era defined by rapid digitization of financial markets, the ability to combine privacy, regulatory compliance, and technological efficiency is no longer optional—it is essential. Dusk Foundation, established in 2018, has emerged as a leading Layer 1 blockchain designed specifically to meet these imperatives. Its unique architecture is built not only to facilitate decentralized innovation but also to integrate seamlessly with the needs of institutional finance, regulatory bodies, and tokenized real-world assets. This dual focus—innovation paired with institutional rigor—positions Dusk as a foundational platform for the future of digital finance.

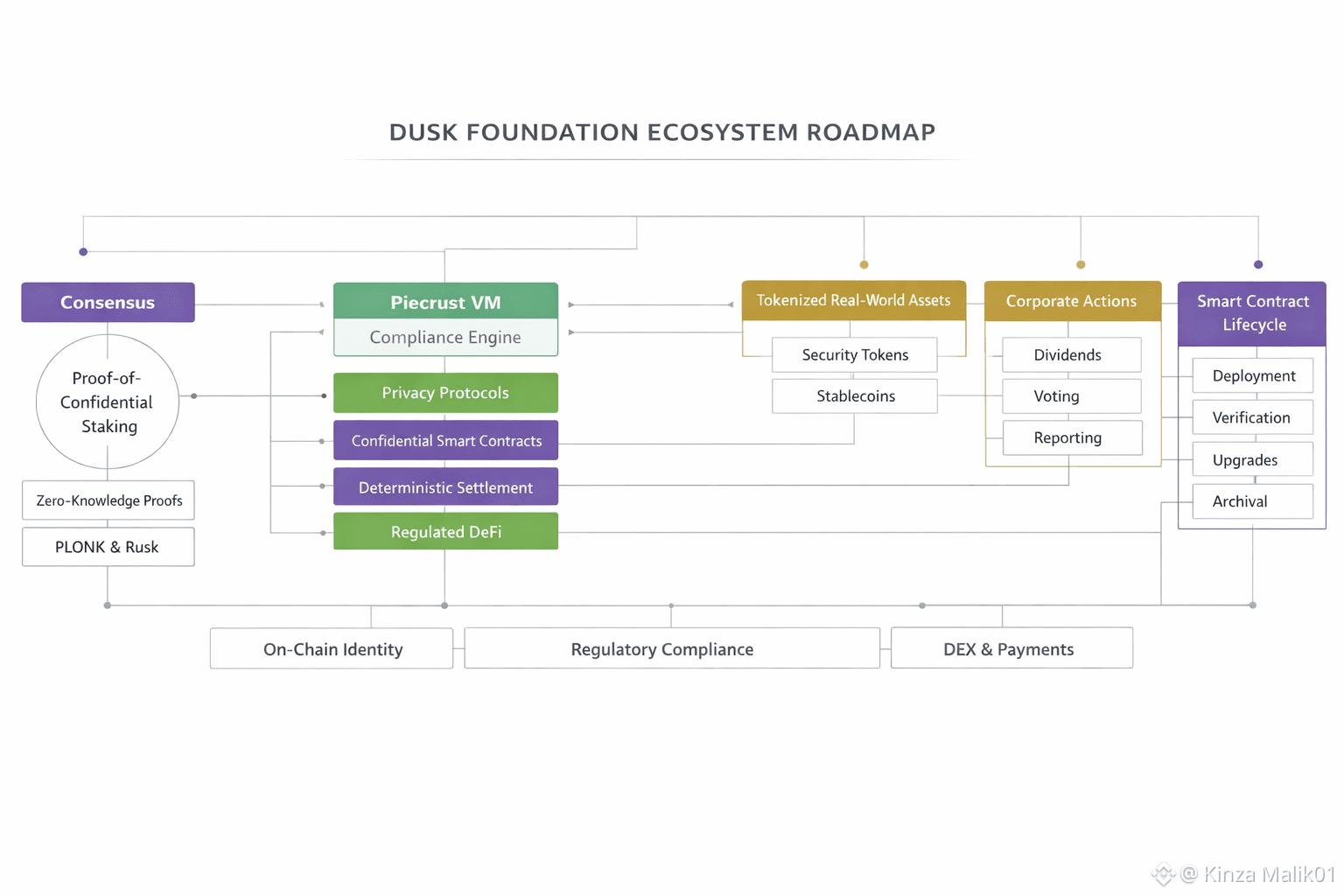

At the heart of Dusk’s value proposition lies its ability to embed compliance directly into the blockchain protocol. Unlike most smart contract platforms that treat regulatory adherence as an afterthought, Dusk’s Piecrust virtual machine allows regulatory logic to be compiled into financial instruments themselves. This approach fundamentally reduces operational risk by ensuring that transactions cannot violate predefined legal parameters. Investor eligibility, jurisdictional restrictions, and corporate actions can all be programmed into the system, making compliance a natural feature rather than a separate, fragile layer. For institutions, this translates into reduced legal uncertainty, lower operational costs, and a platform capable of scaling to meet enterprise-level requirements.

Privacy is equally integral to Dusk’s design. Financial institutions require confidentiality to protect proprietary strategies, trading positions, and investor data. Traditional public blockchains expose this information, creating significant risk for professional market participants. Dusk solves this challenge using zero-knowledge proofs, which allow transactions to be verified for correctness without revealing sensitive details. Regulators, auditors, or authorized participants can selectively access necessary information, enabling a controlled and auditable ecosystem. This balance between privacy and transparency ensures that Dusk can serve both the confidentiality demands of institutions and the accountability requirements of regulators—a combination rarely found in blockchain platforms.

The potential applications of Dusk’s technology are broad and compelling. By supporting tokenized equity and debt instruments, Dusk enables companies to issue shares, bonds, or structured products directly on-chain while maintaining compliance with local and international regulations. Funds and alternative investment products can operate with automated reporting and programmable compliance, dramatically reducing operational overhead. Regulated decentralized finance becomes feasible, unlocking liquidity for institutions without compromising legal or privacy standards. Furthermore, Dusk’s deterministic settlement ensures that trades conclude with finality, reducing systemic risk and supporting the integrity of the broader financial system.

Another distinguishing feature of Dusk is its holistic approach to real-world asset tokenization. Whereas many blockchain projects focus narrowly on creating tokens, Dusk emphasizes the entire asset lifecycle—from issuance to trading, settlement, corporate actions, and eventual redemption. By embedding compliance, privacy, and auditability throughout this lifecycle, Dusk creates an ecosystem where digital assets are not only technically transferable but legally and operationally enforceable. This end-to-end design makes the platform highly attractive to institutional participants, bridging the gap between legacy financial systems and modern, blockchain-based solutions.

Dusk’s focus on regulated infrastructure positions it uniquely in the competitive landscape. Unlike general-purpose Layer 1 networks that prioritize speculative trading or consumer-facing applications, Dusk targets the core requirements of financial markets. Its implicit competitors are not other blockchains but legacy infrastructure providers: clearinghouses, custodians, and settlement systems that remain costly, slow, and fragmented. By providing a public, decentralized, and cryptographically secure alternative, Dusk has the potential to redefine the foundations of institutional finance while maintaining compliance and privacy at scale.

Strategically, Dusk benefits from being an early entrant in the regulated blockchain space. Its founding in 2018 provided ample time to refine its architecture, develop the Piecrust VM, and test its privacy and compliance protocols. As regulatory frameworks for digital securities mature globally, the demand for infrastructure capable of reconciling blockchain innovation with legal certainty will only increase. Dusk is well-positioned to capture this opportunity, offering a platform that meets both technical and regulatory expectations, a combination that few competing solutions can match.

From an investment and operational perspective, the platform presents several compelling advantages. First, by reducing operational and compliance risk through embedded legal logic, Dusk lowers the costs and complexity of launching and managing digital financial products. Second, by providing selective privacy with auditability, it encourages institutional participation, which can dramatically increase liquidity and network utility. Third, the deterministic settlement model mitigates systemic risk, an important consideration for regulators and large-scale asset managers. Finally, the ecosystem-centric approach, which encompasses the full lifecycle of tokenized assets, ensures long-term relevance and adaptability as markets evolve.

Dusk also aligns closely with broader trends in global finance. Institutions are increasingly exploring tokenization, on-chain settlement, and digital securities, yet most existing blockchains fail to meet the regulatory and operational requirements necessary for large-scale adoption. Dusk addresses this gap directly, offering a platform that is simultaneously decentralized, secure, private, and compliant. This positions the foundation as a potential backbone for next-generation financial infrastructure, bridging traditional markets with blockchain-native innovations.

Moreover, Dusk demonstrates that regulation and innovation need not be adversaries. By integrating compliance into the protocol rather than treating it as a constraint, the platform shows that blockchain can enhance legal certainty and operational efficiency while preserving decentralization and transparency where needed. This alignment of technology with regulatory requirements creates a compelling value proposition for banks, asset managers, corporates, and regulators seeking to explore blockchain without compromising legal or operational standards.

Looking forward, the potential for Dusk to influence the financial ecosystem is significant. Its architecture supports scalable, secure, and compliant tokenized markets; it encourages institutional adoption; and it provides a pathway for integrating traditional and digital financial systems. As regulators clarify their frameworks and institutions become increasingly comfortable with blockchain-based settlement, platforms like Dusk are likely to play a central role in the evolution of global finance. Its early focus on privacy, compliance, and auditability ensures that it remains relevant not just for today’s market needs but for the emerging landscape of digital financial infrastructure.

In conclusion, Dusk Foundation represents a critical evolution in blockchain technology, bridging the gap between innovation and institutional requirements. By embedding compliance, privacy, and auditability directly into the protocol, Dusk provides a platform that is uniquely suited to serve regulated markets at scale. Its focus on the full asset lifecycle, combined with privacy-preserving mechanisms and deterministic settlement, positions it as a key enabler of the tokenized financial economy. For institutions, regulators, and innovators alike, Dusk offers not only a technological solution but a blueprint for building a more secure, efficient, and compliant financial ecosystem. In a landscape increasingly defined by the convergence of regulation and digital innovation, Dusk Foundation stands as a compelling and forward-looking cornerstone of the next generation of financial infrastructure