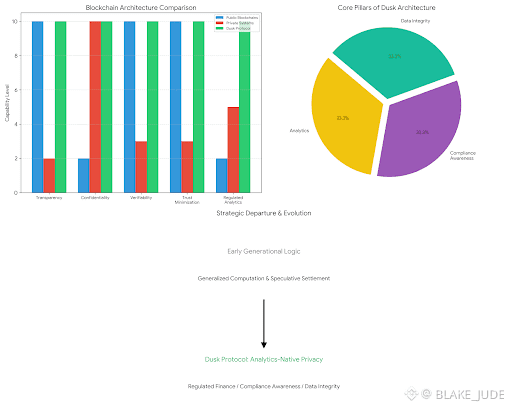

Dusk represents a deliberate departure from the early generational logic of public blockchains positioning itself not as a generalized computation network or speculative settlement layer but as a financial infrastructure protocol where analytics compliance awareness and data integrity are embedded directly into the ledgers architecture. Founded in 2018 Dusk was conceived during a period when blockchain adoption by institutions was repeatedly constrained by a fundamental contradiction public ledgers offered transparency but lacked confidentiality while private systems preserved privacy at the cost of verifiability and trust minimization. Dusks core proposition is that this dichotomy is not structural but architectural and that a protocol can be designed to support privacy preserving finance while still producing high fidelity auditable and analytics rich on chain data.

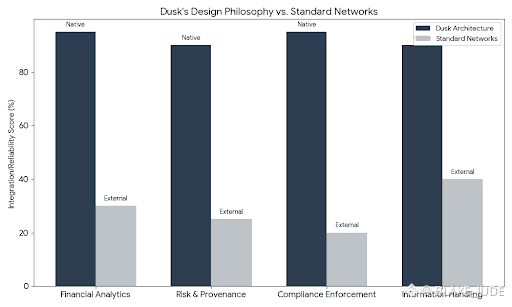

At the center of Dusks design philosophy is the idea that financial analytics should not be retrofitted through external data providers or off chain surveillance tools but should instead emerge natively from the protocol execution and consensus layers. Unlike Bitcoin where transparency is absolute but semantic meaning is largely absent or Ethereum where analytics depend heavily on interpretation of arbitrary smart contract state Dusk structures its ledger around explicitly financial objects such as confidential transactions regulated assets and permission aware market activity. This allows on chain data to be inherently contextual meaning that risk exposure asset provenance and transactional intent can be derived cryptographically rather than inferred probabilistically.

Dusks modular ledger architecture is critical to this outcome. By separating transaction privacy execution logic and settlement finality into distinct but interoperable layers the protocol ensures that sensitive financial data can remain shielded while still generating verifiable attestations that feed into network wide analytics. Zero knowledge proofs are not treated merely as a privacy tool but as an information compression mechanism enabling validators regulators and counterparties to confirm compliance constraints balance correctness and systemic integrity without accessing raw transactional details. This transforms analytics from a visibility problem into a verification problem aligning more closely with institutional risk models.

The importance of this approach becomes evident when viewed through the lens of regulated finance. Institutions do not require full transparency they require reliable answers to specific questions. Is an asset fully collateralized. Is a participant authorized. Are capital constraints respected. Is settlement final and legally enforceable. Dusks architecture is designed to answer these questions at the protocol level producing cryptographic guarantees that can be aggregated into real time risk metrics and compliance signals. This contrasts with most public networks where compliance is enforced externally through intermediaries who monitor addresses and transactions after the fact often introducing latency opacity and operational risk.

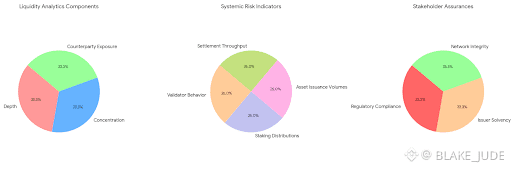

Liquidity visibility on Dusk further illustrates how analytics first design reshapes blockchain utility. In traditional decentralized finance liquidity fragmentation and opaque pools create blind spots that are tolerable for retail speculation but unacceptable for institutional balance sheets. Dusks protocol level treatment of assets and markets allows liquidity conditions to be assessed without compromising participant confidentiality. By encoding asset characteristics and market rules into the ledger itself the network enables real time assessment of depth concentration and counterparty exposure. This creates an environment where liquidity analytics are not dependent on scraping contract state or interpreting off chain signals but are a direct output of the networks state transitions.

Embedded risk analytics are a natural extension of this framework. Because Dusk transactions carry cryptographic attestations regarding compliance authorization and asset validity validators and governance participants can observe systemic risk trends without accessing sensitive data. This allows the protocol to support forms of macroprudential oversight that are impossible on most blockchains. Validator behavior staking distributions asset issuance volumes and settlement throughput can be analyzed collectively to detect stress concentration or anomalous activity. Importantly this analysis is not discretionary it is enforced by the same cryptographic rules that govern transaction validity ensuring that risk signals are trustworthy and manipulation resistant.

Compliance oriented transparency on Dusk is therefore not a contradiction in terms but a redefinition of transparency itself. Rather than exposing all data to all participants the protocol exposes the right assurances to the right stakeholders. Regulators can verify that assets meet issuance criteria and that transfers respect jurisdictional constraints. Issuers can demonstrate solvency and adherence to disclosure requirements. Validators can confirm network integrity and economic alignment. All of this occurs without introducing privileged observers or backdoors preserving the decentralized trust model that underpins blockchain security. In this sense Dusk advances the concept of selective transparency from a governance aspiration to a technical reality.

Data driven governance is another area where Dusks analytics centric approach distinguishes it from earlier networks. Governance decisions on many blockchains are informed by token weighted voting with limited contextual data often leading to outcomes driven more by speculation than systemic insight. Dusks governance framework is designed to incorporate on chain analytics related to network health validator performance asset activity and compliance events. This enables governance participants to make decisions based on empirically verifiable conditions rather than abstract preferences. Over time such a model supports a more resilient and institutionally credible governance process aligning protocol evolution with measurable financial and operational realities.

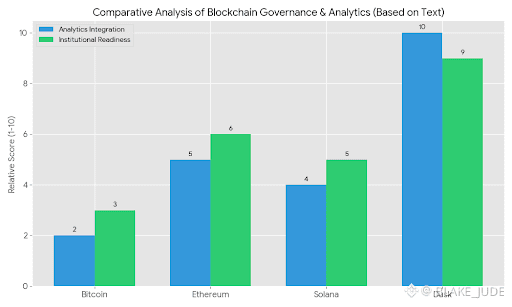

When compared to Bitcoin Dusk reflects a shift away from radical transparency toward functional trust. Bitcoins strength lies in its simplicity and immutability but its analytics ecosystem exists entirely off chain reliant on heuristics and external surveillance to interpret activity. Ethereum introduced programmability but at the cost of increased complexity and interpretive ambiguity requiring sophisticated tooling to extract meaningful financial insight. Solana optimized for throughput but its account model and execution design still treat analytics as a secondary layer. Dusks contribution is to integrate analytics into the protocols ontology ensuring that financial meaning is preserved alongside cryptographic security.

This integration has direct implications for institutional adoption. Financial institutions operate under constraints that demand predictability auditability and accountability. By reducing operational blind spots through native on chain intelligence Dusk lowers the friction between decentralized infrastructure and institutional risk frameworks. Custodians can reconcile assets with cryptographic certainty. Issuers can automate compliance reporting. Validators can assess systemic conditions without privileged access. Regulators can observe market integrity without compromising participant privacy. Each of these capabilities addresses a specific barrier that has historically limited blockchains role in regulated finance.

Ultimately Dusk should be understood not as a privacy blockchain with analytics features but as an analytics first financial ledger that uses privacy as an enabling condition rather than a marketing attribute. Its architectural choices reflect an understanding that trust in financial systems emerges not from visibility alone but from the ability to produce reliable verifiable knowledge under constraint. As digital assets continue to converge with traditional finance protocols that internalize analytics compliance awareness and financial intelligence at the base layer will define the next phase of blockchain maturity. In that broader shift toward financial grade infrastructure Dusk occupies a distinctive position illustrating how decentralized systems can evolve beyond experimentation into durable components of global financial architecture.