Most blockchains try to be everything at once general-purpose platforms designed to handle any use case imaginable.The result is often inefficiency, especially when it comes to payments.

Stablecoins don’t need maximal flexibility.They need speed, predictability, low cost, and reliability.

That’s why Plasma stands out to me. It isn’t trying to compete with every Layer-1 narrative. Instead, it’s engineered specifically for stablecoin infrastructure, and that design choice shapes every technical decision beneath the surface.

In this article, I want to share my perspective on Plasma’s architecture and why its focused approach could matter long term for global payment systems.

Purpose Before Generality:

After spending years exploring blockchain infrastructure, one pattern keeps repeating chains that chase every possible use case usually struggle to excel at any single one.

Plasma takes the opposite route.

Rather than optimizing for NFTs, gaming, DAOs, and DeFi all at once, it prioritizes stablecoin efficiency payments, settlements, and value transfer at scale. This focus immediately simplifies trade-offs and allows the protocol to optimize where it matters most.

That philosophy alone makes Plasma worth studying.

PlasmaBFT: Consensus Optimized for Payments

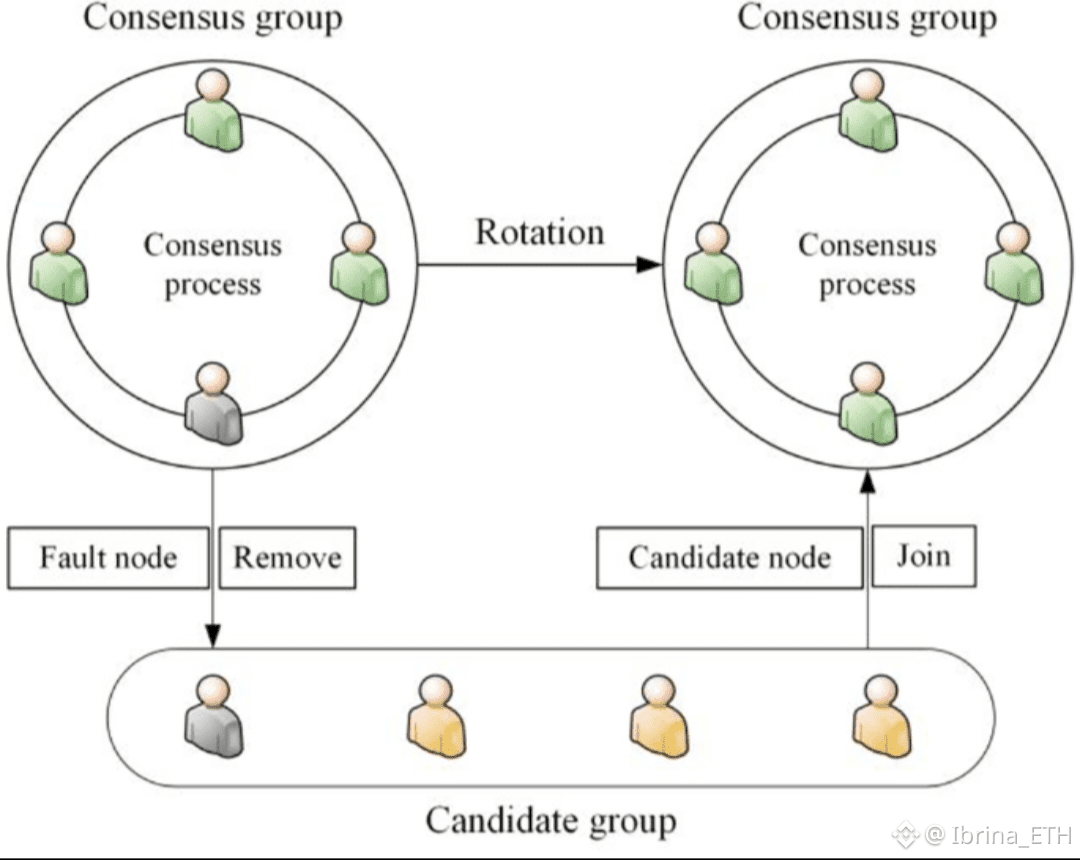

At the heart of Plasma design is PlasmaBFT, a consensus mechanism derived from Fast HotStuff.

HotStuff itself builds on proven Byzantine Fault Tolerant models like PBFT, but PlasmaBFT refines the approach for high-throughput, payment-heavy environments.

Instead of optimizing for complex computation, PlasmaBFT emphasizes:

Fast finality

Predictable confirmation times

Efficient validator coordination

Block times are designed to remain consistently low, even under load. For stablecoin payments, this matters more than theoretical decentralization metrics. A payment network that pauses or slows during congestion quickly loses trust.

From an educational standpoint, PlasmaBFT highlights an important lesson in blockchain design: consensus mechanisms should reflect the problem they are solving.

EVM Compatibility Without the Usual Friction:

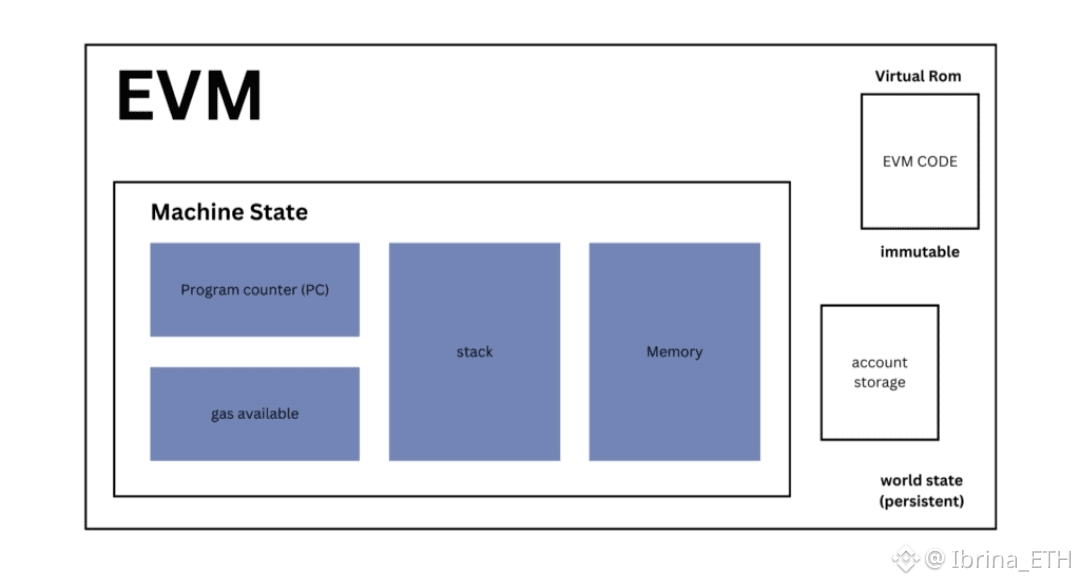

One of Plasma’s strongest design decisions is full EVM compatibility.

Developers can deploy existing Ethereum smart contracts using familiar tools like Hardhat or Foundry, without rewriting code or learning a new execution environment. Plasma achieves this through a modified Reth execution layer, maintaining compatibility while optimizing performance.

Where this becomes especially interesting for stablecoins is gas economics.

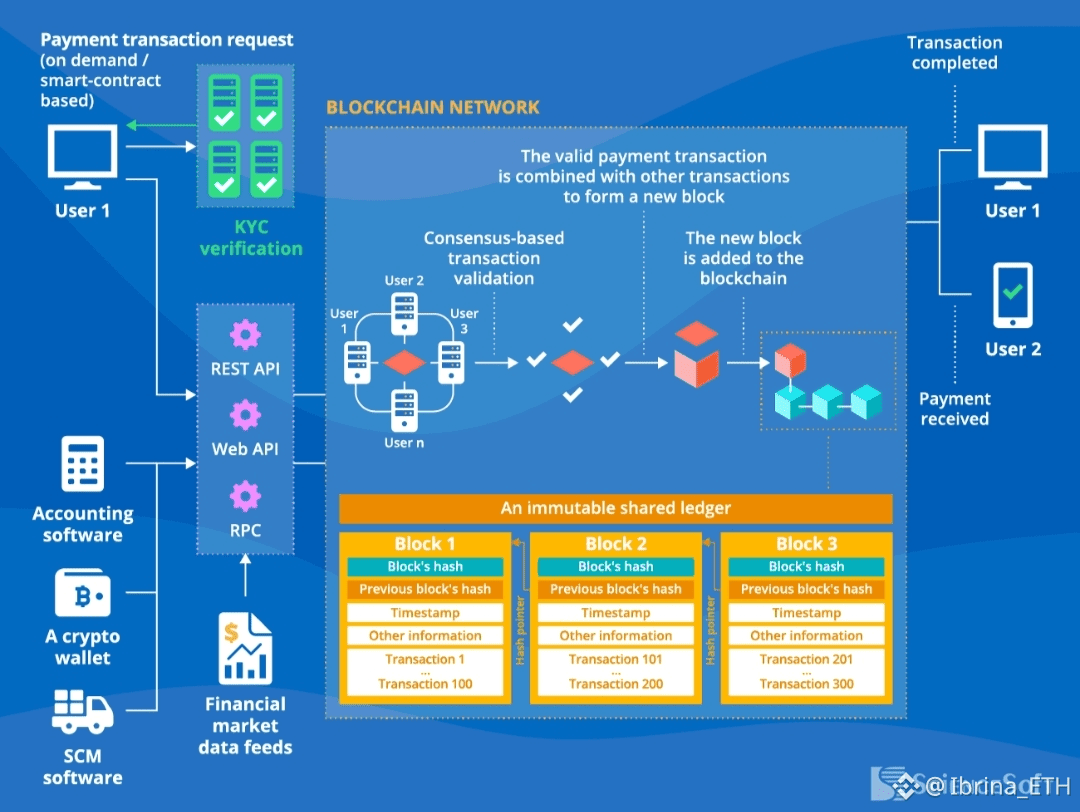

Plasma supports custom gas tokens, allowing transaction fees to be paid in whitelisted assets such as USD₮. In some cases, protocol-level paymasters can sponsor gas entirely, enabling stablecoin transfers that feel effectively free to the end user.This removes a major friction point in crypto UX holding multiple assets just to transact.

Security and Privacy as Infrastructure, Not Features:

For any payment-focused chain, security isn’t optional it’s foundational.

Plasma integrates a native Bitcoin bridge designed for trust-minimized transfers. This opens the door to hybrid financial applications, such as using BTC as collateral within stablecoin systems, without relying on fragile third-party bridges.

Privacy is treated with similar care :

Confidential transactions obscure sensitive details like amounts or addresses while preserving verifiability and compliance. This mirrors real-world finance, where transactions are private by default but still auditable when required.Rather than treating privacy as a bolt-on feature, Plasma embeds it at the protocol level a choice that supports long-term adoption in regulated environments.

Performance That Reflects Its Mission

Plasma’s performance metrics reflect its narrow focus:

Thousands of transactions per second

Low, predictable fees

Stablecoin-native settlement flows

By supporting multiple stablecoins and high-volume transfers, the network avoids the congestion patterns that often plague general-purpose chains during peak usage.

The lesson here is simple but powerful:specialization enables scalability.Instead of scaling endlessly through upgrades, Plasma scales by design.

Why Plasma’s Long-Term Vision Matters?

What makes Plasma compelling to me isn’t any single technical feature it’s the coherence of the system.Every component reinforces the same goal to serve as durable infrastructure for stablecoins and digital payments.

As tokenized assets, regulated finance, and potentially CBDCs continue to emerge, networks that prioritize reliability over experimentation may quietly become the most important layers in the stack. Plasma feels built for that future.

Final Thoughts:

Plasma isn’t revolutionary because it invents entirely new concepts.It’s meaningful because it applies existing ideas with discipline and purpose.

By optimizing consensus, execution, fees, and privacy around stablecoins, Plasma demonstrates how focused blockchain design can create infrastructure that lasts. For developers, researchers, and anyone interested in the future of on-chain payments, Plasma is worth studying not as hype, but as a case study in sustainable blockchain architectur.

Do you think specialized chains like Plasma are necessary for stablecoins to scale globally, or will general-purpose blockchains eventually catch up?