For most of history, “hard money” meant one thing: metals you could hold in your hand.

Today, that idea has evolved.

Bitcoin, gold, and silver live in the same family of assets for a simple reason:

👉they don’t depend on anyone’s promise.

👉No CEO.

👉No dividends.

👉No government guarantee.

Their value doesn’t come from cash flows or quarterly reports.It comes from scarcity you can’t fake.

👉What they have in common

🔥No central issuer

🔥No government can print more gold.

🔥No corporation can dilute bitcoin.

🔥These assets answer to physics and math, not politicians.

🔥No counterparty risk

🔥Stocks and bonds are claims on someone else.

🔥Gold, silver, and bitcoin are bearer assets.

If you hold them, you own them with no permission required.

🔥Hard scarcity

🔥Gold and silver are limited by geology and energy.

🔥Bitcoin is limited by code.

That’s why all three have survived monetary debasement again and again.

🔥Global recognition

🔥They’re neutral money.

🔥They work whether you’re in New York, Lagos, or Buenos Aires.

🔥No passport required.

👉Where they differ (and why it matters)

🔥Portability

🔥Moving serious value in metal takes trucks, guards, and time.

🔥Bitcoin moves across the planet in minutes, sometimes seconds.

🔥Verification

🔥Metal needs assays and trust.

🔥Bitcoin verifies itself, instantly, on a public ledger anyone can check.

🔥Custody

🔥Gold needs vaults and insurance.

🔥Bitcoin can live on a hardware wallet in your pocket or fully self-custodied digitally.

🔥Premiums

🔥Physical metals usually cost more than spot.

🔥Bitcoin trades globally with tight spreads, 24/7.

Performance isn’t the whole story Yes, returns matter. But resilience matters more.

Each of these assets has played a role at different times, under different conditions. They don’t move together, and they don’t cancel each other out. That’s the key.

The false debate

Online, it’s framed like a fight:

You’re either a “gold bug” or a “bitcoiner.” That’s not investing, that’s tribalism. A sovereign investor doesn’t need to choose sides. They choose tools.

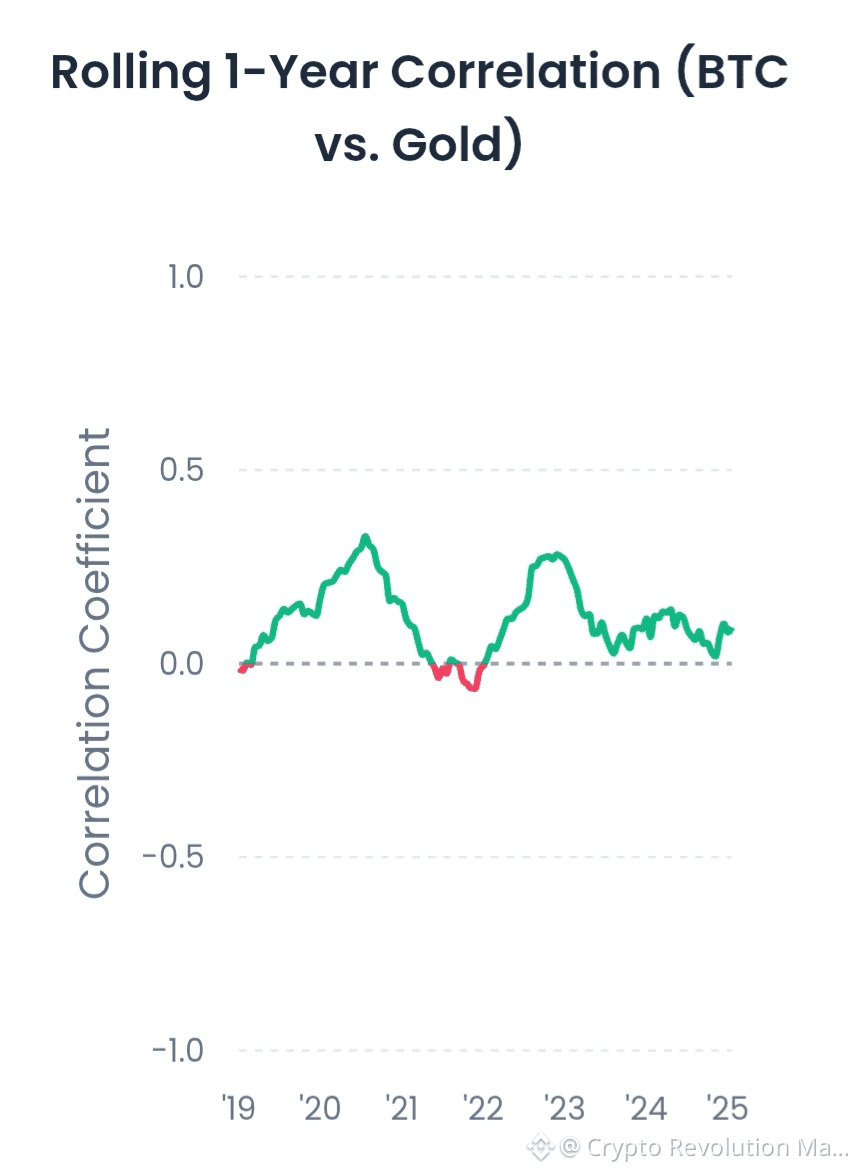

Bitcoin and precious metals have shown low correlation over time.

They respond differently to stress, policy mistakes, and market cycles. Holding both isn’t confusion. It’s clarity.

Final thought

This isn’t about replacing the old with the new. It’s about strengthening your foundation. Gold and silver represent thousands of years of monetary wisdom. Bitcoin represents a technological leap forward. Different forms. Same mission.Preserve purchasing power. Stay sovereign. Think long term.

👉The strongest portfolios aren’t built on beliefs, they’re built on conviction and balance.