actual financial institutions that want confidentiality without running afoul of regulators. That positioning is rare, and that’s why institutional players are starting to take notice.

Cross-Chain Bridges and Interoperability

One of the most exciting technical leaps for Dusk has been its interoperability advancements. The team has been rolling out cross-chain bridges that allow assets to move between Dusk and other major networks like Ethereum and EVM-compatible chains. That’s huge because it dramatically expands the use cases for DUSK beyond just its own blockchain.

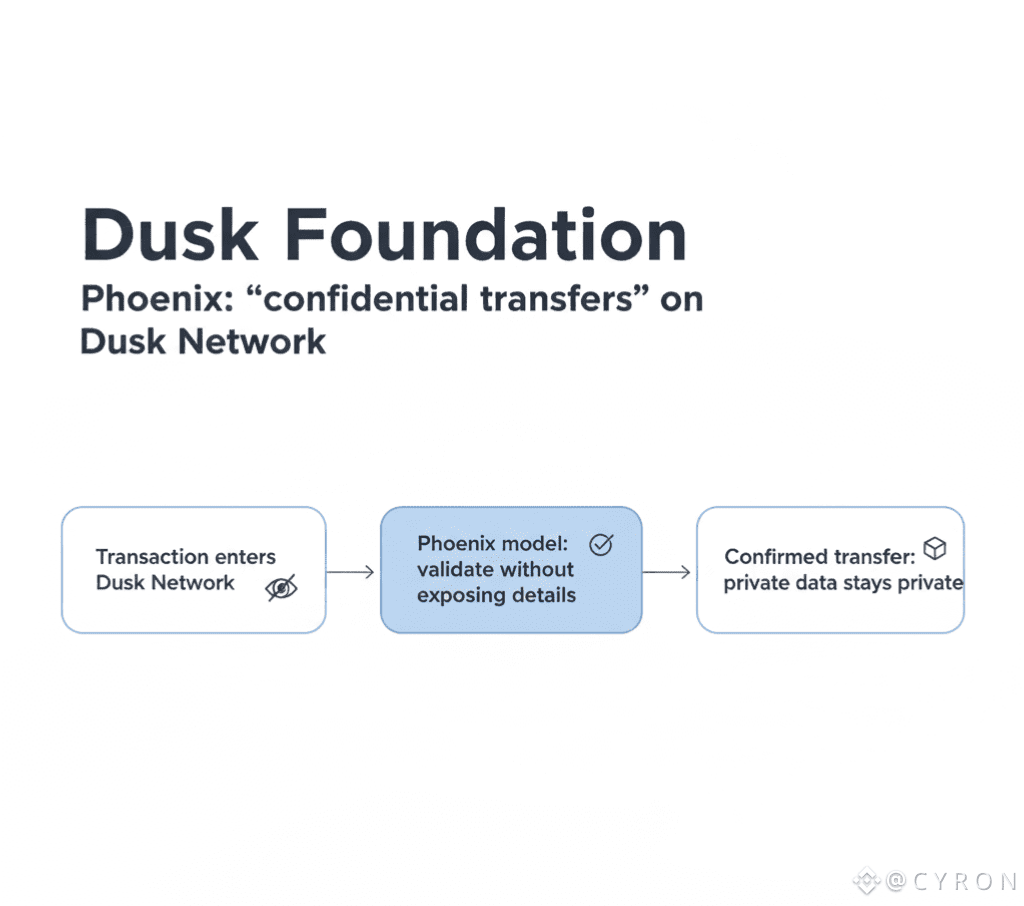

And importantly, these bridges aren’t just about moving tokens around. They use zero-knowledge proofs to preserve privacy and compliance during transfers. So you get the best of both worlds: seamless cross-chain liquidity and privacy that still plays nice with regulatory frameworks.

Developers building on other chains can bring their assets into the Dusk ecosystem without giving up control of private data or exposing sensitive onchain activity. That interoperability is a massive part of the long-term play here.

Real-World Assets Going Onchain

One of my favorite things to talk about when it comes to Dusk is how it’s tackling real-world asset tokenization. We’ve been hearing about tokenized stocks, bonds, and debt for years, but until now most of that talk has lived in whitepapers and hype cycles. Dusk is doing it for real.

Licensed financial institutions are using the network to tokenize hundreds of millions of euros in regulated securities. This is not a small pilot program. This is actual, regulated financial instruments moving onto a public blockchain, with all of the compliance checks you’d expect from a European regulatory environment.

That capability – to tokenize and trade real securities onchain – is groundbreaking. It opens up a path for traditional investors to engage with blockchain technology in a way that doesn’t feel like a leap of faith. Instead of asking financial institutions to change how they think, Dusk is giving them infrastructure that integrates with the systems they already use.

The Rise of DuskEVM

Another big piece of the puzzle that’s been rolling out is DuskEVM, the Ethereum Virtual Machine-compatible execution layer for the Dusk Network. If you’ve spent time in Ethereum or other EVM ecosystems, you know just how much developer tooling and network effects matter.

With DuskEVM, developers can deploy Solidity smart contracts just like they do on Ethereum, but now with privacy features and compliance tooling baked in. That bridges a huge gap between existing smart contract developers and the privacy-first world that Dusk is building. It’s like giving builders the best of both worlds.

This move also dramatically lowers the barrier to entry for project teams who want to build on Dusk without learning a completely new programming language or ecosystem from scratch.

Infrastructure and Developer Momentum

I’m the kind of person who watches development activity closely, and Dusk has been shipping updates at a steady clip. The project runs a release cycle that pushes new improvements roughly every three weeks, and over the past few cycles we’ve seen significant upgrades in everything from contract size limits to consensus enhancements and developer tooling.

Having a predictable cadence of releases shows that there’s an active team and community behind this project. It also means that innovations aren’t one-off or hype driven. They’re deliberate and iterative, and that’s the kind of technical maturity that helps projects survive market ups and downs.

Ecosystem Expansion: dApps and Tools

The ecosystem around Dusk is growing, and that’s another reason this project feels different today than it did even six months ago. We’re seeing real dApps launch on the network that bring tangible utility to DUSK holders and users.

There’s a cross-chain NFT marketplace where assets can be listed and traded without middlemen. There’s a self-sovereign identity platform that gives users control over their own data. And there’s a staking dashboard that lets holders see real-time analytics about their positions and earnings.

These might seem like small pieces on their own, but when combined they create a more complete ecosystem that’s not just about speculation or holding tokens. It’s about use cases and everyday utility.

Market Interest and Price Momentum

Let’s talk about the market for a second, because you’ve probably seen the price moves and wondered what’s driving them. DUSK has experienced notable rallies this year, including one explosive move where the token surged over forty percent in a single session and has put up some very strong gains relative to other privacy coins.

This isn’t just noise. Traders and investors are rotating into DUSK because they recognize something is happening beneath the surface. People are starting to see that this project is not just another meme or copycat privacy token. It’s carving out infrastructure that’s actually useful in regulated finance.

And as more real-world activity gets tokenized and moved onto the network, that’s the kind of fundamental growth that markets eventually pay attention to.

Listings, Liquidity, and Exchange Presence

Part of what has made that market interest possible is that DUSK now has much broader exchange coverage than it did in the past. It’s getting listed on major platforms that bring exposure to new traders and liquidity pools that help ensure smoother trading.

This isn’t a fringe token stuck on a handful of obscure exchanges anymore. It’s being made available across several venues globally, including platforms that open doors to markets in North America and beyond.

In practical terms, that means deeper liquidity, smaller spreads, and access to a broader audience of builders, traders, and institutions.

Looking Ahead: What’s Next for Dusk

Okay so where does this go from here? If 2025 was about getting the mainnet live and proving the technology was real, and if early 2026 was about rolling out the first wave of privacy-compliant financial infrastructure, then the next phase for Dusk is about adoption.

We’re going to see more real-world assets tokenized onchain. We’re going to see more developers build privacy-enabled dApps on DuskEVM. And we’re going to see institutions start to experiment with blockchain infrastructure that they actually understand and trust.

At the same time, the broader market may continue to reinterpret whether privacy technology and regulatory compliance are at odds, or whether they can coexist. Dusk is betting on coexistence, and so far it’s proving that thesis in ways that most people didn’t expect.

Final Thoughts

What’s happening with Dusk right now feels like watching the early days of something that might be much bigger than we all realize. Forget the old notion of privacy coins as just anonymous transaction tools. Dusk is building infrastructure for finance, with privacy as a feature, not a bug.

This project is bridging gaps between TradFi and DeFi in ways that most other chains only talk about in theory. And the best part is that it’s doing it with working technology, real integrations with regulated entities, and a growing ecosystem that’s producing tangible use cases.

If you’re not paying attention to DUSK yet, now is the moment to at least understand why people are talking about it. Because whether this ends up being a giant sleeper success or just a very interesting experiment, it’s already delivering some of the most innovative work in crypto today.